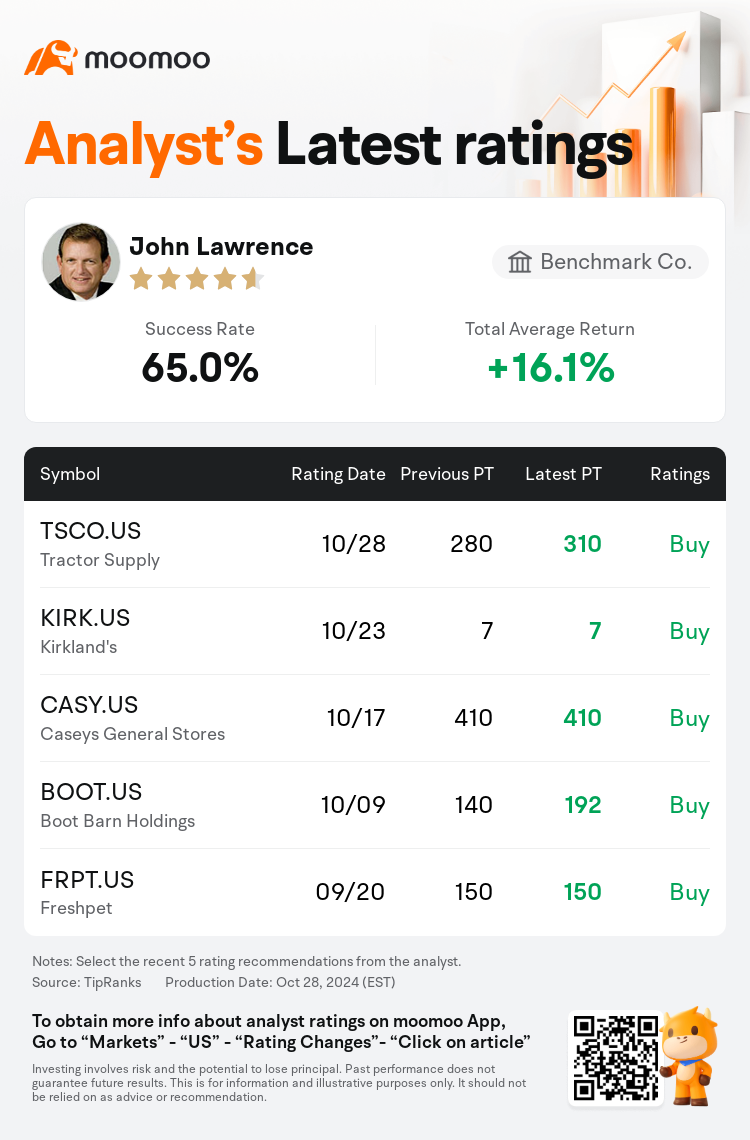

Benchmark Co. analyst John Lawrence maintains $Tractor Supply (TSCO.US)$ with a buy rating, and adjusts the target price from $280 to $310.

According to TipRanks data, the analyst has a success rate of 65.0% and a total average return of 16.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Tractor Supply (TSCO.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Tractor Supply (TSCO.US)$'s main analysts recently are as follows:

It was anticipated that shares were primed for an upward revision in estimates prior to the earnings announcement. However, subtle hints from the company have led to a slight decrease in projections for 2025. It is expected that the company will reveal the next phase of its strategy in December, potentially generating enthusiasm for the retailer's future prospects.

Tractor Supply's sales continue to exhibit weakness, casting doubt on its prospects to achieve its mid-single-digit comp target. It is anticipated that margin increases will begin to diminish. However, the company is recognized for offering a degree of defensiveness and exposure to possible post-election trends, which might maintain share value.

The company's recent performance, characterized by alignment with quarterly expectations and an increase in the lower end of the guidance range, failed to maintain the stock's position near its historic peak. Analysts suggest that the stock's valuation, considered high prior to earnings, did not present much opportunity for growth, given the current multiples relative to next year's earnings and EBITDA. Projections for the fiscal years 2024 and 2025 have remained consistent, with no changes to the earnings per share forecasts.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

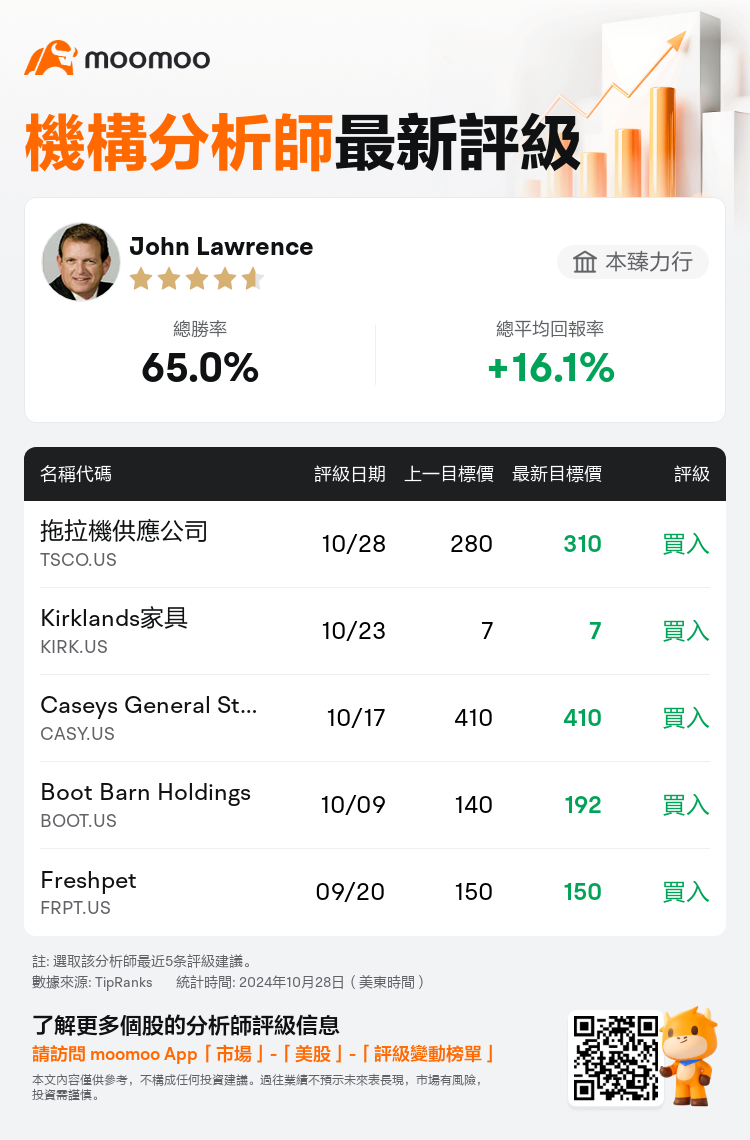

本臻力行分析師John Lawrence維持$拖拉機供應公司 (TSCO.US)$買入評級,並將目標價從280美元上調至310美元。

根據TipRanks數據顯示,該分析師近一年總勝率為65.0%,總平均回報率為16.1%。

此外,綜合報道,$拖拉機供應公司 (TSCO.US)$近期主要分析師觀點如下:

此外,綜合報道,$拖拉機供應公司 (TSCO.US)$近期主要分析師觀點如下:

預計在業績公佈之前,股價已爲向上修正估值做好了準備。但是,該公司的微妙暗示導致對2025年的預測略有下降。預計該公司將在12月公佈其下一階段的戰略,這可能會激發人們對零售商未來前景的熱情。

拖拉機供應公司的銷售繼續表現疲軟,這使人們對其實現中等個位數的競爭目標的前景產生了懷疑。預計利潤率的增長將開始減少。但是,該公司因提供一定程度的防禦能力和對可能的選舉後趨勢的曝光度而獲得認可,這可能會維持股票價值。

該公司最近的業績以與季度預期保持一致以及指導區間的下限上調爲特徵,未能將該股的位置維持在歷史峯值附近。分析師認爲,鑑於目前相對於明年收益和息稅折舊攤銷前利潤的倍數,該股的估值在盈利前被認爲很高,但並未帶來太大的增長機會。對2024和2025財年的預測保持一致,每股收益預測沒有變化。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$拖拉機供應公司 (TSCO.US)$近期主要分析師觀點如下:

此外,綜合報道,$拖拉機供應公司 (TSCO.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of