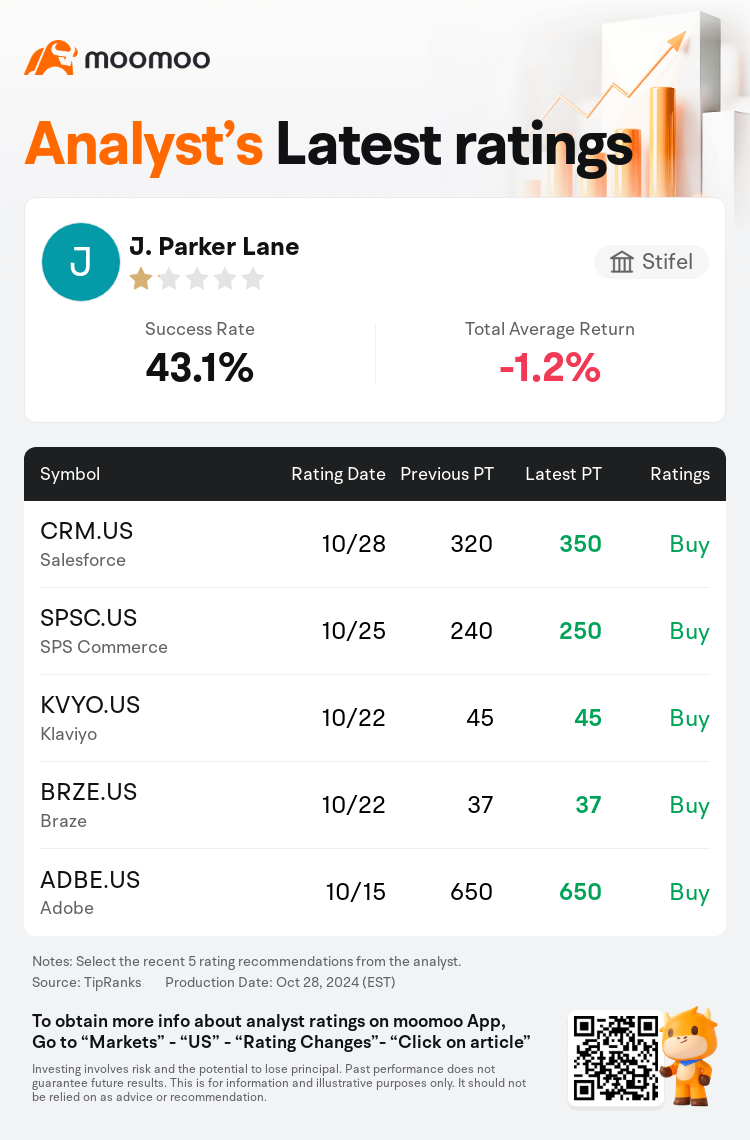

Stifel analyst J. Parker Lane maintains $Salesforce (CRM.US)$ with a buy rating, and adjusts the target price from $320 to $350.

According to TipRanks data, the analyst has a success rate of 43.1% and a total average return of -1.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Upon a closer examination of Salesforce's potential for agent-based AI and its implications for the company's revenue, it is recognized that there is a considerable amount still unknown. It is therefore prudent to hold off on modifying any financial models until more information is available from the company, early adopters, and additional partners. Nevertheless, preliminary estimates indicate that the 'Agentforce Service Agent' could represent a multi-billion dollar opportunity for Salesforce, with current valuations possibly underestimating the sustained revenue growth that this new agent model could deliver.

After conducting a survey involving 33 customers to gauge the outlook for IT spending in Q4 and into 2025, investment priorities in software, the impact of generative AI, and the potential for Data Cloud revenue generation, indications point to a mix of trends affecting Salesforce. There's a suggestion that while factors that could reignite Salesforce's revenue growth seem to be on the horizon, a variety of influences such as a typical end-of-year surge in IT spending, introductions of products like AgentForce and Data Cloud, potential shifts in interest rates, and the conclusion of the U.S. elections, are expected to stabilize the company's sales efficacy and contribute to a more predictable pattern in its upcoming quarterly financial disclosures.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

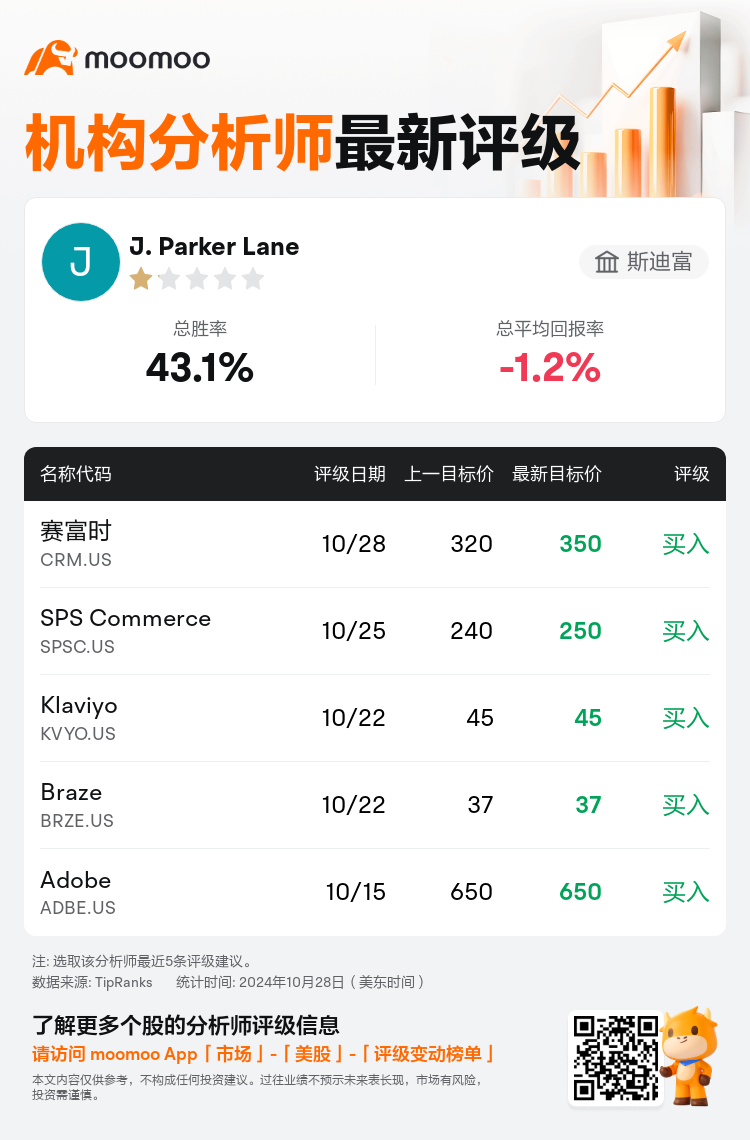

斯迪富分析师J. Parker Lane维持$赛富时 (CRM.US)$买入评级,并将目标价从320美元上调至350美元。

根据TipRanks数据显示,该分析师近一年总胜率为43.1%,总平均回报率为-1.2%。

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

在仔细研究了Salesforce基于代理的人工智能的潜力及其对公司收入的影响后,人们认识到,仍有相当多的未知数。因此,谨慎的做法是推迟修改任何财务模型,直到公司、早期采用者和其他合作伙伴提供更多信息为止。尽管如此,初步估计表明,“Agentforce服务代理” 可能为Salesforce带来数十亿美元的机会,而目前的估值可能低估了这种新代理模式可能带来的持续收入增长。

在进行了一项涉及33名客户的调查以评估第四季度及2025年的信息技术支出前景、软件投资重点、生成式人工智能的影响以及数据云创收的潜力之后,有迹象表明影响Salesforce的趋势多种多样。有人认为,尽管可能重启Salesforce收入增长的因素似乎即将到来,但预计各种影响将稳定公司的销售效率,并在即将发布的季度财务披露中形成更可预测的模式,例如IT支出的典型年终激增、AgentForce和Data Cloud等产品的推出、利率的潜在变化以及美国大选的结束。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of