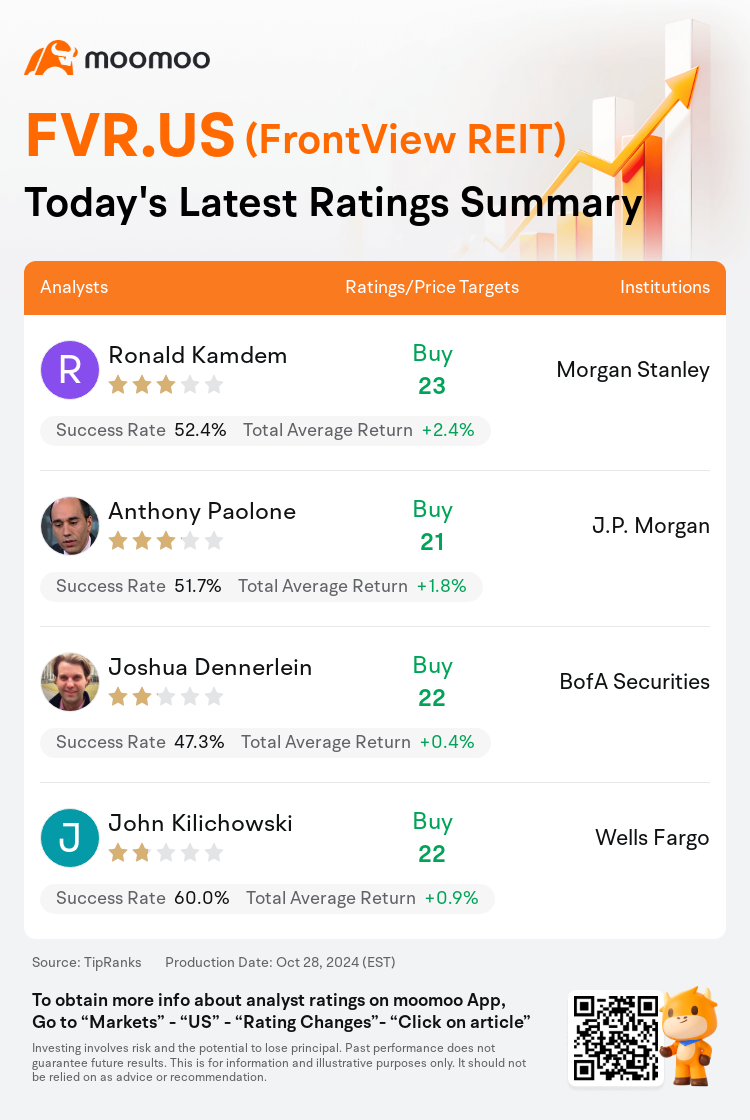

On Oct 28, major Wall Street analysts update their ratings for $FrontView REIT (FVR.US)$, with price targets ranging from $21 to $23.

Morgan Stanley analyst Ronald Kamdem initiates coverage with a buy rating, and sets the target price at $23.

J.P. Morgan analyst Anthony Paolone initiates coverage with a buy rating, and sets the target price at $21.

BofA Securities analyst Joshua Dennerlein initiates coverage with a buy rating, and sets the target price at $22.

BofA Securities analyst Joshua Dennerlein initiates coverage with a buy rating, and sets the target price at $22.

Wells Fargo analyst John Kilichowski initiates coverage with a buy rating, and sets the target price at $22.

Furthermore, according to the comprehensive report, the opinions of $FrontView REIT (FVR.US)$'s main analysts recently are as follows:

FrontView REIT, recognized for its net lease model encompassing 278 properties in prime, high-traffic locales spread across 31 states and usually bound by long-term leases, is poised to benefit from the diminishing rate environment. The REIT's diverse tenant roster and prospects for external expansion contribute to its positive outlook.

FrontView REIT is seen as a unique net-lease platform with a sole focus on outparcel properties that offer prominent visibility. Analysts believe that the current share levels represent a 'compelling entry point' as we enter a period of easing by the Federal Reserve.

The initiation of coverage on FrontView REIT noted its recent initial public offering that may fuel acquisitions and potentially lead to higher-than-average earnings growth. The analyst expressed a belief that a revaluation could be anticipated if the company's efforts are successful. The company's portfolio quality and prospects for growth were highlighted as being among the best in its group, contrasting with its valuation, which is perceived to be relatively low.

FrontView REIT, which concentrates on single-tenant properties prominently located along heavily trafficked thoroughfares, is anticipated to demonstrate 'sector-leading' funds from operations growth by 2025. This forecast is predicated on the projection of $200M in acquisitions for the year. Moreover, the REIT is noted for trading at a notable discount to its net asset value and possessing a portfolio of high-quality unencumbered assets.

Here are the latest investment ratings and price targets for $FrontView REIT (FVR.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

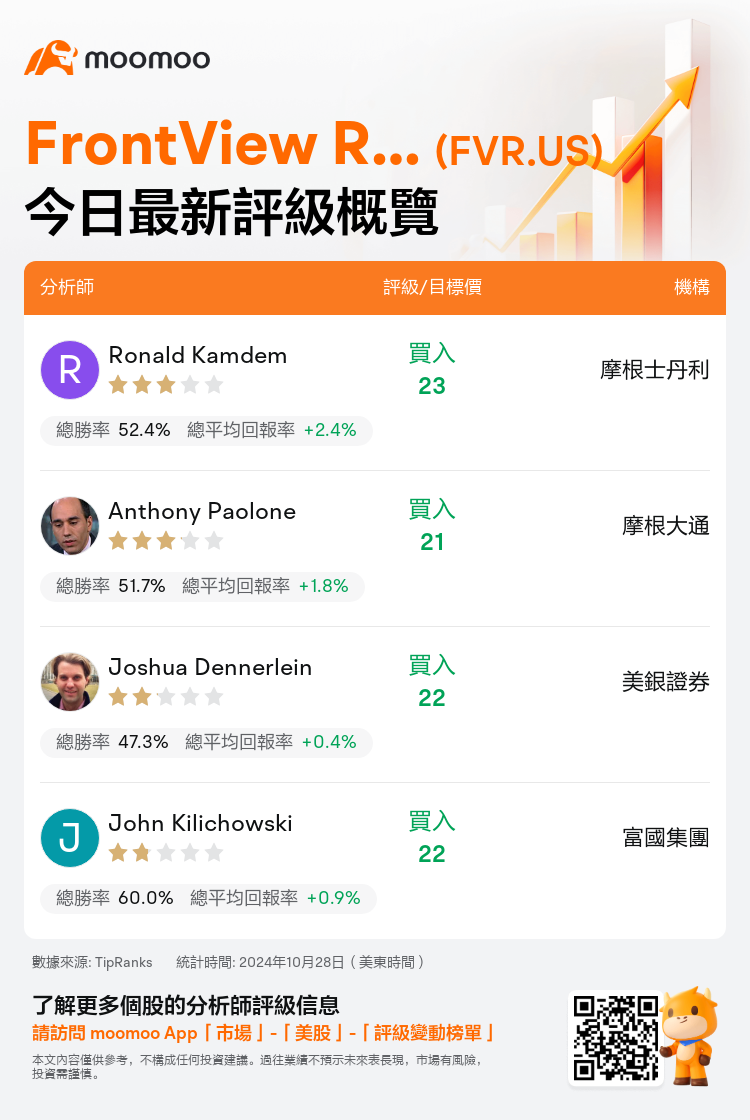

美東時間10月28日,多家華爾街大行更新了$FrontView REIT (FVR.US)$的評級,目標價介於21美元至23美元。

摩根士丹利分析師Ronald Kamdem首次給予買入評級,目標價23美元。

摩根大通分析師Anthony Paolone首次給予買入評級,目標價21美元。

美銀證券分析師Joshua Dennerlein首次給予買入評級,目標價22美元。

美銀證券分析師Joshua Dennerlein首次給予買入評級,目標價22美元。

富國集團分析師John Kilichowski首次給予買入評級,目標價22美元。

此外,綜合報道,$FrontView REIT (FVR.US)$近期主要分析師觀點如下:

FrontView REIt以其涵蓋31個州的278個處於黃金、高流量地點的淨租賃模式而聞名,通常受長期租約約束,從衰退的利率環境中獲益。REIT的多樣化租戶名單和外部擴張前景有助於形成積極的展望。

FrontView REIt被視爲一家專注於提供突出可見度的外圍房產的獨特淨租賃平台。分析師認爲當前股價水平代表了一個「引人注目的入場點」,因爲我們正進入聯儲局開始減息期。

關於FrontView REIt的研究啓動指出了其最近的首次公開募股,這可能推動收購併潛在地導致高於平均水平的盈利增長。分析師認爲,如果公司的努力成功,可能會預期重新評估。公司的投資組合質量和增長前景被認爲是同行中最好的之一,與其被視爲相對低估的估值形成對比。

FrontView REIt專注於位於車流繁忙幹道上的單一租戶物業,預計到2025年將展示「板塊領先」的運營資金增長。這一預測建立在對該年的20000萬美元收購的預測基礎上。此外,衆所周知,該REIt以明顯折價於其淨資產價值交易,並擁有一系列高質量無負擔資產。

以下爲今日4位分析師對$FrontView REIT (FVR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Joshua Dennerlein首次給予買入評級,目標價22美元。

美銀證券分析師Joshua Dennerlein首次給予買入評級,目標價22美元。

BofA Securities analyst Joshua Dennerlein initiates coverage with a buy rating, and sets the target price at $22.

BofA Securities analyst Joshua Dennerlein initiates coverage with a buy rating, and sets the target price at $22.