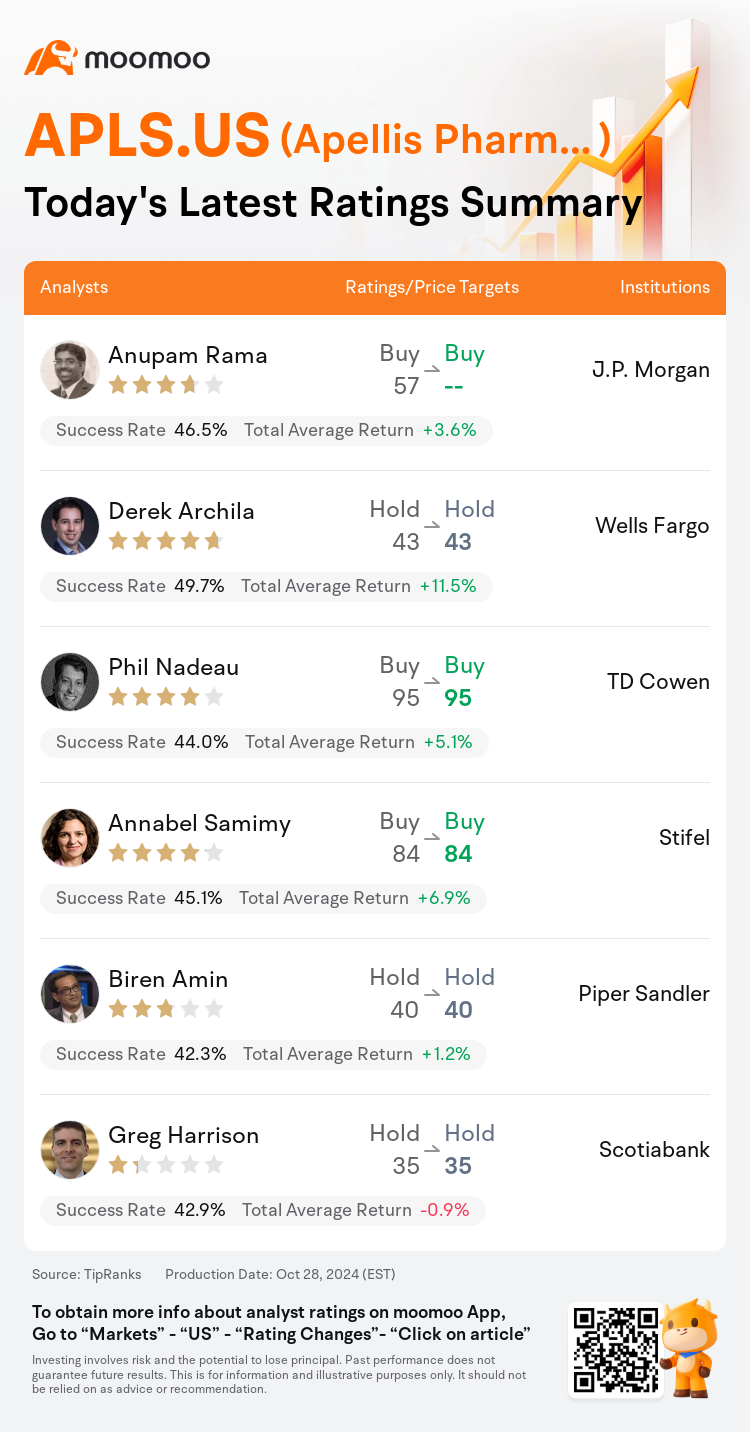

On Oct 28, major Wall Street analysts update their ratings for $Apellis Pharmaceuticals (APLS.US)$, with price targets ranging from $35 to $95.

J.P. Morgan analyst Anupam Rama maintains with a buy rating.

Wells Fargo analyst Derek Archila maintains with a hold rating, and maintains the target price at $43.

TD Cowen analyst Phil Nadeau maintains with a buy rating, and maintains the target price at $95.

TD Cowen analyst Phil Nadeau maintains with a buy rating, and maintains the target price at $95.

Stifel analyst Annabel Samimy maintains with a buy rating, and maintains the target price at $84.

Piper Sandler analyst Biren Amin maintains with a hold rating, and maintains the target price at $40.

Furthermore, according to the comprehensive report, the opinions of $Apellis Pharmaceuticals (APLS.US)$'s main analysts recently are as follows:

The initiation of coverage on Apellis highlighted that complement inhibitors Syfovre and Izervay were approved for geographic atrophy with the goal of slowing atrophy growth in the retina, rather than on functional benefits such as vision improvement, which is the metric for anti-VEGFs in wAMD. Consultants, who are considered key opinion leaders, have a reserved stance towards recommending Syfovre or Izervay, with a projection that at their peak, only about 20%-25% of patients will be suitable candidates.

A recent survey of U.S. retinal specialists revealed ongoing expansion within the complement inhibitor class, with an uptick in prescriptions for both Syfovre and its competitor, Izervay. The findings further suggest that Syfovre not only retains its position as the market leader but also has a competitive edge when it comes to initiating treatment in new patients.

Here are the latest investment ratings and price targets for $Apellis Pharmaceuticals (APLS.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月28日,多家华尔街大行更新了$Apellis Pharmaceuticals (APLS.US)$的评级,目标价介于35美元至95美元。

摩根大通分析师Anupam Rama维持买入评级。

富国集团分析师Derek Archila维持持有评级,维持目标价43美元。

TD Cowen分析师Phil Nadeau维持买入评级,维持目标价95美元。

TD Cowen分析师Phil Nadeau维持买入评级,维持目标价95美元。

斯迪富分析师Annabel Samimy维持买入评级,维持目标价84美元。

派杰投资分析师Biren Amin维持持有评级,维持目标价40美元。

此外,综合报道,$Apellis Pharmaceuticals (APLS.US)$近期主要分析师观点如下:

Apellis的覆盖启动强调,补体抑制剂Syfovre和Izervay已经获得地理性萎缩治疗的批准,目的是减缓视网膜萎缩生长,而不是关注功能性益处,例如对于wAMD的抗血管内皮生长因子(VEGF)的指标。被认为是关键意见领袖的顾问对于推荐Syfovre或Izervay持谨慎态度,预测它们的顶峰时期,只有大约20%-25%的患者会是合适的候选者。

美国视网膜专家的最新调查显示,补体抑制剂类别持续扩大,Syfovre和其竞争对手Izervay的处方有所增加。调查结果进一步表明,Syfovre不仅保持着市场领导地位,而且在为新患者启动治疗时具有竞争优势。

以下为今日6位分析师对$Apellis Pharmaceuticals (APLS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Phil Nadeau维持买入评级,维持目标价95美元。

TD Cowen分析师Phil Nadeau维持买入评级,维持目标价95美元。

TD Cowen analyst Phil Nadeau maintains with a buy rating, and maintains the target price at $95.

TD Cowen analyst Phil Nadeau maintains with a buy rating, and maintains the target price at $95.