① Due to the sharp increase in revenue share of new products and new processes, the cost of new products and new processes in the customer verification process was relatively high, and the company's gross margin declined in stages; ② Tuojing Technology's total assets increased by 32.06% over the end of the previous year, which was mainly explained by the increase in inventory due to the expansion of business scale.

“Science and Technology Innovation Board Daily”, October 28 (Reporter Qiu Siyu) Today (October 28), Tuojing Technology released its report for the third quarter of 2024.

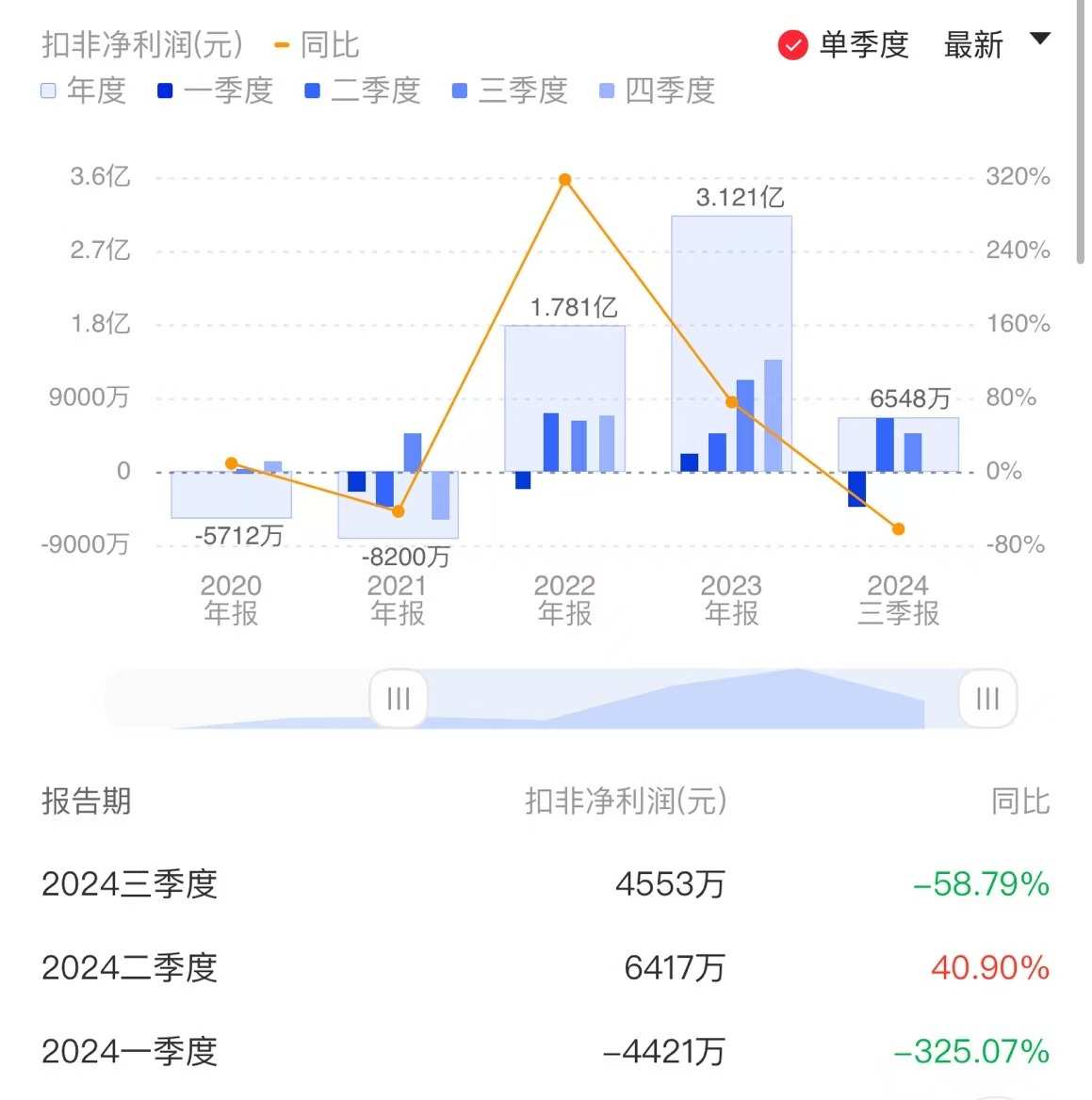

The company achieved operating income of 2.278 billion yuan in the first three quarters, up 33.79% year on year; net profit to mother 0.271 billion yuan, up 0.10% year on year; after deducting non-net profit of 65.485 million yuan, a year-on-year decrease of 62.72%.

Tuojing Technology achieved revenue of 1.011 billion yuan in the third quarter, an increase of 44.67% year on year; after deducting non-net profit of 45.5275 million yuan, a year-on-year decrease of 58.79%.

Tuojing Technology achieved revenue of 1.011 billion yuan in the third quarter, an increase of 44.67% year on year; after deducting non-net profit of 45.5275 million yuan, a year-on-year decrease of 58.79%.

In response, Tuojing Technology said that non-recurring profit and loss increased significantly year-on-year in the third quarter, mainly due to the increase in the price of shares held by the company in Suzhou Kema Material Technology Co., Ltd., resulting in a fair value change income of 0.072 billion yuan. Also, in the first three quarters, the company's government subsidy revenue, which included non-recurring profit and loss, was 0.125 billion yuan, an increase of 23.22% over the previous year.

Tuojing Technology is mainly engaged in R&D, production, sales and technical service of high-end semiconductor special equipment. Its main products include plasma enhanced chemical vapor deposition (PECVD) equipment, atomic layer deposition (ALD) equipment, and sub-normal pressure chemical vapor deposition (SACVD) equipment. It has been used in domestic fabs 14nm and above integrated circuit manufacturing lines, and has carried out product verification tests at 10nm and below.

Regarding the reason for the increase in revenue, Tuojing Technology explained that it has mainly benefited from high-intensity R&D investment. The company's new products and new process machines have made breakthrough progress in client verification, and the mass production scale of PECVD, ALD, SACVD, HDPCVD, and ultra-high depth-to-width ratio groove filling CVD continues to expand.

The company also added that its revenue increased steadily in the first three quarters due to revenue recognition of various process equipment developed based on new equipment platforms (PF-300M and PF-300T Plus) and new reaction chambers (Supra-D).

The net profit growth rate was less than that of revenue. Tuojing Technology attributed this to two reasons: a phased decline in gross margin and R&D investment. According to reports, mainly due to the sharp increase in revenue share of new products and processes, the cost of new products and new processes in the customer verification process is relatively high, and gross margin has declined in stages. The company's gross margin for the first three quarters was 43.59%, down 6.75 percentage points year over year.

In terms of R&D investment, from January to September this year, Tuojing Technology's R&D investment reached 0.481 billion yuan, an increase of 0.126 billion yuan over the previous year, an increase of 35.73%. Furthermore, the company's net cash flow from operating activities in the first three quarters was -0.999 billion yuan, which is a decrease from -1.363 billion yuan in the same period last year.

Tuojing Technology's total assets increased by 32.06% over the end of the previous year. In response, the company explained that it was mainly due to the increase in inventory due to the expansion of business scale. The company's inventory value at the end of September 2024 was 7.077 billion yuan, up 55.33% from the beginning of the year, mainly due to the increase in products shipped. From January to September 2024, the company's shipment value increased by more than 160% year-on-year.

拓荆科技第三季度实现营业收入10.11亿元,同比增长44.67%;

拓荆科技第三季度实现营业收入10.11亿元,同比增长44.67%;