CITIC Guoan Information Industry Co., Ltd. (SZSE:000839) shares have continued their recent momentum with a 33% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 56%.

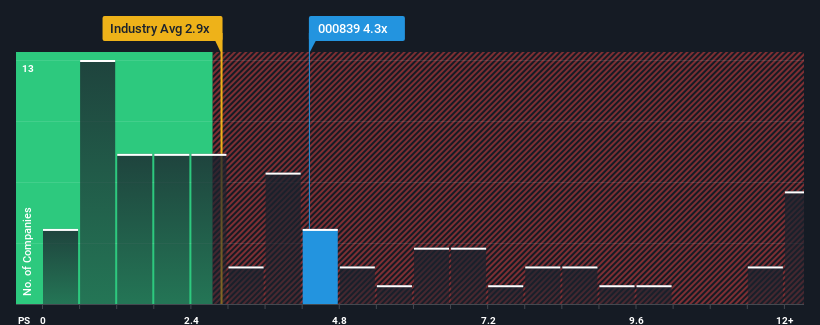

Since its price has surged higher, when almost half of the companies in China's Media industry have price-to-sales ratios (or "P/S") below 2.9x, you may consider CITIC Guoan Information Industry as a stock probably not worth researching with its 4.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How CITIC Guoan Information Industry Has Been Performing

Revenue has risen firmly for CITIC Guoan Information Industry recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for CITIC Guoan Information Industry, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For CITIC Guoan Information Industry?

There's an inherent assumption that a company should outperform the industry for P/S ratios like CITIC Guoan Information Industry's to be considered reasonable.

There's an inherent assumption that a company should outperform the industry for P/S ratios like CITIC Guoan Information Industry's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.3% last year. Pleasingly, revenue has also lifted 49% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 14% shows it's about the same on an annualised basis.

With this information, we find it interesting that CITIC Guoan Information Industry is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does CITIC Guoan Information Industry's P/S Mean For Investors?

CITIC Guoan Information Industry's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't expect to see CITIC Guoan Information Industry trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for CITIC Guoan Information Industry that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.