Kexin Development Co.,Ltd,Shanxi (SHSE:600234) shares have continued their recent momentum with a 31% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 44% in the last twelve months.

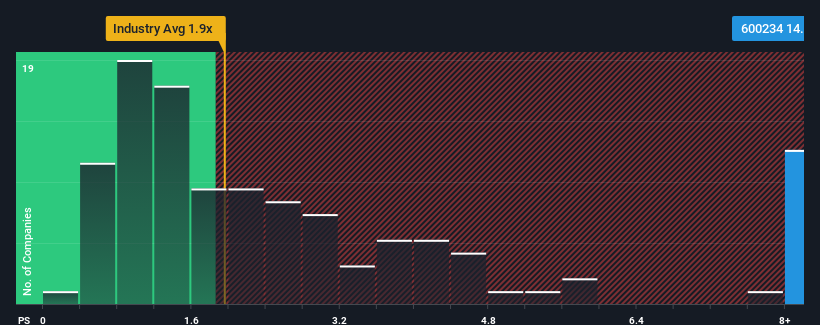

Following the firm bounce in price, given around half the companies in China's Consumer Durables industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Kexin DevelopmentLtdShanxi as a stock to avoid entirely with its 14.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Kexin DevelopmentLtdShanxi's P/S Mean For Shareholders?

Kexin DevelopmentLtdShanxi has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Kexin DevelopmentLtdShanxi, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Kexin DevelopmentLtdShanxi's Revenue Growth Trending?

Kexin DevelopmentLtdShanxi's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Kexin DevelopmentLtdShanxi's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 94% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 9.1% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Kexin DevelopmentLtdShanxi is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Kexin DevelopmentLtdShanxi's P/S Mean For Investors?

The strong share price surge has lead to Kexin DevelopmentLtdShanxi's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Kexin DevelopmentLtdShanxi currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Kexin DevelopmentLtdShanxi you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.