The Chongqing Fenghwa Group Co., Ltd. (SHSE:600615) share price has done very well over the last month, posting an excellent gain of 29%. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

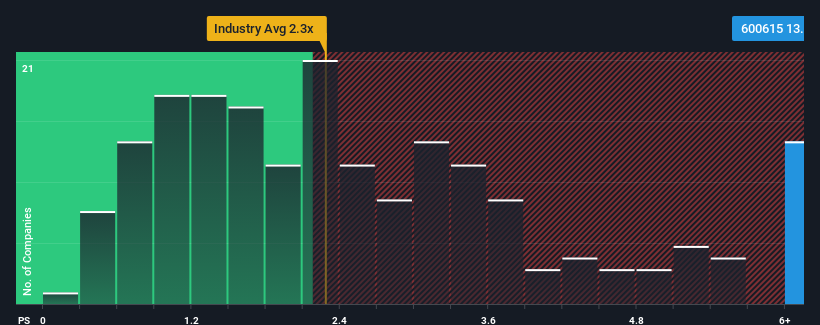

Following the firm bounce in price, when almost half of the companies in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Chongqing Fenghwa Group as a stock not worth researching with its 13.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Chongqing Fenghwa Group's P/S Mean For Shareholders?

The revenue growth achieved at Chongqing Fenghwa Group over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Chongqing Fenghwa Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Chongqing Fenghwa Group's is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as Chongqing Fenghwa Group's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 27% last year. The latest three year period has also seen an excellent 114% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 24% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Chongqing Fenghwa Group's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Chongqing Fenghwa Group's P/S Mean For Investors?

The strong share price surge has lead to Chongqing Fenghwa Group's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Chongqing Fenghwa Group maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Chongqing Fenghwa Group has 2 warning signs (and 1 which is significant) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.