On October 29, Juxing Technology (920111.BJ) opened for subscription.

According to the Zhidao Finance APP, on October 29, Juxing Technology (920111.BJ) opened for subscription, with an issue price of 6.25 yuan per share, a maximum subscription limit of 1.8444 million shares, a P/E ratio of 12.73 times, belonging to the Beijing Stock Exchange, and Guotou Securities is its exclusive sponsor.

The prospectus disclosed that Juxing Technology's main business is the research and development, production, and sales of electric contact products, with main products being electric contact heads and electric contact components, which are the main source of operating income during the reporting period. In addition, the company's electric contact products also include electric contact materials, which are the core raw materials for producing electric contact heads and electric contact components. The electric contact materials produced by the company are mainly used for the production of electric contact heads and electric contact components, with a small amount sold externally.

According to the statistics of the Electrical Alloy Branch of the China Electrical Equipment Industry Association, from 2021 to 2023, the company's domestic market share of rivet-type electric contact heads has ranked first for three consecutive years (based on sales quantity). The company has established good cooperative relationships with well-known enterprises in the industry such as Chunlushou Company, Hongfa Technology (600885.SH), Gongniu Group (603195.SH), Sanyou Lianzhong (300932.SZ), Meishuo Technology (301295.SZ), Shenle shares, Hongshi Electric, and Zetsdevelop electronic, among others.

According to the statistics of the Electrical Alloy Branch of the China Electrical Equipment Industry Association, from 2021 to 2023, the company's domestic market share of rivet-type electric contact heads has ranked first for three consecutive years (based on sales quantity). The company has established good cooperative relationships with well-known enterprises in the industry such as Chunlushou Company, Hongfa Technology (600885.SH), Gongniu Group (603195.SH), Sanyou Lianzhong (300932.SZ), Meishuo Technology (301295.SZ), Shenle shares, Hongshi Electric, and Zetsdevelop electronic, among others.

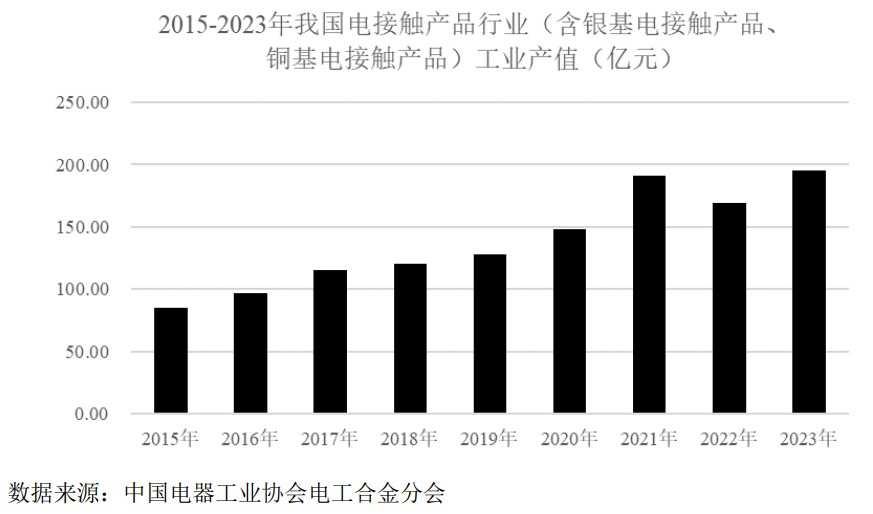

According to the statistics of the Electrical Alloy Branch of the China Electrical Equipment Industry Association, in 2023, the total industrial output value of China's electric contact product industry (including silver-based electric contact products, copper-based electric contact products) reached 19.56 billion RMB, and the compound annual growth rate during the period of 2015-2023 was 10.98%.

Furthermore, according to the AVC and China Household Electric Appliance Network's "2024 China Household Appliance Retail and Innovation White Paper", in 2021, China's total household appliance retail value was 856.5 billion RMB, in 2022 it was 820.4 billion RMB, with a year-on-year decrease of 4.21%. In 2023, China's total household appliance retail value was 849.8 billion RMB, an increase of 3.58% compared to 2022. Typically, each air conditioner requires 4-8 relays, each refrigerator requires 4-5 relays, and each washing machine requires 6-7 relays. The huge sales scale in the household appliance market provides a good application space for electric contact products.

In recent years, the smart home market in the home appliance industry is rapidly rising. According to CSHIA (Smart Home Collaborative Innovation Platform) statistics, from 2016 to 2022, the compound annual growth rate of China's smart home market size is 16.50%. According to the industry research report released by Statista, it is expected that by 2025, the domestic smart home market size will exceed 800 billion yuan, with a compound annual growth rate of 15.80%.

In recent years, the smart home industry has expanded rapidly, transitioning from single-product smart to scene smart, and is currently moving from multi-scene smart linkage to whole-house active smart. In the rapid development of the industry, many emerging smart home system companies from non-traditional furniture and home appliance brands have emerged. According to AVCLOUD statistics, UIOT Super Smart Home/Ruizhu Smart/Dnake have already captured 9.10%/8.50%/6.20% market share in the fitted house market in 2022, ranking top in the smart home system market. In addition, giants like Huawei, Xiaomi, and others have already begun to expand in relevant fields.

It is understood that Juxing Technology plans to use the funds raised after deducting the issuance expenses for the following projects:

Financially, in 2021, 2022, and 2023, the company achieved operating income of approximately 0.596 billion yuan, 0.492 billion yuan, and 0.603 billion yuan respectively. The company's net income was approximately 57.9243 million yuan, 36.6111 million yuan, and 75.3271 million yuan respectively.

It is worth noting that the prospectus specifically alerts investors to pay attention to the risk of fluctuations in raw material prices. During the reporting period, the company's main raw materials needed for production were silver and silver alloy, copper and copper alloy, with the purchase amounts collectively accounting for 92.60%, 90.92%, 92.80%, and 94.13% of the total raw material procurement respectively. The purchase prices of silver and silver alloy, copper and copper alloy are greatly affected by domestic and foreign political and economic situations and macroeconomic policies.

During the reporting period, the average purchase prices of the company's silver and silver alloy were 4.5862 million yuan/ton, 4.1431 million yuan/ton, 4.9733 million yuan/ton, and 602.71 thousand yuan/ton respectively. The average purchase prices of copper and copper alloy were 0.059 million yuan/ton, 0.0603 million yuan/ton, 0.0597 million yuan/ton, and 6.62 thousand yuan/ton respectively, with significant price fluctuations. If the silver and copper prices continue to fluctuate significantly in one direction in the short term, due to the risk transmission mechanism of the company's silver and copper price fluctuations having a certain lag, the fluctuations will have a significant impact on the company's profitability, especially in the case of sharp declines in silver and copper prices, there is a risk of a substantial decline in gross margin and net income for the company.

根据中国电器工业协会电工合金分会统计,2021年度至 2023年度,公司铆钉型电触头的国内市场占有率连续三年均排名第一(按照销售数量统计)。公司目前已经与春禄寿公司、宏发股份(600885.SH)、公牛集团(603195.SH)、三友联众(300932.SZ)、美硕科技(301295.SZ)、申乐股份、鸿世电器、赛特勒电子等业内知名企业建立了良好的合作关系。

根据中国电器工业协会电工合金分会统计,2021年度至 2023年度,公司铆钉型电触头的国内市场占有率连续三年均排名第一(按照销售数量统计)。公司目前已经与春禄寿公司、宏发股份(600885.SH)、公牛集团(603195.SH)、三友联众(300932.SZ)、美硕科技(301295.SZ)、申乐股份、鸿世电器、赛特勒电子等业内知名企业建立了良好的合作关系。