Should You Be Adding Tianjin Tianyao Pharmaceuticals (SHSE:600488) To Your Watchlist Today?

Should You Be Adding Tianjin Tianyao Pharmaceuticals (SHSE:600488) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Tianjin Tianyao Pharmaceuticals (SHSE:600488). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Tianjin Tianyao Pharmaceuticals' Improving Profits

Over the last three years, Tianjin Tianyao Pharmaceuticals has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Tianjin Tianyao Pharmaceuticals' EPS shot up from CN¥0.088 to CN¥0.12; a result that's bound to keep shareholders happy. That's a commendable gain of 40%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Despite consistency in EBIT margins year on year, Tianjin Tianyao Pharmaceuticals has actually recorded a dip in revenue. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Despite consistency in EBIT margins year on year, Tianjin Tianyao Pharmaceuticals has actually recorded a dip in revenue. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

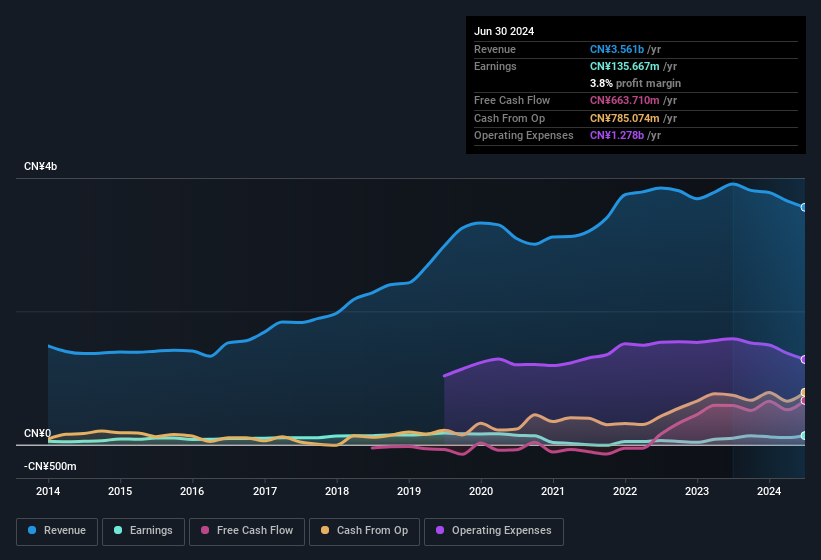

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Tianjin Tianyao Pharmaceuticals Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. Our analysis has discovered that the median total compensation for the CEOs of companies like Tianjin Tianyao Pharmaceuticals with market caps between CN¥2.9b and CN¥11b is about CN¥988k.

The Tianjin Tianyao Pharmaceuticals CEO received total compensation of only CN¥151k in the year to December 2023. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Tianjin Tianyao Pharmaceuticals Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Tianjin Tianyao Pharmaceuticals' strong EPS growth. Strong EPS growth is a great look for the company and reasonable CEO compensation sweetens the deal for investors ass it alludes to management being conscious of frivolous spending. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. Still, you should learn about the 2 warning signs we've spotted with Tianjin Tianyao Pharmaceuticals (including 1 which is concerning).

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.