After Leaping 32% Dazhong Transportation (Group) Co., Ltd. (SHSE:600611) Shares Are Not Flying Under The Radar

After Leaping 32% Dazhong Transportation (Group) Co., Ltd. (SHSE:600611) Shares Are Not Flying Under The Radar

Those holding Dazhong Transportation (Group) Co., Ltd. (SHSE:600611) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 207% following the latest surge, making investors sit up and take notice.

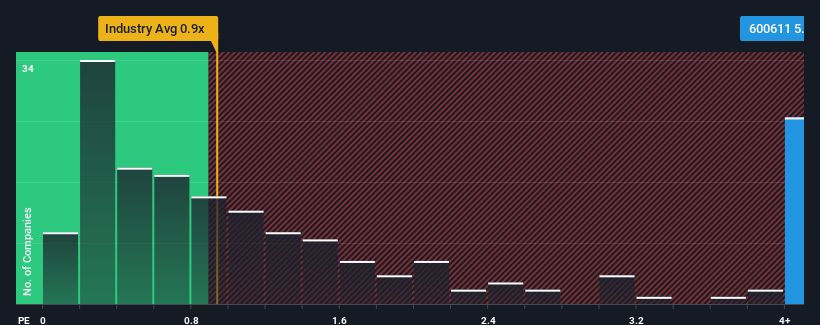

After such a large jump in price, given around half the companies in China's Transportation industry have price-to-sales ratios (or "P/S") below 3.2x, you may consider Dazhong Transportation (Group) as a stock to avoid entirely with its 5.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Dazhong Transportation (Group)'s P/S Mean For Shareholders?

The revenue growth achieved at Dazhong Transportation (Group) over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Dazhong Transportation (Group)'s earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Dazhong Transportation (Group)'s to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Dazhong Transportation (Group)'s to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. The latest three year period has also seen an excellent 69% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 5.9% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Dazhong Transportation (Group) is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has lead to Dazhong Transportation (Group)'s P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Dazhong Transportation (Group) can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Dazhong Transportation (Group) you should be aware of, and 2 of them are a bit unpleasant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.