Shenzhen FRD Science & Technology (SZSE:300602) Sheds CN¥1.0b, Company Earnings and Investor Returns Have Been Trending Downwards for Past Five Years

Shenzhen FRD Science & Technology (SZSE:300602) Sheds CN¥1.0b, Company Earnings and Investor Returns Have Been Trending Downwards for Past Five Years

It is a pleasure to report that the Shenzhen FRD Science & Technology Co., Ltd. (SZSE:300602) is up 46% in the last quarter. But if you look at the last five years the returns have not been good. After all, the share price is down 34% in that time, significantly under-performing the market.

With the stock having lost 7.9% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

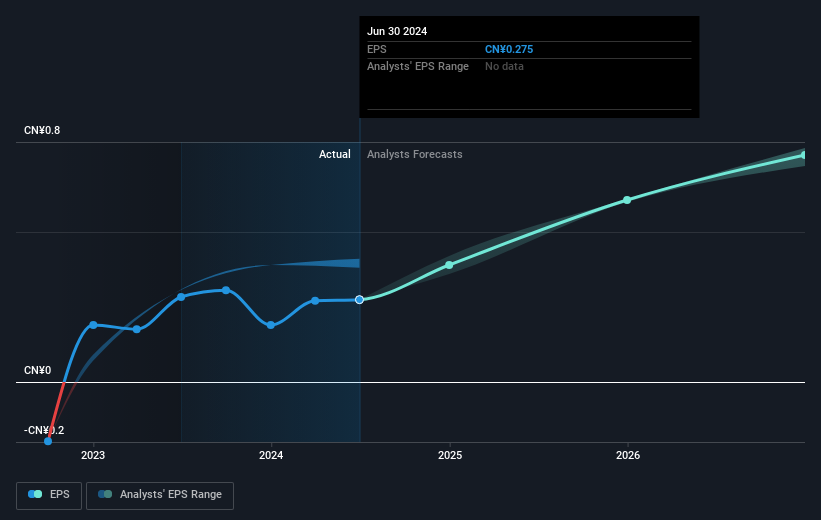

Looking back five years, both Shenzhen FRD Science & Technology's share price and EPS declined; the latter at a rate of 12% per year. The share price decline of 8% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve. The high P/E ratio of 75.26 suggests that shareholders believe earnings will grow in the years ahead.

Looking back five years, both Shenzhen FRD Science & Technology's share price and EPS declined; the latter at a rate of 12% per year. The share price decline of 8% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve. The high P/E ratio of 75.26 suggests that shareholders believe earnings will grow in the years ahead.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While the broader market gained around 7.4% in the last year, Shenzhen FRD Science & Technology shareholders lost 1.3% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 6% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Shenzhen FRD Science & Technology you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.