Market Mover | Premier Investments shares surge 10%, maintaining a strong upward trend

Market Mover | Premier Investments shares surge 10%, maintaining a strong upward trend

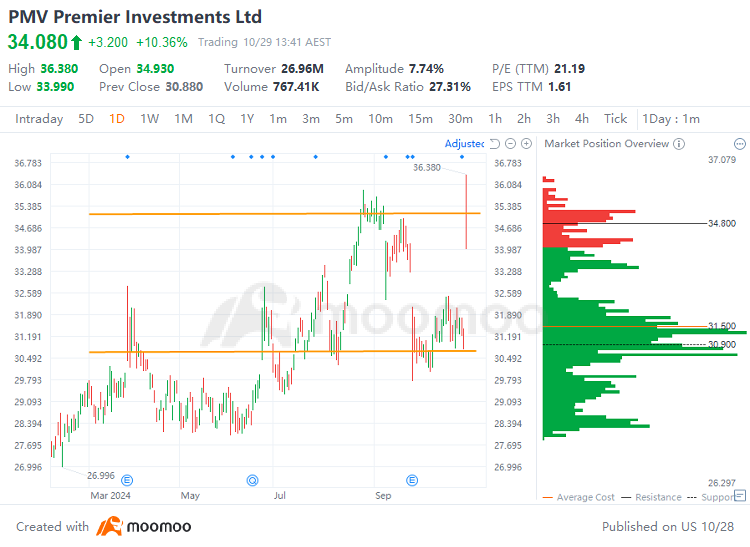

$Premier Investments Ltd (PMV.AU)$ shares rose 10.36% on Tuesday, with the trading volume growing to A$26.96 million. Today, the stock price hit a record high, surging by 17.81% to A$36.38. Premier Investments has rose 10.27% over the past week, with a cumulative gain of 30.22% year-to-date.

$Premier Investments Ltd (PMV.AU)$ 股價週二上漲了10.36%,交易量增至A$2696萬。今天,股價創下歷史新高,飆升了17.81%,達到A$36.38。Premier投資公司過去一週上漲了10.27%,年初以來累計漲幅達30.22%。

Premier Investments's technical analysis chart:

Premier Investments的技術面分析圖表:

Technical Analysis:

技術面分析:

Support: A$30.73

Resistance: A$35.00

Price range A$30.73 to A$35.00: The trading range indicates a heavy concentration of buy orders, with the stock price on an upward trend. The stock repeatedly touched the level near A$30.73, where it found significant support and subsequently rebounded. There is a strong presence of buy orders around A$30.73. There is considerable upward pressure near the resistance level of A$35.00, with a lot of profit-taking positions, which suggests strong selling pressure. Going forward, it will be crucial to monitor whether the stock can effectively break through the resistance level at A$35.00.

壓力位:A$30.73

支撐位:A$35.00

價格區間A$30.73至A$35.00:交易區間顯示大量買單聚集,股價處於上升趨勢。股價多次觸及A$30.73附近水平,找到重要支撐並隨後反彈。A$30.73附近存在大量買單。在A$35.00阻力位附近存在相當大的上升壓力,有很多盈利平倉位置,表明強烈的賣出壓力。未來關鍵在於監控股價能否有效突破A$35.00的阻力位。

Market News :

市場資訊:

Premier Investments released its FY24 earnings report, showcasing a remarkable performance with a Net Profit after Tax (“NPAT”) that has grown from A$106.8 million in pre-COVID FY19 to A$257.9 million in FY24, marking an increase of over 140%. Under the guidance of our Board, the company has not only maintained a robust balance sheet but also rewarded shareholders with record fully franked ordinary dividends in FY24, totaling 133 cents per share, which is a 16.67% increase from the prior year's ordinary dividends. Additionally, FY24 saw a record sales figure of A$508.6 million, an uplift of 6.2% from FY23, surpassing the half a billion-dollar mark. The company also enhanced its retail footprint by opening 9 new stores and relocating or expanding 9 existing ones, which significantly improved the customer experience.

The company announced that it executed a definitive share sale and implementation agreement (“SSIA”) with Myer Holdings (“Myer”). As per the agreement, Myer is set to acquire just group (“Just Group”), encompassing five apparel brands: Just Jeans, Jay Jays, Portmans, Dotti, and Peter Alexander. Additionally, Smiggle will be part of “Premier Retail” that Premier will retain ownership of after the transaction is completed.

Premier Investments發佈了其FY24業績,展示了remarkable的表現,淨利潤(NPAT)從COVID疫情前的FY19的A$10680萬增長到FY24的A$25790萬,增幅超過140%。在我們董事會的指導下,公司不僅保持了強勁的資產負債表,還向股東們分紅派息,FY24年度全額衝抵的普通股分紅達到133分,比前一年的普通股分紅增長了16.67%。此外,FY24年度銷售額達到A$50860萬,較FY23增長了6.2%,超過了50億美元的大關。公司還通過開設9家新店和調整或擴建9家現有店鋪來擴大零售版圖,顯著提升了客戶體驗。

公司宣佈與Myer Holdings(「Myer」)簽署了一份明確的股份出售和實施協議(「SSIA」)。根據協議,Myer將收購 Just Group(「Just Group」),包括五個服裝品牌:Just Jeans、Jay Jays、Portmans、Dotti和Peter Alexander。此外,Smiggle將成爲Premier交易完成後Premier保留所有權的「Premier Retail」的一部分。

Overall Analysis:

總體分析:

Fundamentally, focus on the company's performance and operational status. Technically, it is necessary to monitor whether the support remains valid, and whether the resistance level of A$35.00 can be effectively broken through.

從基本面看,關注公司的業績和運營狀況。從技術面分析來看,有必要監測支撐位是否仍然有效,以及A$35.00的支撐位能否被有效突破。

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.

在這種情況下,投資者應採取謹慎的策略,設置止損點來管理風險,並對公司發展和市場情況保持持續警惕。

Source: Premier Investments

資訊來源:Premier Investments

Resistance: A$35.00

Resistance: A$35.00