在中國政府公佈強勁的股市流動性提振措施以及刺激經濟增長的一籃子政策措施後,總部位於英國的銀行業巨頭匯豐(HSBC)表示,該行客戶的港股交易活動顯著增強。

智通財經APP獲悉,在中國政府公佈強勁的股市流動性提振措施以及刺激經濟增長的一籃子政策措施後,總部位於英國的銀行業巨頭匯豐(HSBC)表示,該行客戶的港股交易活動顯著增強,整體客戶交易業務因港股熱度激增而得到全面促進。在此之前,華爾街金融巨頭高盛與花旗紛紛發佈針對於港股市場的看漲研報,有着「牛市旗手」稱呼的高盛高呼政策「組合拳」刺激下港股這輪「長期牛市行情」遠未結束,花旗則大膽預測明年年中恒生指數有望衝擊26000點。

匯豐在週二表示,上個月中國政府所宣佈「政策組合拳」推動第三季度末港股市場的「波動性升高」,從而大幅提振了香港市場的客戶財富規模,以及股票和外匯市場的客戶交易活動。匯豐強調,中國政府的刺激措施將持續大幅促進香港股市交易。匯豐與華爾街投資機構們對於港股的看漲立場,可能意味着港股橫盤震盪後將迎來新一輪爆發。

在第三季度全球資金對於港股的交易熱情高漲的助推之下,將香港視爲最大市場的匯豐最新公佈的第三季度利潤超過市場普遍預期,這是在匯豐新任首席執行官喬治斯·埃爾赫德里(Georges Elhedery)領導下匯豐的首次業績。匯豐商業活動的全面回升,凸顯了世界第二大經濟體在政府最新的一籃子刺激措施推動下正在復甦的跡象。

在第三季度全球資金對於港股的交易熱情高漲的助推之下,將香港視爲最大市場的匯豐最新公佈的第三季度利潤超過市場普遍預期,這是在匯豐新任首席執行官喬治斯·埃爾赫德里(Georges Elhedery)領導下匯豐的首次業績。匯豐商業活動的全面回升,凸顯了世界第二大經濟體在政府最新的一籃子刺激措施推動下正在復甦的跡象。

外資對於港股的投資熱情持續升溫

香港股市,通常來說是外資投資於中國的第一門戶,同時也是華爾街等外資機構投資中國公司的最佳切入口。更重要的是,受益於聯儲局意外減息50個點子開啓減息週期,以及國內貨幣刺激政策提供的流動性支持,港股可謂吃到「中美雙重流動性紅利」。

港股相比於中國A股市場,更加受益於全球流動性寬鬆預期,畢竟對於外資無限制的港股市場能夠享受到國內刺激政策以及聯儲局減息週期,乃至歐洲減息所帶來的龐大流動性刺激。展望港股未來,在持續的流動性紅利以及國內促銷費、促生育、推動民營經濟發展政策等政策預期催化劑之下,新一輪牛市可能遠未結束。

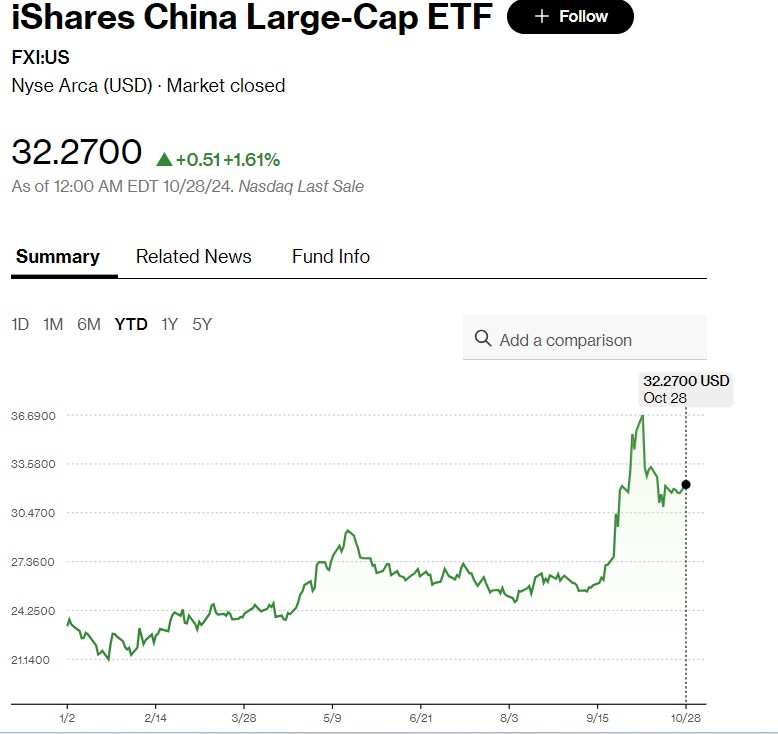

在紐交所上市的聚焦於中國資產的熱門ETF——iShares中國大盤股ETF(FXI.US),目前ETF整體規模已經突破百億美元大關,凸顯出國外資金對於中國資產,尤其是對於港股的投資熱情持續升溫。這也是在美國股票市場上市的中國股票ETF這一類別中首次有ETF標的規模突破100億美元,今年以來該ETF價值漲幅高達34%,甚至跑贏標普500指數。

據了解,iShares中國大盤股ETF全面聚焦於港股市場,爲國際投資者們提供投資於中國最頂級上市公司的主要途徑,該ETF覆蓋港股市場上市值規模最大、流動性最好的50只股票。iShares中國大盤股ETF的第一大權重股是美團,佔比超過10%,其次爲阿里巴巴、騰訊、建設銀行和京東,前十還有小米、比亞迪、中國平安、中國銀行和工商銀行這些港股市場最熱門股票標的。

「KWEB」這一聚焦於中國海外上市互聯網公司的ETF的提供商KraneShares對於中國資產前景持樂觀態度。KraneShares首席投資官Brendan Ahern表示,長期以來,中國股票在全球股票指數中的代表性嚴重不足,與全球同類股票相比,其股票估值普遍較低。「聯儲局正在減息,那麼爲什麼不拿出一部分利潤投資性價比較高的中國資產呢?」Ahern在採訪中表示。「估值中蘊藏着巨大的投資機遇。」

「牛市旗手」高盛領銜的華爾街金融巨頭們看好中國資產前景

政府的大規模刺激計劃引發新一輪外資買入浪潮以及上調中國股市投資評級的狂熱浪潮,包括全球資管巨頭貝萊德(BlackRock Inc.)在內的一些長期唱淡中國股市(包含港股與A股)的外資機構也轉爲看漲立場,並且這些外資機構用真金白銀推動中國股市大舉反彈。

長期對中國股市持謹慎立場的貝萊德近日表示,將中國股票的評級從「中性」上調至「超配」。該機構認爲,鑑於中國股市相對於發達市場股市的折價接近創記錄水平,且存在可能刺激外國投資者們重新入市的強勁催化劑,各大機構在短期內仍有適度增持中國股票的空間。

有着「全球股市牛市旗手」稱號的華爾街金融巨頭高盛近日發表研報稱,上調中國股市(包含港股與A股)評級至「超配」,並且將滬深300指數的目標點位從4000提高到4600。週二滬深300指數收於3924.65點。高盛還將涵蓋涵蓋阿里巴巴、騰訊以及貴州茅台等中國核心資產的MSCI中國指數(MSCI China Index)目標點位從66提高到84,相比之下MSCI中國指數最新收於67.34點。行業配置方面,高盛表示,鑑於資本市場活動增加和資產表現改善,將保險和其他金融(例如,券商、交易所以及投資機構)上調至「超配」;同時,高盛維持對中國互聯網和娛樂、技術硬件和半導體、消費者零售和服務以及日用品行業的「超配」立場。

另一華爾街大行花旗集團近日發表研報稱,將截至2025年6月底的港股基準指數——恒生指數目標上調24%至26,000點,並將2025年底目標定爲28,000點。相比之下,恒生指數週二收於20701.14點,花旗集團對於滬深300及MSCI中國指數明年上半年目標點位則分別調升至4,600及84點,截至明年底的目標點位則定爲4,900及90點。

華爾街知名投資機構伯恩斯坦(Bernstein)近日重申該機構對中國股市的「戰術性增持立場」,並表示在政策提振下,中國股市將進一步上漲。該機構在週四發佈的一份最新研報中寫道:「中國政府近期出臺的一系列刺激政策以及財政刺激基調,引發投資者的強烈看漲反應,大量國際資金湧入中國股市,來自美國的被動資金流入規模也創下歷史新高。在一系列政策出臺後,我們轉爲樂觀立場,並且仍然認爲中國市場的風險回報偏向上行。」

此前曾正確預測中國股市9月底大漲的美國銀行策略師Lars Naeckter近日表示,雖然港股恒生中國企業指數在近幾日內回吐一部分漲幅,但考慮到國家政策繼續發力和外資機構重新進入港股市場的意願,市場仍有可能進一步反彈。Naeckter的美銀團隊還建議對美股市場的「中國大盤股ETF」採用看漲期權策略。

總部位於澳大利亞的全球頂級投資機構麥格理(Macquarie)近期發佈報告,上調了多隻在美國與香港兩地上市的中國互聯網公司的股票評級,主要的理由在於企業盈利可見性提高,以及中國政府持續的政策刺激舉措。麥格理的分析團隊在研報中指出,與2023年初相比,這些互聯網公司目前的基本面實際上更爲強勁,但估值水平一直只有2023年初的一半。

麥格理將阿里巴巴和拼多多的股票評級從「中性」上調爲「跑贏大盤」,該機構還重申對於京東以及和美團的「跑贏大盤」評級。該機構分析團隊還預計,中國政府將採取進一步的行動刺激經濟增長,尤其是在消費和數字化服務領域,預計這些互聯網公司將持續受益於政策。

在第三季度全球资金对于港股的交易热情高涨的助推之下,将香港视为最大市场的汇丰最新公布的第三季度利润超过市场普遍预期,这是在汇丰新任首席执行官乔治斯·埃尔赫德里(Georges Elhedery)领导下汇丰的首次业绩。汇丰商业活动的全面回升,凸显了世界第二大经济体在政府最新的一篮子刺激措施推动下正在复苏的迹象。

在第三季度全球资金对于港股的交易热情高涨的助推之下,将香港视为最大市场的汇丰最新公布的第三季度利润超过市场普遍预期,这是在汇丰新任首席执行官乔治斯·埃尔赫德里(Georges Elhedery)领导下汇丰的首次业绩。汇丰商业活动的全面回升,凸显了世界第二大经济体在政府最新的一篮子刺激措施推动下正在复苏的迹象。