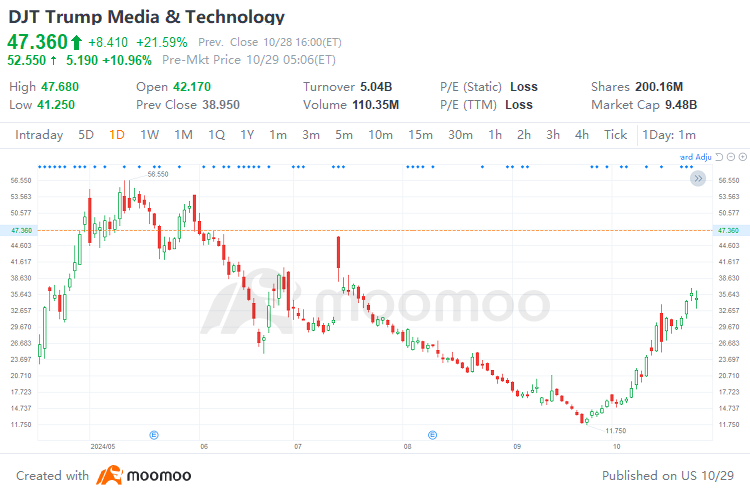

On Monday, $Trump Media & Technology (DJT.US)$ surged by 20%, becoming a focal point in the global market. With Trump holding a 57% stake in the company, it is viewed as one of the top concept stocks for the upcoming U.S. election. As the election progresses, the stock price has risen over 240% from its lows in recent weeks.

After surviving an assassination attempt in mid-July, Trump saw DJT's stock price spike by 30% in a single day, reaching a high of $46. As of yesterday's market close, the stock was priced at $47.36, with market sentiment gradually favoring Trump's chances of victory.

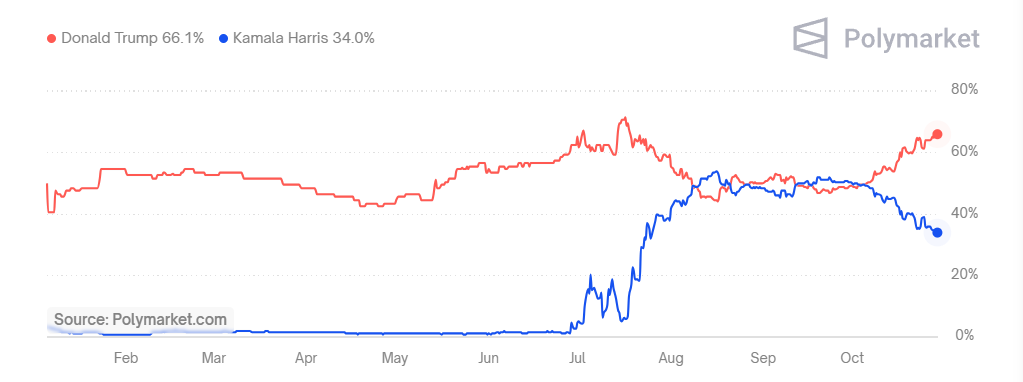

According to the latest data from Polymarket, the probability of Trump returning to the White House has reached 68%.

Increasing signs indicate that the U.S. stock market is re-embracing the "Trump trade," with other Trump-related stocks also regaining attention.$Phunware (PHUN.US)$ which participated in Trump's 2020 campaign, has risen over 200% this month. Additionally, cryptocurrency stocks publicly supported by Trump have rebounded collectively, with Bitcoin rising more than 10% from its lows earlier this month.

Increasing signs indicate that the U.S. stock market is re-embracing the "Trump trade," with other Trump-related stocks also regaining attention.$Phunware (PHUN.US)$ which participated in Trump's 2020 campaign, has risen over 200% this month. Additionally, cryptocurrency stocks publicly supported by Trump have rebounded collectively, with Bitcoin rising more than 10% from its lows earlier this month.

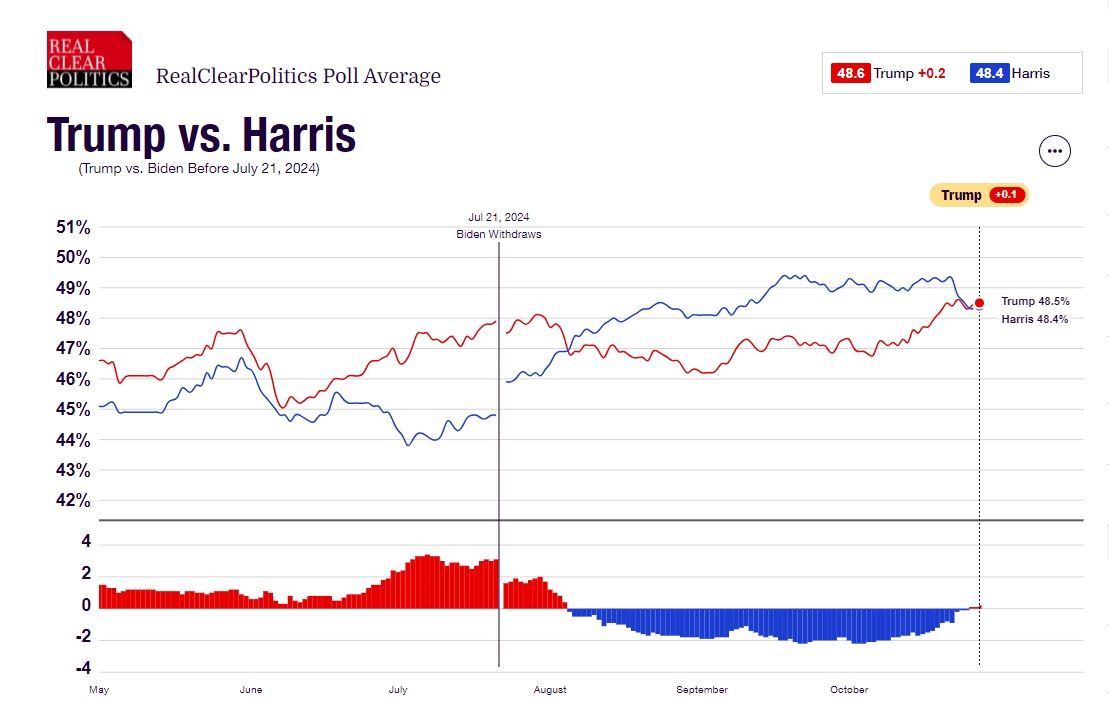

Notably, on Monday, Trump’s polling support surpassed Harris’s by 0.2 percentage points (48.6 vs. 48.4), marking the first time Trump has led since August, though both candidates remain in a statistical tie.

As some investors have noted, markets often develop amidst divergence and conclude with frenetic surges. The election results are expected to be announced on 5 November, and we may witness the gradual fading of one-sided market bets, with expectations shifting towards favorable industries under a new regime.

Currently, the market generally believes that, given Trump's positions, his policies will support cryptocurrency, traditional energy, infrastructure development, and tax cuts. Conversely, if Harris were to take office, she would likely favor welfare policies, healthcare, green energy, and support for U.S. exports and housing.

With the 2024 U.S. presidential election in a state of flux, how can bullish and bearish investors seize profit opportunities? Find out more>>

The U.S. election is a tight race! How to track related concept stocks? Open moomoo> U.S. stocks> Concept sectors to see Trump and Harris concept stocks at a glance!