The volume has dropped! What signal?

The volume of A-shares fell today!

Major stock indexes were green across the board. By the close, the Shanghai Index fell 1.08%, the Shenzhen Index fell 1.33%, the GEM Index fell 2.32%, and the Beijing Stock Exchange 50 Index rose 3.68%. The turnover of the Shanghai, Shenzhen and Beijing markets was 2114.9 billion yuan, up from the previous day's volume of 210.8 billion yuan.

(The content of this article is a list of objective data and information and does not constitute any investment advice)

(The content of this article is a list of objective data and information and does not constitute any investment advice)

Today's decline in A-share volume, compounded by high-ranking stocks diving at the end of the session, what signal would that be?

1

The purchase of Beijing Stock Exchange 50 Index funds has been restricted!

Sometimes, you are puzzled, why can't people always beat their own humanity?

Recently, I've been reading a lot of fund managers' reports for the third quarter and saw Wang Luyao of the Sino-Thai Fund write in the third quarter report:

The large market fluctuations in the last few days of the third quarter will be memorable for all participants in the secondary market. We would like to use this to re-examine one question:

Why should investors be persuaded to be patient and reduce operations?

By counting the yield of Shanghai and Shenzhen 300 and Wandequan A for 4,800 trading days over the past 20 years, long-term investment returns are determined by the 30 days with the highest increase. In other words, if the highest increase is missed for 30 days, the annualized return will go from 8.4% to a negative value. However, 30 days accounted for only 0.6% of 4,800 trading days. If you think about the hopeless atmosphere in July and August, it would be as difficult to accurately grasp the bottom based on industry sentiment and macro-analysis.

Famous FT reporter Robin Wiggsworth wrote in “The Trillion Index”: An index fund invented by financial industry rebels and heretics, which was initially ridiculed, is the biggest innovation in the financial industry in the past 50 years.

Why is that?

Index funds were invented because people realized that most people are actually bad investors. The best long-term returns are obtained by buying a sufficiently large and sufficiently diversified investment portfolio, then holding it for a long time and trading as little as possible.

People invented index funds, apparently to eliminate the original crime of investing, but now everyone is redeeming active equity funds while robbing “T+0” ETFs, “20CM” ETFs, and even buying Beijing Stock Exchange index funds with limited purchases. It's a blatant sense of magical reality.

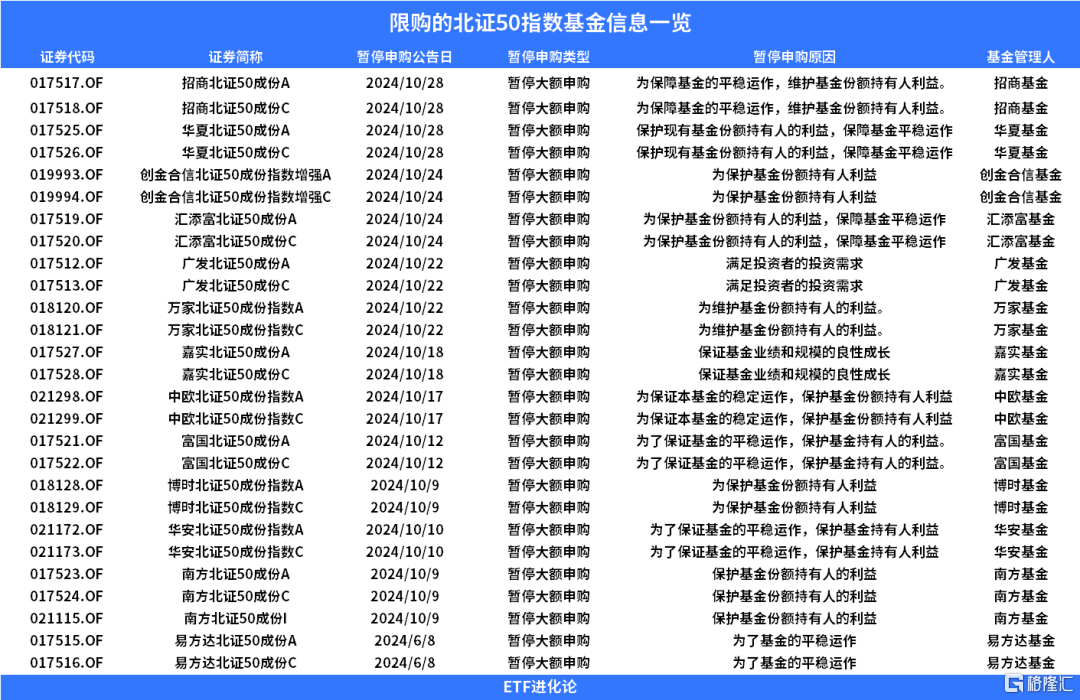

On October 28, the Huaxia North Stock Exchange 50 Component Index Fund and the China Merchants Beijing Stock Exchange 50 Component Index Fund announced purchase restrictions.

Earlier, Beijing Stock Exchange 50 Index funds owned by companies such as Bosch, E-Fangda, Huitianfu, Wells Fargo, Harvest, and ICBC Credit Suisse also announced the suspension of large subscriptions.

However, what you can't question is that the Beijing Stock Exchange 50 Index not only had a high rise but a small retracement. The increase directly doubled from September 24 to October 8. It was also the first index to surpass the high of October 8 since the A share capital round. It has risen 19.94% from October 9 to now.

Judging from the performance of the A-share style, the small market and growth style have continued to be stronger than the market value for two consecutive weeks. Compared to a few months ago, market sentiment has picked up significantly.

Coinciding with the disclosure of all public fund reports for the third quarter of 2024, let's take a look at the unprecedented surge in amounts since 9.24. How will it affect the latest pattern of public funds?

2

“Repayment” is probably the main act of the moment

In the third quarter, public funds earned more than 1.12 trillion yuan, and all types of funds made profits.

According to data from the Galaxy Securities Fund Research Center, the total profit of 1,1958 funds in the third quarter of this year was 1123.436 billion yuan. Among them, stock fund profit is 633.934 billion yuan, hybrid fund profit is 306.132 billion yuan, bond fund profit is 48.698 billion yuan, money market fund profit is 534.68 billion yuan, and QDII fund profit is 67.441 billion yuan.

Looking at a further breakdown, the third-quarter profits of stock ETFs, stock ETF funds, Hong Kong Stock Connect Stock ETF, and Hong Kong Stock Connect Stock ETF Linked Fund were 433.516 billion yuan, 59.67 billion yuan, 12.05 billion yuan, and 1,922 billion yuan respectively, totaling 507.158 billion yuan, contributing 80% to the stock fund's Q3 profit.

Therefore, it is well deserved that index funds are highly sought after.

Most of the top 10 funds ranked by profit in the third quarter were broad-based ETF funds, with profits generally exceeding 10 billion yuan. The E-Fangda Blue Chip Selection managed by Zhang Kun is the only active equity fund product that made it into the top 20.

According to statistics from the China Foundation Association, at the end of September, the total size of public funds exceeded 32 percent, an increase of 1.16 trillion yuan over the end of August.

The biggest highlight was the biggest increase in stock funds. The size of stock funds increased by 977.178 billion yuan in September, and the size of mixed funds increased by 445.406 billion yuan to 3.75 trillion yuan.

Judging from changes in fund shares, equity funds increased by 60.501 billion to 3.04 trillion in September, and the debt base increased by 26.9 billion shares in September. The share of the cargo base decreased the most, by 358.918 billion shares in September, mixed funds reduced 25.296 billion shares to 3.26 trillion shares in September, and QDII funds also experienced a decrease in share.

What can be seen from this is that although the size of hybrid funds increased in September, the share continued to decline since 2021.

The Minsheng Strategy Team's latest research report also said that “capital redemption” may be the main act now, and this is also one of the main disruptions in the current market transaction level.

2

Passive partial equity funds have received significant incremental funding for six consecutive quarters

By analyzing fund data for the third quarter of this year, the Minsheng Strategy Team summed up an interesting characteristic — passive “wave” and “capital redemption” of active funds.

According to the team's statistics, the net outflow of active funds rebounded from 72.331 billion yuan in 2024Q2 to 109.351 billion yuan in 2024Q3. As net worth rebounded in the third quarter, active partial equity funds instead experienced indiscriminate redemptions. Therefore, it is believed that most active partial equity funds may experience “principal redemption.”

In stark contrast to this, passive partial equity funds have received large amounts of incremental capital for six consecutive quarters, and in the third quarter, they surpassed the size of active partial equity funds holding A-shares for the first time.

As ETFs become more and more a huge force in micropricing in the market that cannot be ignored, what are the latest changes in ETFs?

Whether it is the CITIC Strategy Team or the People's Livelihood Strategy Team, analyzing the financial characteristics of A-shares since September 24, they all believe that individual investors may be the main participants.

After calculating the ETF net subscription data for October 8 and October 9, CITIC Securities believes that incremental capital is mainly due to the pulsed entry of retail investors, and that institutional capital did not enter the market on a large scale.

The Minsheng Strategy Team believes that individual investors have been the main incremental participants since October.

Both financial and individual ETFs have made significant net purchases of A-shares, especially in fields such as science and technology innovation/GEM, while North China and institutional ETFs have repeatedly withdrawn to varying degrees.

According to Wind data, from September 24 to October 11, ETF capital inflows totaled 285.4 billion yuan, of which 10.8-10.11 had a net weekly net inflow of 153.2 billion yuan, a record high. Since October 11, there has been a slight outflow.

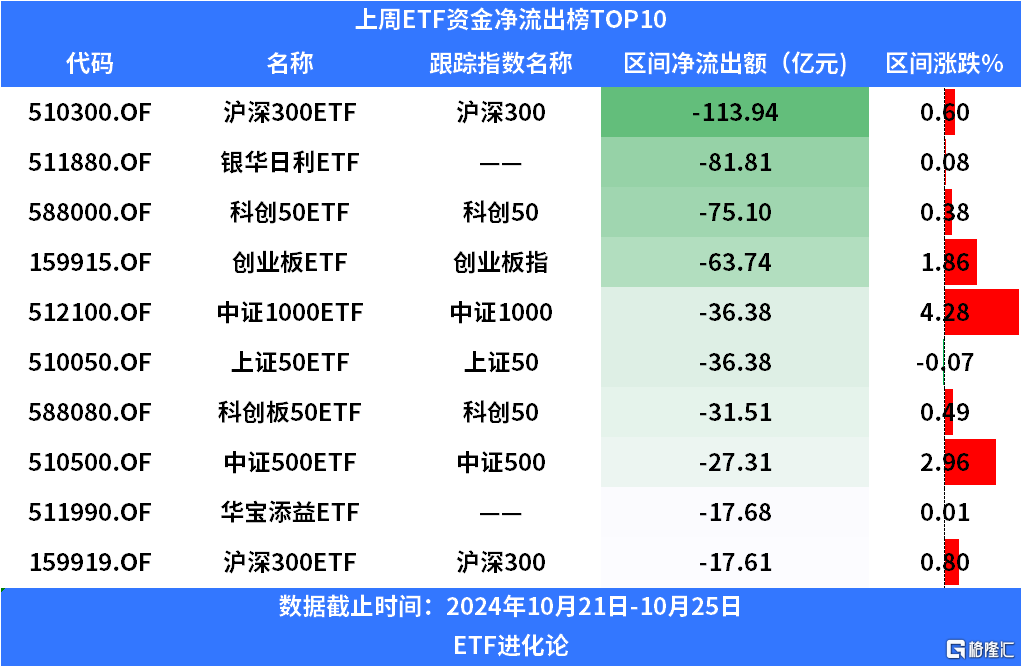

The net redemption of equity ETFs was 38.028 billion yuan last week, and there was a large outflow of capital from the index sector related to the Science and Technology Innovation Board. The net capital outflow for the whole week was 25.901 billion yuan, especially the Shanghai and Shenzhen 300 ETF and the Double Innovation Sector ETF. The net redemptions all exceeded 10 billion dollars.

Today, ETFs have continued to be net redeemed since October 11, compounded by “principal redemptions” of mixed stock funds. This is probably one of the main disruptions in the current market transaction level.

(本文内容均为客观数据信息罗列,不构成任何投资建议)

(本文内容均为客观数据信息罗列,不构成任何投资建议)