①The trading volume of multiple CSI 300, CSI 500, and CSI 1000 indexes increased significantly compared to yesterday, with the trading volume of the CSI 300 ETF (510360) increasing by 168% compared to the previous day. ②Concept stocks in the consumer electronics sector, OFILM Group Co., Ltd., were sold off by Swhy Anhui Branch for 0.977 billion, with the branch having relatively few previous appearances on the list.

The total trading volume of the Shanghai-Hong Kong Stock Connect today was 250.947 billion, with Kweichow Moutai and Contemporary Amperex Technology ranking first in the trading volume of the Shanghai and Shenzhen Stock Connects. In terms of main capital flow in the sector, the optics optoelectronics sector topped the list in net inflow of main capital. In terms of ETF trading volume, ChinaAMC Star50 ETF (588000) ranked first. Regarding futures positions, IM futures main contracts saw a net increase in long positions of over ten thousand contracts, with the increase in long positions exceeding that of short positions. In the dragon and tiger list, Xiangxue Pharmaceutical was bought by institutions for 0.151 billion; Shenzhen Huaqiang was bought by institutions for over 60 million; China Greatwall was sold by institutions for 0.207 billion, bought by Citic Securities Chongqing Jinkai Avenue Branch for 0.437 billion, bought by a quantitative position for over 50 million; Dark Horse Technology Group was sold by institutions for over 70 million; Yinbang Clad Material was sold by institutions for over 60 million; Cofco Biotechnology was bought by four first-line speculative seats, with the Citic Securities Peking Headquarters Branch buying for 0.185 billion; Tianshui Huatian Technology was bought by Guotou Securities Xi'an Qujiang Chinan Road Branch for 0.134 billion.

I. Top ten trading volumes of the Shanghai-Hong Kong Stock Connect

Today, the total trading volume of the Shanghai Stock Connect was 119.192 billion, and the total trading volume of the Shenzhen Stock Connect was 131.755 billion.

Today, the total trading volume of the Shanghai Stock Connect was 119.192 billion, and the total trading volume of the Shenzhen Stock Connect was 131.755 billion.

Looking at the top ten trading stocks in the Shanghai Stock Connect, Kweichow Moutai ranked first; Chongqing Sokon Industry Group Stock and Foxconn Industrial Internet ranked second and third respectively.

Looking at the top ten trading stocks in the Shanghai Stock Connect, Kweichow Moutai ranked first; Chongqing Sokon Industry Group Stock and Foxconn Industrial Internet ranked second and third respectively.Looking at the top ten trading stocks in HK->SZ Stock Connect, Contemporary Amperex Technology ranked first; East Money Information and Zhongji Innolight ranked second and third respectively.

II. Bulk orders of individual stocks in different sectors

In terms of sector performance, sectors such as Zhipu AI, brain-computer interface, AI smartphones, and quantum technology are among the top gainers, while sectors such as film and television, coal, steel, and CRO are among the top decliners.

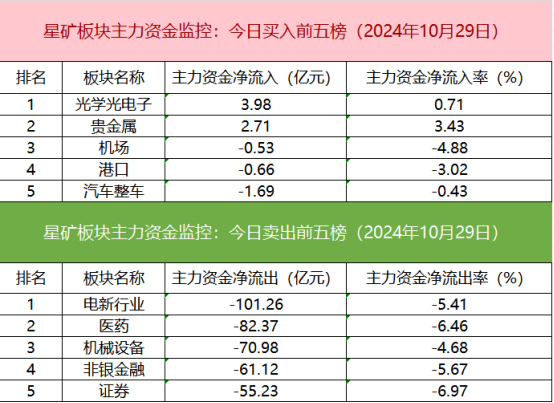

From the monitoring data of the main sector funds, the optical optoelectronics sector has the highest net inflow of main funds.

From the monitoring data of the main sector funds, the optical optoelectronics sector has the highest net inflow of main funds.In terms of sector fund outflows, funds from the new energy sector are the largest net outflows, with a net outflow amount exceeding one hundred billion.

From the data of main fund monitoring of individual stocks, the sectors to which the top ten stocks with net inflows of main funds belong are relatively mixed, with Zhongke Shuguang ranking first in net inflows.

From the data of main fund monitoring of individual stocks, the sectors to which the top ten stocks with net inflows of main funds belong are relatively mixed, with Zhongke Shuguang ranking first in net inflows.The sectors to which the top ten stocks with net outflows of main funds belong are relatively mixed, with East Money Information leading in net outflows.

III. ETF trading

Among the top ten ETFs in terms of turnover, ChinaAMC STAR50 ETF (588000) ranks first in turnover; 300ETF (510300) ranks second in turnover.

Among the top ten ETFs in terms of turnover, ChinaAMC STAR50 ETF (588000) ranks first in turnover; 300ETF (510300) ranks second in turnover. Looking at the top ten ETFs with the highest turnover growth rate, the turnover of multiple csi 300, csi 500, and csi 1000 indices increased significantly, among which the turnover of guangfa300 ETF Fund (510360) increased by 168% on a month-on-month basis, ranking first.

Looking at the top ten ETFs with the highest turnover growth rate, the turnover of multiple csi 300, csi 500, and csi 1000 indices increased significantly, among which the turnover of guangfa300 ETF Fund (510360) increased by 168% on a month-on-month basis, ranking first.IV. Futures positions

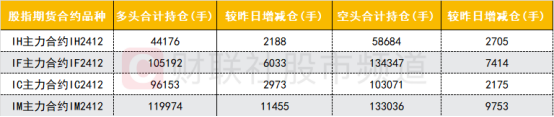

Both long and short positions of the four major index futures contracts have significantly increased their positions. The short positions of IH and IF contracts have increased significantly; the long positions of IC and IM contracts have increased more, with the long positions of the IM contract exceeding tens of thousands of lots.

Both long and short positions of the four major index futures contracts have significantly increased their positions. The short positions of IH and IF contracts have increased significantly; the long positions of IC and IM contracts have increased more, with the long positions of the IM contract exceeding tens of thousands of lots.V. Dragon-Tiger List

1. Institutions

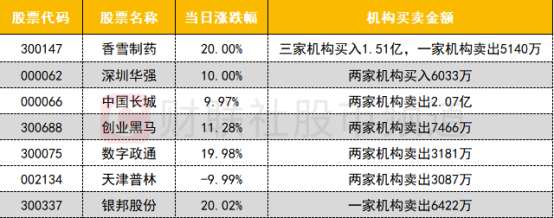

The Shanghai stock dragon and tiger list data for today has not been disclosed yet. In the Shenzhen stock market, the institutional activity is moderate. In terms of buying, Xiangxue Pharmaceutical received institutional buying of 0.151 billion; Shenzhen Huaqiang received institutional buying of over 60 million.

The Shanghai stock dragon and tiger list data for today has not been disclosed yet. In the Shenzhen stock market, the institutional activity is moderate. In terms of buying, Xiangxue Pharmaceutical received institutional buying of 0.151 billion; Shenzhen Huaqiang received institutional buying of over 60 million.On the selling side, the concept stock China Greatwall in the innovation sector encountered institutional selling of 0.207 billion; the AI concept stock Dark Horse Technology Group encountered institutional selling of over 70 million; the consumer electronics concept stock Yinbang Clad Material encountered institutional selling of over 60 million.

2. Institutional investors

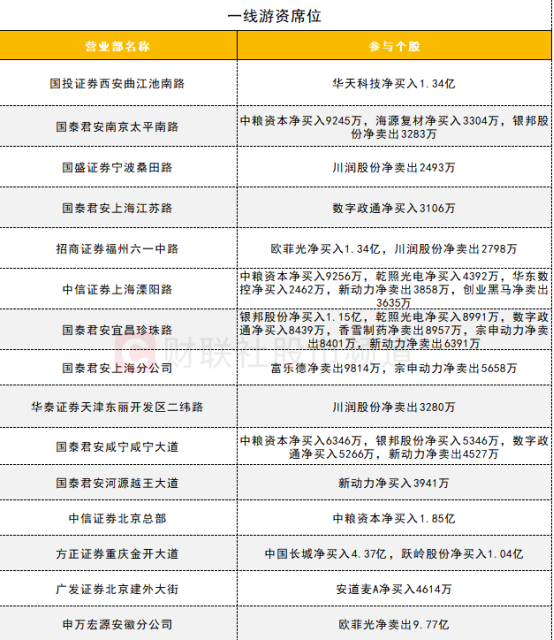

The activity of first-tier speculative funds is relatively high. Cofco Biotechnology, a diversified finance concept stock, received buying from four first-tier speculative funds, including Citic Securities Beijing Headquarters trading department buying of 0.185 billion; China Greatwall received buying from the Zhengzhou Jin Kai Avenue trading department of Founder Securities of 0.437 billion; Tianshui Huatian Technology, a concept stock in advanced packaging, received buying from the Xi'an Qujiangchi South Road trading department of Guotou Securities of 0.134 billion; OFilm Group Co., Ltd received buying from the Fuzhou Liuyi Middle Road trading department of China Merchants of 0.134 billion. However, the stock also encountered selling from the Anhui branch trading department of Shenwan Hongyuan of 0.977 billion, the trading department had not been on the list frequently before, and the trading volume was relatively small when listed. This selling may be a reduction in holdings by non-major shareholders of the stock.

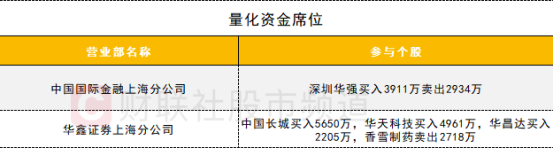

The activity of first-tier speculative funds is relatively high. Cofco Biotechnology, a diversified finance concept stock, received buying from four first-tier speculative funds, including Citic Securities Beijing Headquarters trading department buying of 0.185 billion; China Greatwall received buying from the Zhengzhou Jin Kai Avenue trading department of Founder Securities of 0.437 billion; Tianshui Huatian Technology, a concept stock in advanced packaging, received buying from the Xi'an Qujiangchi South Road trading department of Guotou Securities of 0.134 billion; OFilm Group Co., Ltd received buying from the Fuzhou Liuyi Middle Road trading department of China Merchants of 0.134 billion. However, the stock also encountered selling from the Anhui branch trading department of Shenwan Hongyuan of 0.977 billion, the trading department had not been on the list frequently before, and the trading volume was relatively small when listed. This selling may be a reduction in holdings by non-major shareholders of the stock. The activity of quantitative funds is average, with China Great Wall Technology Group receiving orders exceeding 50 million from one quantitative seat to buy.

The activity of quantitative funds is average, with China Great Wall Technology Group receiving orders exceeding 50 million from one quantitative seat to buy.

今日沪股通总成交金额为1191.92亿,深股通总成交金额为1317.55亿。

今日沪股通总成交金额为1191.92亿,深股通总成交金额为1317.55亿。