List of major asset restructuring companies in October.

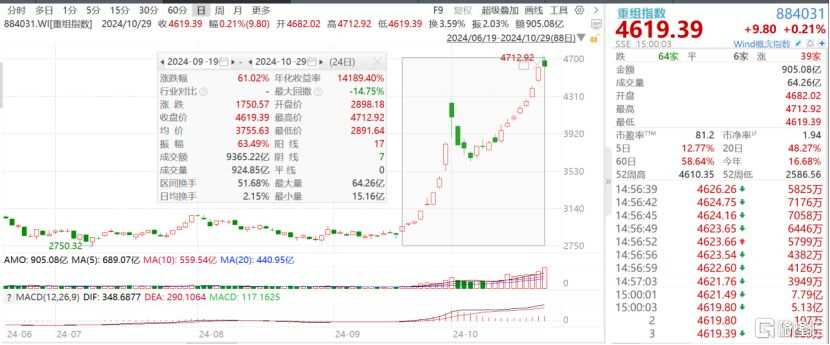

In the past week, the rotation speed between sectors of A-shares has accelerated, and the merger and acquisition market has gradually strengthened. Many companies have shown the momentum of big bull stocks, with Wind's restructuring index rising by 61% from September 19 to date.

Leading stock in mergers and acquisitions and restructurings, Hainan Shuangcheng Pharmaceuticals, saw its intraday stock price reach 40 yuan, ten times higher than the low point on July 25, 2024. From September 10th when the announcement of the acquisition of Aura Semiconductors was made until October 28th, Hainan Shuangcheng Pharmaceuticals experienced a market with 24 limit-up days over 27 days.

On the evening of October 28, three more companies (Huafon Chemical, Cabio Biotech (Wuhan), Shandong Dawn Polymer) successively issued suspension announcements for asset acquisitions or restructurings, pushing the sentiment of mergers and acquisitions to a peak. Today, the restructuring index briefly rose to 4712 points during trading hours, but there was a clear fund outflow towards the end of the session, causing some stocks related to restructuring concepts to plummet.

On the evening of October 28, three more companies (Huafon Chemical, Cabio Biotech (Wuhan), Shandong Dawn Polymer) successively issued suspension announcements for asset acquisitions or restructurings, pushing the sentiment of mergers and acquisitions to a peak. Today, the restructuring index briefly rose to 4712 points during trading hours, but there was a clear fund outflow towards the end of the session, causing some stocks related to restructuring concepts to plummet.

Image source: Wind

Image source: WindOf course, most of the companies included in the restructuring index are those with visible merger and acquisition plans. In the past half month, the merger and acquisition market has further spread to the periphery, with some companies not yet announcing merger plans, but already attracting market attention. For example, Shandong Huapeng, Guangdong Songfa Ceramics, and Xiamen Changelight have already doubled from the bottom.

Among them, Shandong Huapeng (603021.SH) had planned a major asset restructuring in 2023, but there was no progress. On February 29th of this year, the company announced the termination of the major asset restructuring.

Until recently, the "Merger and Acquisition Six Measures" policy encouraging mergers and acquisitions was introduced, igniting the market's memory once again, with large sums of funds pouring into Shandong Huapeng.

From the first heavy volume limit-up on October 18th to 8 trading days later on October 29th, the total trading amount of Shandong Huapeng reached 1.37 billion yuan, with a total turnover ratio of 84% within the range. As of the close on October 29th, Shandong Huapeng's market cap was 1.92 billion yuan. If it weren't for the last-minute plunge, Shandong Huapeng would have achieved 8 consecutive trading limit-up.

Shandong Huapeng's stock price trend (as of October 29, 2024), source: East Money Information

Shandong Huapeng's stock price trend (as of October 29, 2024), source: East Money Information01

Shandong Huapeng has incurred annual losses in performance

Shandong Huapeng is headquartered in Rongcheng, a coastal city at the eastern end of the Shandong Peninsula. It went public on the Shanghai Stock Exchange in April 2015.

The company's main business is glass manufacturing, with multiple subsidiaries including Shandong Huapeng Shidao Glass Products Co., Ltd., Anqing Huapeng Changjiang Glass Co., Ltd., Gansu Shidao Glass Co., Ltd., specializing in the research, production, and sales of various medium-to-high-end glass bottles and glassware.

On October 21, 2022, Haikong Holdings acquired 77.8531 million shares of Shandong Huapeng held by Zhang Dehua at a price of 7.09 yuan per share, costing 0.552 billion yuan. After the transaction was completed, Haikong Holdings became the controlling shareholder of Shandong Huapeng, and the actual controller changed to Yang Xiaohong.

In addition to Shandong Huapeng, Haikong Holdings also holds 60.9% stake in GEM-listed company Haikexinyuan (301292.SZ). Haikexinyuan focuses on the research and development, production, and sales of lithium-ion battery electrolyte solvents and high-end chemicals such as propylene glycol, dipropylene glycol, and 1,3-butanediol. Its products are widely used in lithium battery materials, pharmaceuticals, daily chemicals, flavors and fragrances, basic chemicals and other fields.

With a diversified layout, Haikong Holdings' strength among private enterprises in China is quite outstanding. In the "2024 Top 500 Private Enterprises in China" list released by the All-China Federation of Industry and Commerce, Haikong Holdings ranks 145th with a revenue of 73.5 billion yuan, and 15th among Shandong companies on the list.

It is noteworthy that while seeking controlling rights, Haikong Holdings once planned to restructure the assets of Shandong Huapeng, intending to inject 100% equity of Dongying Hebang Chemical Co., Ltd. (referred to as Hebang Chemical) into the listed company and dispose of existing assets.

According to the Gelonghui, on October 14, 2022, Shandong Huapeng announced that it planned to issue shares and pay cash to purchase 100% equity of Hebang Chemical held by Haikong Holdings, and at the same time issue shares to specific parties to raise funds of no more than 0.24 billion yuan.

According to disclosure, Shandong Huapeng's performance has been weak, with only one positive year for net income attributable to shareholders in 2020 over the past few years. Deducting non-net profit, Shandong Huapeng has accumulated losses of 1.352 billion yuan from 2019 to September 2024.

In the 2023 annual report, the company explained that the international situation is complex, geopolitical conflicts are intensifying, global economic recovery is weak, domestic economic growth faces significant pressure, the consumer market is sluggish, industry competition is intensifying, resulting in pressure on the company's performance.

Looking further back, Shandong Huapeng had only positive non-net profit in the year of listing and the second year (2015 and 2016). Starting from the third year, each year has been in deficit, truly waiting for acquisition by all shareholders for a turnaround.

Shandong Huapeng stated in the acquisition proposal that the asset-liability ratio of the listed company is relatively high. As of June 31, 2023, the asset-liability ratio in the consolidated financial statements was 80.52%; on the other hand, the company's profitability is poor. Therefore, the future development prospects of the original business of the listed company are unclear, and actively seeking business transformation.

Key financial data of Shandong Huapeng, source: East Money Information

Key financial data of Shandong Huapeng, source: East Money Information02

In February 2024, Shandong Huapeng terminated the acquisition of Hebang Chemical

The target of the intended acquisition Hebang Chemical was established in 2011 and is a wholly-owned subsidiary of Haike Holdings. The company's main products include caustic soda, epichlorohydrin, and other products such as liquid chlorine, hydrogen chloride, hydroxylamine hydrochloride, and hydrogen.

Caustic soda, as a basic chemical product, has certain cyclical fluctuations in upstream raw material supply and downstream consumption demand with changes in the economic development situation. The product demand, prices, and macroeconomic environment are closely related.

Financial data shows that in the fiscal year 2020, 2021, 2022, and January-June 2023, Hebang Chemical achieved net profits of 18.5391 million yuan, 0.158 billion yuan, 0.152 billion yuan, and 12.1374 million yuan respectively.

According to the revised acquisition prospectus released in August 2023, the transaction price for 100% equity of Hebang Chemical is 1.124 billion yuan. Without considering the raising of supporting funds, the main financial data of Shandong Huapeng will see significant improvement before and after the completion of the asset replacement. Taking 2022 as an example, before acquiring Hebang Chemical, Shandong Huapeng's net income attributable to shareholders was -0.38 billion yuan; if the acquisition of Hebang Chemical is successful and the original business is divested, the company's net income will increase to 0.152 billion yuan.

In the acquisition proposal, Shandong Huapeng stated that prior to this transaction, the main business of the listed company was the research, production, and sales of glassware products and glass bottle products. After this transaction is completed, the profitable and high-potential Hebang Chemical will become a wholly-owned subsidiary of the listed company; at the same time, the listed company will gradually dispose of the existing businesses with weak growth and uncertain future prospects.

After the completion of Hebang Chemical's injection and the disposal of existing businesses, the listed company will achieve the transformation of its main business, changing to the research, production, and sales of chemical products such as caustic soda and epichlorohydrin. In the future, focusing on the green circular industry chain of "chlor-alkali - epichlorohydrin - epoxy resin", the company will continue to grow, strengthen and refine its operations; fully leverage its existing resource advantages and position itself for development in the direction of new energy and new materials.

However, things did not go as planned, and the acquisition was hastily concluded in 2024.

Shandong Huapeng announced on June 29, 2023, and December 29, 2023, respectively, that due to the impending expiration of the financial information in the declaration documents for the transaction, the company applied to the Shanghai Stock Exchange to suspend the review of the restructuring matters.

On February 29, 2024, Shandong Huapeng once again announced the termination of the acquisition. The announcement stated that since the start of this restructuring, the listed company and relevant parties have actively promoted various work. This transaction took a long time, and there have been certain fluctuations and changes in the macroeconomic and industry environments. Considering the current external market environment, the operating conditions of the target company, and other factors, to effectively safeguard the interests of the listed company and the broader investors, after careful consideration by the listed company, it is proposed to terminate the current restructuring matters.

03

Epilogue

In the annual report of 2023 and the semi-annual report of 2024, Shandong Huapeng Glass stated that in the face of complex domestic and international economic situations, the company's board of directors adheres to a problem-oriented, target-oriented, and results-oriented approach, firmly driving the dual-wheel strategy; in the future, it will continue to optimize the product structure and business sectors, accelerate the disposal progress of inefficient and ineffective assets, timely increase the intensity of asset restructuring, and steadily promote the company's transformation and upgrading.

Therefore, the market speculates that the termination of Shandong Huapeng Glass's acquisition this time is not the end. In order to protect the shell, Shandong Huapeng Glass may continue to seek asset injections in the future, hence the highly anticipated market situation.

Mergers and acquisitions may seem lively, but they are actually difficult to participate in. For companies that have already announced, once trading resumes, it often hits the daily limit up, and by the time the market opens, the stock price is already at a high level. It takes great courage to buy at that point, and it's very difficult to hold on if there's any subsequent volatility.

As for companies that have not yet finalized mergers and acquisitions, one can only rely on perception and judgment of market funds to choose core bundled tickets to participate, which has a high degree of randomness. This is vividly demonstrated in today's market, with Shandong Huapeng Glass plummeting at the close of trading, causing maximum intraday losses of 13 points for investors who bought in the morning; while some more core restructuring targets have not yet shown any signs of movement.

In a previous article, it was mentioned that the capital markets are ever-changing, and not all expectations of mergers and reorganizations will necessarily come to fruition. Participating in such investments requires staying alert at all times and ensuring that positions are kept within one's own risk tolerance limits.

就在10月28日晚,又有三家公司(华峰化学、嘉必优、道恩股份)先后发布资产收购或重组停牌公告,将并购重组的情绪推到了高峰;今日重组指数盘中一度冲高到4712点,不过尾盘明显有资金出逃,部分重组概念个股跳水。

就在10月28日晚,又有三家公司(华峰化学、嘉必优、道恩股份)先后发布资产收购或重组停牌公告,将并购重组的情绪推到了高峰;今日重组指数盘中一度冲高到4712点,不过尾盘明显有资金出逃,部分重组概念个股跳水。