In the third quarter, due to the decline in both product sales and prices in the cement business, the company's revenue and profit declined by double digits year on year.

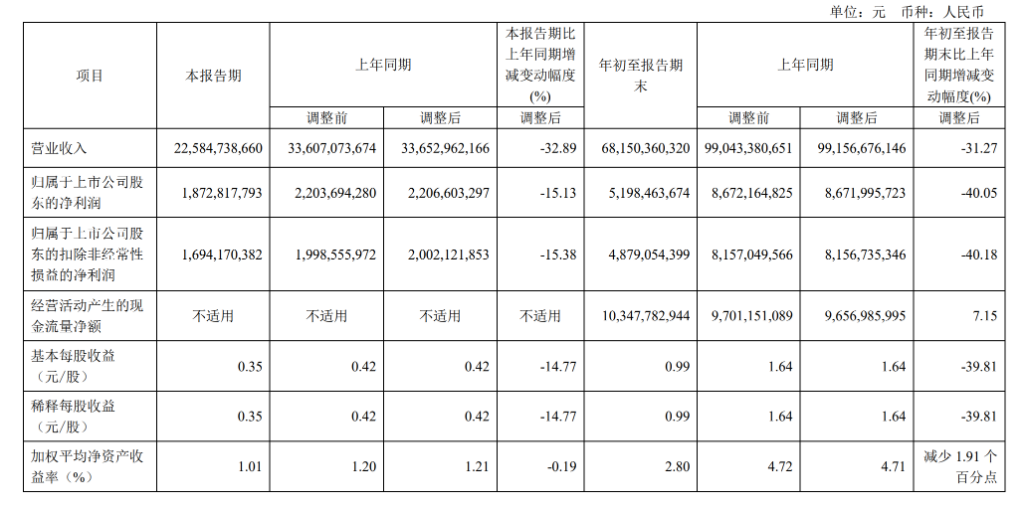

In the third quarter, the company's revenue decreased by 32.89% compared to the same period last year due to the decline in both product sales and prices in the cement business.

On the 29th, Conch Cement announced the following announcement:

- Revenue: Third-quarter revenue was 22.585 billion yuan, a year-on-year decrease of 32.89%.

- Net profit: Net profit attributable to shareholders of listed companies in the third quarter was 1.873 billion yuan, a year-on-year decrease of 15.13%.

- Basic earnings per share: $0.35 for the third quarter, a year-on-year decrease of 14.77%.

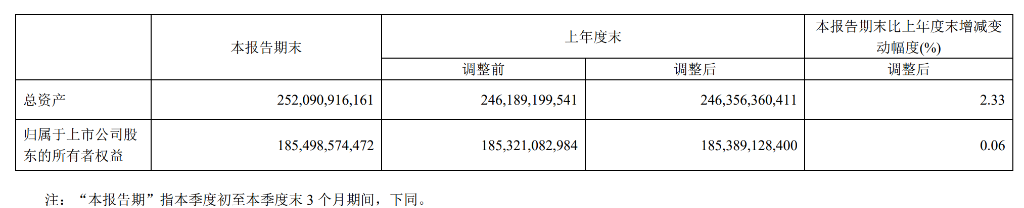

- Total assets: As of the end of the reporting period, the company's total assets were 252.091 billion yuan.

In the first three quarters, the company's cumulative revenue was 68.15 billion yuan, down 31.27% year on year, and net profit was 5.198 billion yuan, down 40.05% year on year. The cumulative basic earnings per share was 0.99 yuan, down 39.81% year over year.

In the first three quarters, the company's cumulative revenue was 68.15 billion yuan, down 31.27% year on year, and net profit was 5.198 billion yuan, down 40.05% year on year. The cumulative basic earnings per share was 0.99 yuan, down 39.81% year over year.

According to the company announcement, operating costs dropped sharply by 32.30% during the reporting period, and management expenses and sales expenses were 4.289 billion yuan and 2,333 billion yuan respectively, all with a slight decrease. R&D expenses were 0.865 billion yuan, a year-on-year decrease of 34.00%, indicating that the company was effective in controlling costs.

In the building materials industry, weakening market demand has affected the price and sales volume of the company's cement products. Increased market competition and fluctuations in raw material costs are important factors affecting the company's performance.

前三季度,公司累计营业收入681.50亿元,同比下降31.27%,净利润为51.98亿元,同比下降40.05%。基本每股收益累计为0.99元,同比下降39.81%。

前三季度,公司累计营业收入681.50亿元,同比下降31.27%,净利润为51.98亿元,同比下降40.05%。基本每股收益累计为0.99元,同比下降39.81%。