Unpacking the Latest Options Trading Trends in Viking Therapeutics

Unpacking the Latest Options Trading Trends in Viking Therapeutics

Financial giants have made a conspicuous bearish move on Viking Therapeutics. Our analysis of options history for Viking Therapeutics (NASDAQ:VKTX) revealed 34 unusual trades.

金融巨頭對Viking Therapeutics採取了明顯的看淡舉措。我們對Viking Therapeutics(納斯達克: VKTX)的期權歷史進行分析後發現了34筆飛凡交易。

Delving into the details, we found 38% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $146,300, and 29 were calls, valued at $2,404,204.

深入了解細節後,我們發現38%的交易者看好,而47%顯示了看淡傾向。在我們發現的所有交易中,有5筆看跌期權,價值146,300美元,而有29筆看漲期權,價值2,404,204美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $105.0 for Viking Therapeutics over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,看來大鱷們在過去3個月一直把矛頭指向Viking Therapeutics的目標價區間15.0至105.0美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

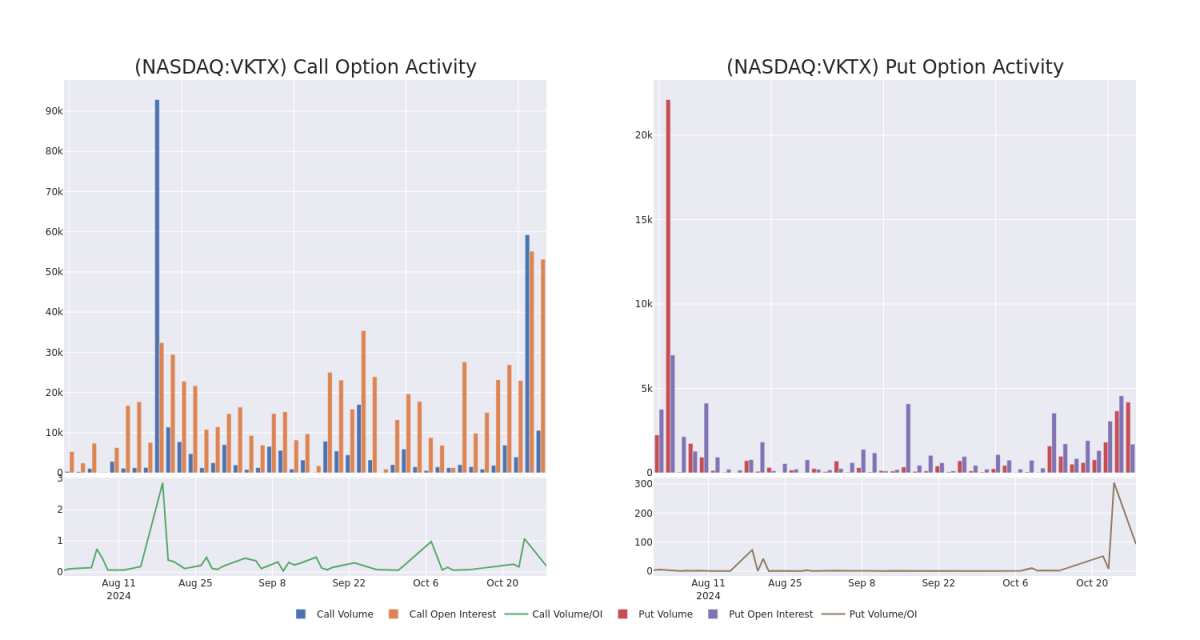

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Viking Therapeutics's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Viking Therapeutics's whale trades within a strike price range from $15.0 to $105.0 in the last 30 days.

在交易期權時,查看成交量和未平倉合約量是一個強有力的舉措。這些數據有助於您跟蹤Viking Therapeutics特定行權價格的期權的流動性和利益。下面,我們可以觀察Viking Therapeutics所有鯨魚交易在過去30天內在15.0至105.0美元行權價區間內的看漲和看跌期權的成交量和未平倉合約量的演變。

Viking Therapeutics 30-Day Option Volume & Interest Snapshot

Viking Therapeutics 30天期權成交量與未平倉合約快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VKTX | CALL | TRADE | BULLISH | 12/20/24 | $9.0 | $8.6 | $8.9 | $75.00 | $213.6K | 745 | 252 |

| VKTX | CALL | SWEEP | BULLISH | 01/16/26 | $62.9 | $59.0 | $61.34 | $15.00 | $191.7K | 154 | 31 |

| VKTX | CALL | TRADE | NEUTRAL | 12/20/24 | $8.1 | $7.5 | $7.8 | $77.50 | $187.2K | 14 | 493 |

| VKTX | CALL | SWEEP | BULLISH | 01/17/25 | $25.5 | $25.3 | $25.5 | $50.00 | $127.5K | 863 | 360 |

| VKTX | CALL | TRADE | BEARISH | 01/17/25 | $25.5 | $25.4 | $25.4 | $50.00 | $127.0K | 863 | 310 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VKTX | 看漲 | 交易 | 看好 | 12/20/24 | 9.0美元 | $8.6美元 | $8.9 | $75.00 | 213.6千美元 | 745 | 252 |

| VKTX | 看漲 | SWEEP | 看好 | 01/16/26 | $62.9 | $59.0 | $61.34 | 15.00美元 | $191.7K | 154 | 31 |

| VKTX | 看漲 | 交易 | 中立 | 12/20/24 | $8.1 | $7.5 | $7.8 | $77.50 | 187.2千美元 | 14 | 493 |

| VKTX | 看漲 | SWEEP | 看好 | 01/17/25 | 25.5美元 | $25.3 | 25.5美元 | $50.00 | $127.5K | 863 | 360 |

| VKTX | 看漲 | 交易 | 看淡 | 01/17/25 | 25.5美元 | 25.4美元 | 25.4美元 | $50.00 | $127.0K | 863 | 310 |

About Viking Therapeutics

關於Viking Therapeutics

Viking Therapeutics Inc is a healthcare service provider. The company specializes in the area of biopharmaceutical development focused on metabolic and endocrine disorders. The company's clinical program pipeline consists of VK2809, VK5211, VK0214 products. VK2809 and VK0214 are orally available, tissue and receptor-subtype selective agonists of the thyroid hormone receptor beta. VK5211 is an orally available, non-steroidal selective androgen receptor modulator.

Viking Therapeutics Inc是一家衛生服務提供商,專門從事代謝和內分泌障礙領域的生物製藥開發。該公司的臨床項目流水線包括VK2809、VK5211、VK0214產品。VK2809和VK0214是口服、組織和受體亞型選擇性的甲狀腺激素受體β激動劑。VK5211是一種口服、非類固醇選擇性雄激素受體調節劑。

Following our analysis of the options activities associated with Viking Therapeutics, we pivot to a closer look at the company's own performance.

在分析與Viking Therapeutics相關的期權交易活動後,我們轉而更近距離地關注該公司的業績表現。

Present Market Standing of Viking Therapeutics

維京療法現行市狀況

- Currently trading with a volume of 2,977,355, the VKTX's price is down by -1.41%, now at $73.47.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 99 days.

- 目前成交量爲2,977,355,VKTX的價格下跌了-1.41%,現在爲$73.47。

- RSI讀數表明該股目前可能接近超買水平。

- 預計業績將在99天后發佈。

Professional Analyst Ratings for Viking Therapeutics

Viking Therapeutics的專業分析師評級

In the last month, 2 experts released ratings on this stock with an average target price of $90.0.

上個月,有2位專家發佈了對該股票的評級,平均目標價爲90.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from HC Wainwright & Co. downgraded its action to Buy with a price target of $90. * Reflecting concerns, an analyst from HC Wainwright & Co. lowers its rating to Buy with a new price target of $90.

20年期期權交易員揭示了他的單線圖技術,顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處進行訪問。* HC Wainwright的一位分析師將其評級下調爲買入,並設定了90美元的目標價。* 反映擔憂,HC Wainwright的一位分析師將其評級降至買入,設定了新的90美元目標價。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Viking Therapeutics with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高利潤的潛力。精明的交易者通過持續的教育、戰略性交易調整、利用各種因子以及保持對市場動態的敏銳感來減輕這些風險。使用Benzinga Pro隨時提醒進行實時交易,跟蹤viking therapeutics的最新期權交易。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Viking Therapeutics's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Viking Therapeutics's whale trades within a strike price range from $15.0 to $105.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Viking Therapeutics's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Viking Therapeutics's whale trades within a strike price range from $15.0 to $105.0 in the last 30 days.