Despite AMD's record-breaking total revenue and most crucial datacenter revenue in the third quarter, the midpoint of the revenue guidance range for the fourth quarter fell slightly short of expectations. Some analysts believe that supply chain constraints prevent the company from meeting the significant demand for ai chips from customers. The company has raised its AI chip revenue forecast for 2024 to over $5 billion and expects the AI accelerator market to reach an annual size of $500 billion by 2028.

In the post-market trading on Tuesday, October 29, AMD, a semiconductor giant striving to catch up with Nvidia in the GPU field in datacenter, released its financial report for the third quarter of the 2024 fiscal year. Investors are closely watching the annual sales guidance for its MI300 AI accelerator chip.

Although AMD's total revenue and crucial datacenter revenue hit record highs in the third quarter, the midpoint of its revenue guidance range for the fourth quarter slightly fell below market expectations. Some analysts say that supply chain restrictions are preventing them from meeting the significant demand for AI chips from customers.

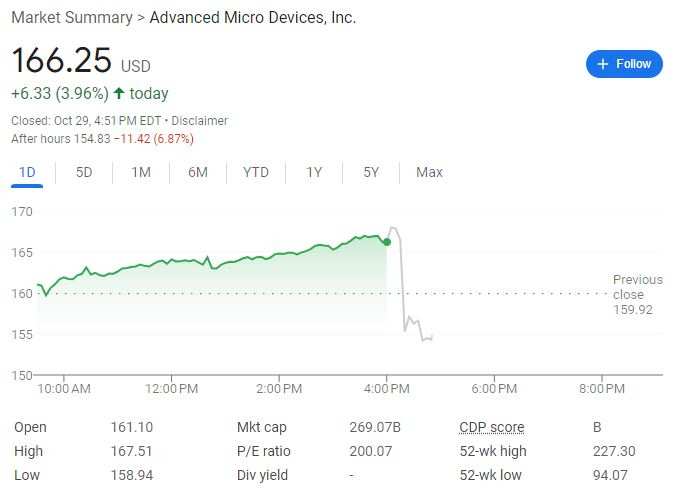

The stock fell nearly 7% after hours, rising nearly 4% on Tuesday before the financial report was released. It has risen nearly 13% this year, while the Nasdaq has risen nearly 25% during the same period. Competitors Nvidia and Intel also recorded slight declines in post-market trading.

The stock fell nearly 7% after hours, rising nearly 4% on Tuesday before the financial report was released. It has risen nearly 13% this year, while the Nasdaq has risen nearly 25% during the same period. Competitors Nvidia and Intel also recorded slight declines in post-market trading.

During the financial report conference call at 5:00 PM Eastern Time, AMD management raised the AI chip revenue forecast for 2024 to over $5 billion, up from the previous expectation of $4.5 billion adjusted during the second quarter report. They mentioned that the upcoming MI accelerator products look promising and anticipate the AI accelerator market to reach an annual scale of $500 billion by 2028, but there was no change in the stock's slump after trading.

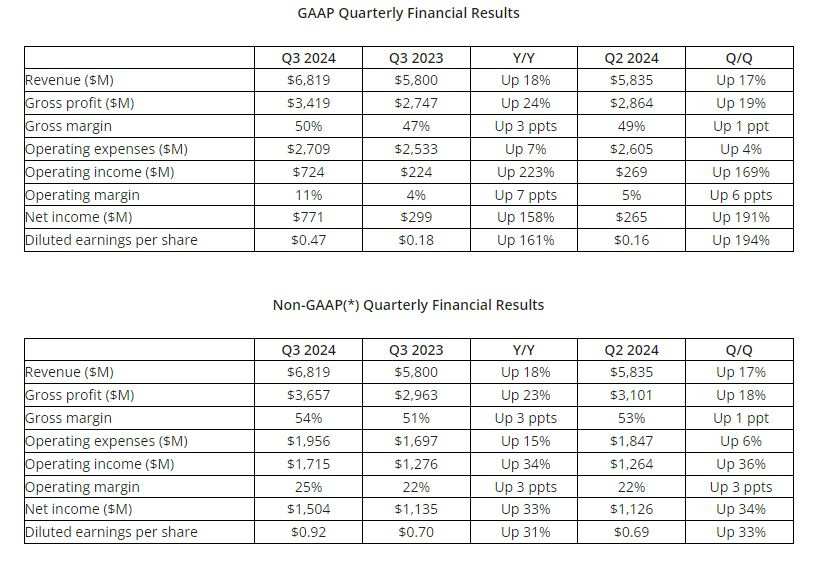

1) Main financial data

Quarterly revenue: $6.82 billion, reaching a record high, an 18% year-on-year growth, and a 17% increase from the previous quarter. Market expectation was $6.71 billion, while the company guided in the range of $6.4 billion to $7 billion.

Gross margin: 50% under GAAP, compared to 47% in the same period last year; under non-GAAP, it is 54%, compared to 51% in the same period last year.

Operating profit: $0.724 billion under GAAP, a year-on-year increase of 223%; under non-GAAP, it is $1.72 billion, a year-on-year growth of 34%, a sequential growth of 36%, with a significant acceleration in growth compared to the previous quarter.

Net income: $0.771 billion under GAAP, a year-on-year increase of 158%; under non-GAAP, it is $1.5 billion, a year-on-year growth of 33%, a sequential growth of 34%, with a significant acceleration in growth compared to the previous quarter.

Diluted EPS: $0.47 under GAAP, a year-on-year increase of 161%; under non-GAAP, it is $0.92, a year-on-year growth of 31%, a sequential growth of 33%, market expectation of $0.92.

2) Outlook

Fourth-quarter revenue: expected to be $7.2 billion to $7.8 billion, with a midpoint of $7.5 billion, representing a year-on-year growth of about 22%, a sequential growth of about 10%, analyst expectation is $7.55 billion.

Fourth-quarter non-GAAP gross margin: expected to be around 54%.

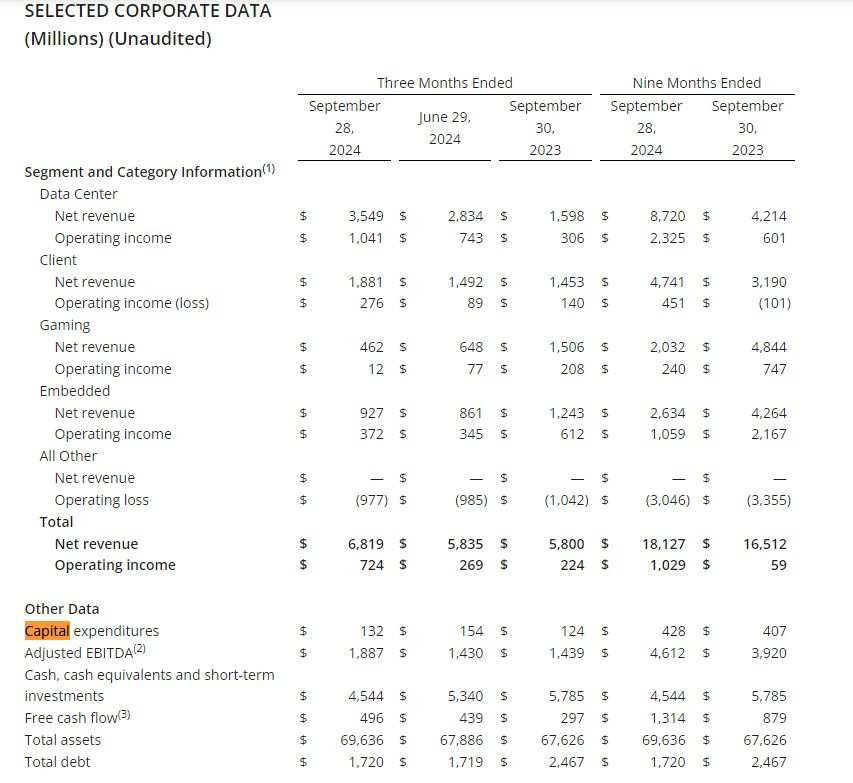

3) Segmented business data

Datacenter business unit: revenue reached a record high of $3.5 billion, a year-on-year increase of 122%, a quarter-on-quarter increase of 25%, market expectation is $3.52 billion.

Client business unit: revenue was $1.9 billion, a year-on-year increase of 29%, a quarter-on-quarter increase of 26%.

Gaming business unit: revenue was $0.462 billion, a year-on-year decrease of 69%, a quarter-on-quarter decrease of 29%.

Embedded business unit: revenue was $0.927 billion, a year-on-year decrease of 25%, a quarter-on-quarter increase of 8%.

Highlights of the third quarter: Datacenter AI revenue doubled year-on-year for two consecutive quarters and exceeded the previous quarter, setting new highs for three consecutive quarters.

In the second quarter of this year, AMD's datacenter business unit revenue hit new highs for two consecutive quarters at $2.8 billion, a year-on-year increase of 115%, a quarter-on-quarter increase of 21%. It can be seen that in the third quarter, the revenue for this heavyweight business has hit new highs for three consecutive quarters, with growth accelerating each quarter this year. Datacenter revenue in the first quarter saw a year-on-year increase of 80% and a quarter-on-quarter increase of 2%.

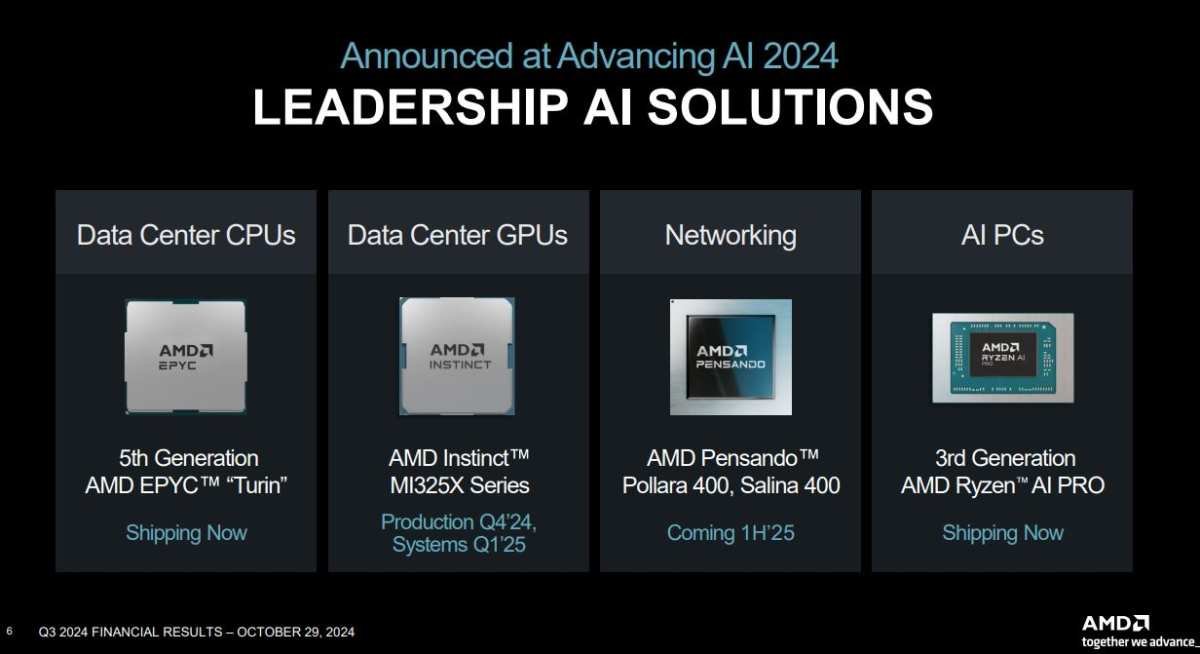

The company stated that this was mainly due to the strong growth in AMD Instinct GPU shipments and the increase in AMD EPYC (Xiaolong) CPU sales.

The client business unit, including personal computer processors, also performed strongly, mainly driven by demand for 'Zen 5' AMD Ryzen processors, but some analysts also pointed out that the growth rate of the personal computer market is lower than some investors' expectations.

The gaming department was mainly affected by the decline in semi-custom income, while the embedded department, including cheaper chips for industrial and other applications, saw a sharp year-on-year decline in income due to customers normalizing inventory levels, with sequential revenue growth driven by demand improvements in multiple end markets.

AMD's Chairman and CEO, Su Zifeng, once again gave an optimistic assessment of the financial report, stating that total revenue in the third quarter hit a new high, benefiting from the sales growth of EPYC and Instinct datacenter products, as well as strong demand for Ryzen PC processors:

"Looking ahead, we see tremendous growth opportunities in the datacenter, client, and embedded businesses, mainly due to the unlimited demand for more computing."

The company's CFO emphasized the significant year-on-year increase in gross margin and earnings per share in the third quarter, stating:

"With significant growth in the datacenter and client departments, we expect to achieve record-high annual revenue in 2024."

Analysis: Supply chain constraints have led to weak revenue guidance for the fourth quarter, but there is still a bullish outlook on AMD gaining market share in the AI accelerator market.

AMD's fourth-quarter revenue guidance can be interpreted in multiple ways. The market's biggest concern is that it suggests a slowdown in AI demand, but some analysts also argue that the health of AI demand is unquestionable. AMD is mainly unable to meet the surge in orders for AI chips due to supply chain constraints.

The world's largest chip foundry, Taiwan Semiconductor, had warned in July that until 2025, the global AI chip production capacity will be very tight, signaling significant obstacles for the supply of these advanced process semiconductors.

Earlier this month, AMD held the Advancing AI event, launching the next generation of AI chips, but did not update the annual sales guidance for the current MI300 AI accelerator, nor did it announce more new major customer partnerships.

Northland Capital Markets released a bullish research report this week stating that AMD's market share in AI accelerator chips will continue to grow, especially as Nvidia's strongest Blackwell product line faces manufacturing delays.

The institution projects that AMD's market share will double in two years, and expects the artificial intelligence revenue to reach $18 billion to $28 billion by 2027, capturing up to 9.7% of the AI accelerator market. In 2023, it will only account for less than 1% (0.7%). The report also mentions:

"With AMD investing billions (in AI) to gain potential future annual revenues of tens of billions of dollars, slowing profit growth may be an issue with operating expenses."

AMD's financial report states that capital expenditures in the third quarter were $0.132 billion, up 6.5% year-on-year, but down over 14% quarter-on-quarter. Capital expenditures for the first nine months of this year amounted to $0.428 billion, an increase of 5.2% year-on-year.

该股盘后一度跌近7%,周二财报发布前收涨近4%,今年累涨近13%,但纳指同期累涨近25%。竞争对手英伟达和英特尔也盘后小幅下挫。

该股盘后一度跌近7%,周二财报发布前收涨近4%,今年累涨近13%,但纳指同期累涨近25%。竞争对手英伟达和英特尔也盘后小幅下挫。