The Singapore dollar is becoming the favorite usa election trade for options investors.

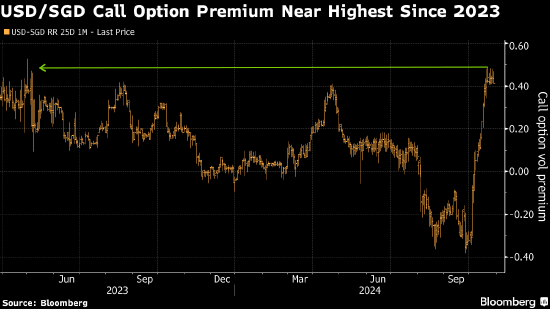

The premium for buying 1-month call options relative to put options has reached near the highest level since May 2023 when the dollar strengthens against the yuan, the value of these call options will rise. According to data from the Depository Trust & Clearing Corporation, as of the current week's end, trades close to or exceeding $0.1 billion in nominal amount were call options, with the longest expiration date up to January 22.

Most central banks manage the economy by setting interest rates, but the Monetary Authority of Singapore manages the economy by influencing the nominal effective exchange rate of the Singapore dollar. The new dollar has become the effective currency for macro investors betting on Trump winning the usa presidential election.

"The market generally believes that if Trump wins, the dollar will rise against other major currencies, especially against Asian currencies," said Mukund Daga, asia forex options head at Barclays in Singapore. He mentioned that hedge funds have shown interest in buying call options expiring in 3 months.

"The market generally believes that if Trump wins, the dollar will rise against other major currencies, especially against Asian currencies," said Mukund Daga, asia forex options head at Barclays in Singapore. He mentioned that hedge funds have shown interest in buying call options expiring in 3 months.

Traders indicate that investors are also positioning for the dollar to rise against the euro and yuan, and if Trump wins the election, these two currencies may be affected by trade policy measures.

"The market has a lot of interest in at-the-money usd/sgd options," said Alvin Tan, Asia forex strategy head at RBC Capital Markets in Singapore.

“市场普遍认为,如果特朗普获胜,美元兑其他主要货币将会上涨,对亚币更是如此,”巴克莱驻新加坡的亚洲外汇期权主管Mukund Daga表示。他说道,对冲基金已表现出购买3个月到期看涨期权的兴趣。

“市场普遍认为,如果特朗普获胜,美元兑其他主要货币将会上涨,对亚币更是如此,”巴克莱驻新加坡的亚洲外汇期权主管Mukund Daga表示。他说道,对冲基金已表现出购买3个月到期看涨期权的兴趣。