當今社會,旅遊已經成爲重要的休閒方式,假期與家人朋友一起去逛景點、吃美食已成爲一種風尚。

據文化和旅遊部數據,2024年國慶7天假期,全國國內出遊7.65億人次,國內遊客出遊總花費高達7008.17億元,人均出遊花費超過900元,可見這是一個龐大的市場。

出門在外,少不了要購買往返車票、訂酒店住宿,這又是一門生意。

目前,攜程、同程旅行等旅行平台已經抓住商機在這個市場深耕,併成功上市了,現在又有出行平台衝擊港股IPO。

目前,攜程、同程旅行等旅行平台已經抓住商機在這個市場深耕,併成功上市了,現在又有出行平台衝擊港股IPO。

格隆匯獲悉,近日,活力集團控股有限公司(以下簡稱「活力集團」)遞表港交所,招商證券(香港)有限公司、民銀資本有限公司爲其聯席保薦人。

活力集團是國內綜合出行平台,據弗若斯特沙利文的資料,公司2023年的總交易額爲308億元,在中國一站式綜合出行平台中位居第二,僅次於攜程。

能把業務做得這麼大,活力集團究竟有何來頭?

01

清華學霸聯手創業

活力集團總部位於深圳,其歷史可追溯至2009年,當時活力天匯(活力集團的主要經營公司)推出首款移動應用航班管家,爲旅客提供實時航班信息。

後來活力集團開始從一家純粹旅行信息提供商發展成爲一個綜合出行平台,爲用戶提供出行前、出行中、出行後的一站式旅遊相關服務。2011年公司的住宿預訂服務正式上線;隨後又在2012年提供機票預訂服務,並推出國內首款移動應用程序高鐵管家,提供列車動態信息及訂票服務。

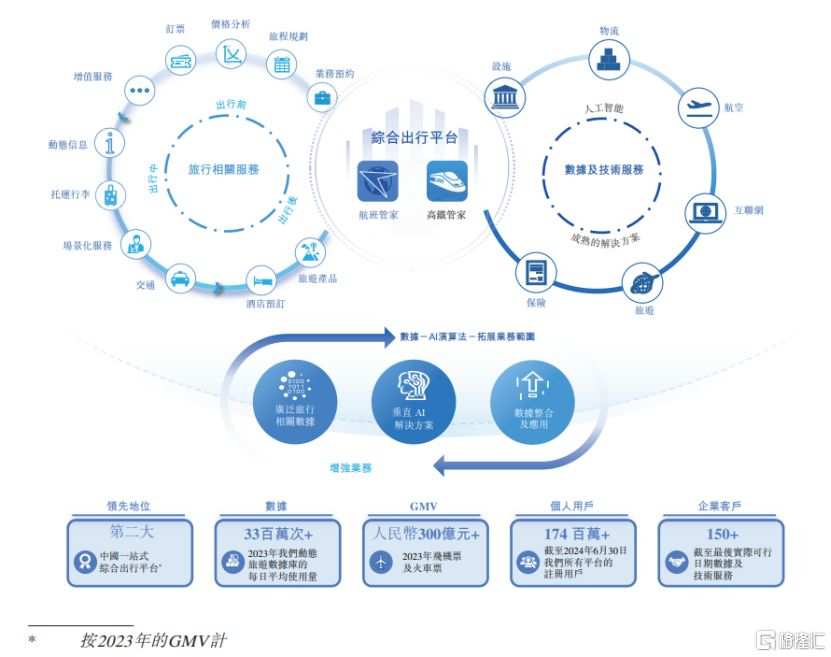

與主要充當旅客與企業之間交易中介的傳統平台不同,活力集團的智能出行服務可以無縫整合飛機、火車及網約車等各類交通方式,還提供值機選座、列車選座、航班延誤查詢、機場信息導航及酒店預訂等一系列配套服務,來應旅途中遇到的各種狀況,確保旅客有輕鬆愉快的旅行體驗。

隨着不斷提供優質的用戶服務,活力集團積累了龐大的用戶群,截至2024年6月底,其所有平台的註冊用戶數累計超過1.74億。

公司提供的產品和服務,圖片來源:招股書

公司幾個創始人都是名校學霸,且在互聯網領域有着經驗的豐富。

活力集團的聯合創始人兼首席執行官王江今年51歲,擁有清華大學工程物理學學士學位。王江曾在北京品味網科技有限公司、華友世紀通訊有限公司、上海西門子移動通信有限公司等多家TMT公司任職,後來在2009 年7月加入活力集團。

聯合創始人易兵今年54歲,畢業於廈門大學,主修系統工程學。易兵曾任傲天信息技術(深圳)有限公司副總經理,2005年9月加入活力集團並一直擔任首席運營官,如今還是公司的執行董事及高級副總裁。

另一個聯合創始人李黎軍今年52歲,擁有清華大學計算機科學及技術學士學位。李黎軍曾任職於深圳市郵電局新技術開發中心,主要負責數據、移動、互聯網等業務的開發建設工作;後來還當過傲天信息技術(深圳)有限公司的總經理及董事,如今是活力集團的非執行董事。

活力集團能迅速發展起來,離不開資本的支持。

早在2016年,活力天匯就獲得了來自華晟領勢、上海創稷、珠海富海、寧波凱撒、陝西紓困基金的融資,隨後幾年又陸續拿到庭瑞、領匯基石的融資。2024年,Fontus也認購了公司股份,投後估值約20.87億元。

02

2023年實現扭虧

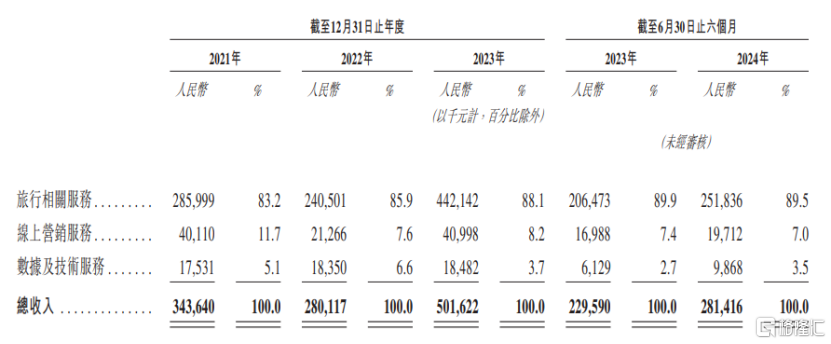

活力集團的大部分收入來自旅行相關服務。

招股書顯示,2021年、2022年、2023年及2024年1-6月(簡稱「報告期」),旅行相關服務的收入佔公司總收入的80%以上,而線上營銷服務、數據及技術服務的收入佔比較低。

公司收入明細,圖片來源:招股書

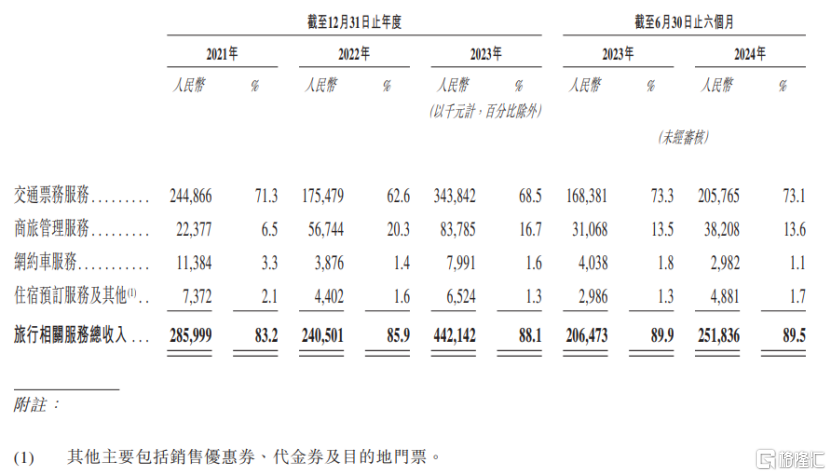

具體來看,公司的旅行相關服務包括交通票務服務、商旅管理服務、網約車服務、住宿預訂服務及其他。

其中,交通票務服務佔旅行相關服務收入的60%以上,這部分收入主要爲機票及火車票預訂、配套增值旅遊服務套餐及會員服務。

公司還在平台上提供與交通票務服務無縫集成的網約車服務,確保遊客的旅行體驗順暢。同時也讓用戶通過公司的平台進行住宿預訂,賺取中介服務佣金,不過這部分收入佔比較小。

除了服務個人客戶之外,活力集團還爲企業客戶提供會議、獎勵旅行、大型會議、展覽及其他企業差旅需要的端到端管理服務。公司通常向企業客戶收取套餐價,扣除成本後產生商旅管理服務收入。

旅行相關服務收入的明細,圖片來源:招股書

業績方面,2021年至2024年上半年,活力集團的收入分別約3.44億元、2.8億元、5.02億元、2.81億元,對應的淨利潤分別約-3.58億元、-75.8萬元、5930.9萬元、3171.2萬元,公司在2023年實現扭虧。

報告期內,活力集團的毛利率分別爲49.8%、47.1%、56.8%、58.6%,存在一定波動。

其中,2022年受疫情影響旅行需求及出行頻率大幅下降,平台交易活動大幅減少,導致同期毛利率下降;2023年商業活動及旅遊需求顯著復甦,平台交易數量增加,毛利率也有所提高。

03

爲攜程同行,2023年市場份額1.2%

旅遊市場包括交通、住宿、觀光、餐飲、購物及其他旅遊活動,旅遊業的發展對於促進經濟增長、拉動消費和就業都發揮着重要作用。未來,在政策的支持和人均可支配收入增長的推動下,中國旅遊市場仍將持續增長。

在旅遊出行方面,活力集團等綜合出行平台可提供不同交通方案的信息查詢、預訂及支付等服務,並根據用戶需求及偏好定製最佳出行方案,比如用戶可以通過互聯網平台提前預定飛機或火車票等。

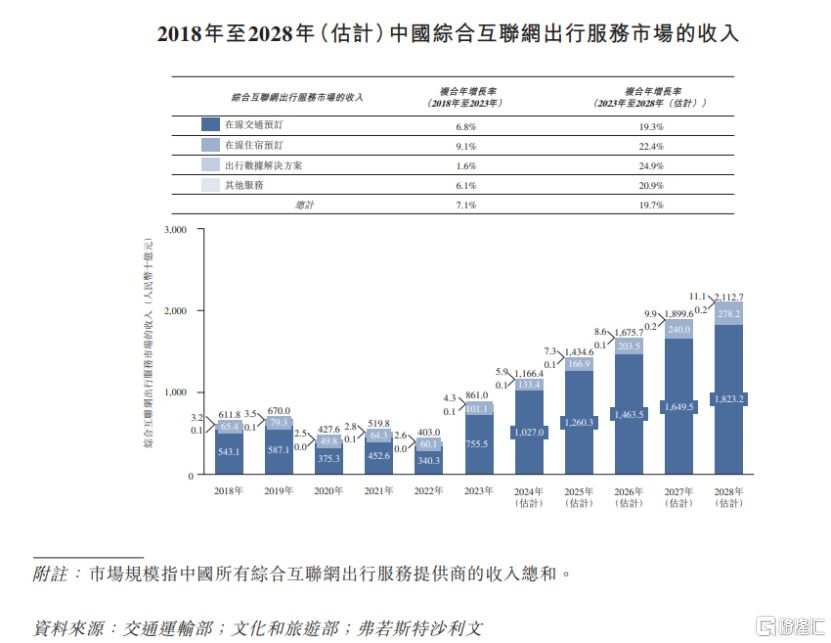

2023年我國綜合互聯網出行服務市場的收入達到8610億元,預計到2028年將達到2.11萬億元,2023年至2028年的複合年增長率爲19.7%。

其中,2023年我國在線交通預訂市場、在線住宿預訂市場、出行數據解決方案的收入分別爲7555億元、1011億元、1億元。

圖片來源:招股書

儘管有着幾千億的市場規模,但我國綜合互聯網出行服務市場相對分散,且競爭激烈,市面上提供在線交通預訂、在線住宿預訂或出行數據解決方案其中一兩種服務的提供商超過1000家。

活力集團不僅面臨着與其他出行平台、傳統旅遊機構及出行服務商之間的競爭,還可能面對來自電商、搜索引擎、社交媒體公司等互聯網公司的激烈競爭。

爲了應對日趨激烈的競爭,公司可能需要開展營銷活動來推廣自己的品牌及獲取新用戶,而這會迫使其產生大量銷售及營銷開支,從而影響經營利潤率及盈利能力。

按2023年綜合互聯網出行服務GMV計,中國前五大提供商約佔總市場規模的67.3%。其中,活力集團以1.2%的市場份額排在11名,不及同行上市公司攜程(公司A)、同程旅行(公司C)及華住集團(公司E)。

中國三大一站式綜合出行平台合計佔綜合互聯網出行服務總份額約33%,其中攜程以31.6%的市場份額位居首位,活力集團排名第二。

儘管活力集團通過多年發展,已成爲我國第二大一站式綜合出行平台,但其市場份額與行業龍頭攜程相比仍存在較大差距,在激烈的行業競爭之下,公司想要提升市佔率也並非易事。

本次申請上市,活力集團擬募集資金用於增強研發能力,並在業務營運中擴大AI的應用;用於擴展全球足跡;豐富及提升公司產品;營運資金及一般企業用途。

目前,携程、同程旅行等旅行平台已经抓住商机在这个市场深耕,并成功上市了,现在又有出行平台冲击港股IPO。

目前,携程、同程旅行等旅行平台已经抓住商机在这个市场深耕,并成功上市了,现在又有出行平台冲击港股IPO。