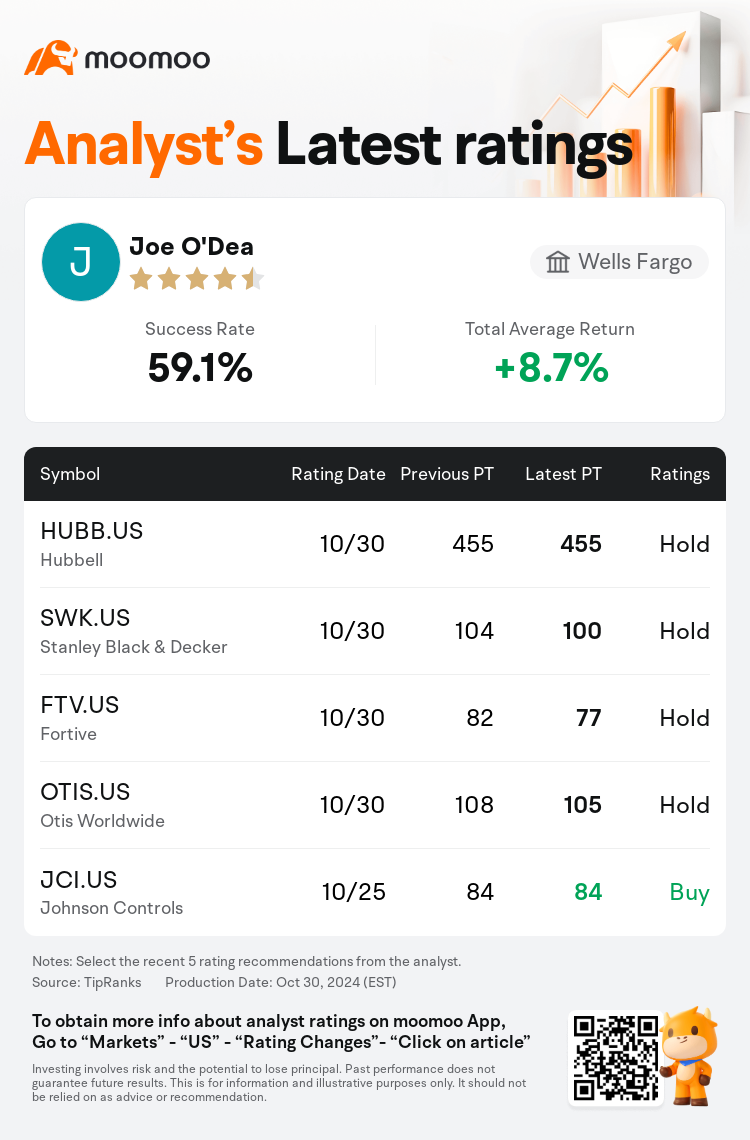

Wells Fargo analyst Joe O'Dea maintains $Hubbell (HUBB.US)$ with a hold rating, and maintains the target price at $455.

According to TipRanks data, the analyst has a success rate of 59.1% and a total average return of 8.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Hubbell (HUBB.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Hubbell (HUBB.US)$'s main analysts recently are as follows:

Despite Hubbell falling short of Q3 organic growth forecasts and projecting Q4 figures roughly 350 basis points under the consensus if one excludes the impact of storm-related demand, the market's strong belief in the Utility segment's prospects over the coming year has enabled it to overlook these organic growth shortfalls and a prolonged inventory reduction. While there is a shared optimism for Utility segment improvements in the ensuing twelve months, there is some apprehension regarding the ambitious expectations set for FY25, particularly since Hubbell Utility volumes have grown at merely a 2% compound annual growth rate since 2020, despite numerous favorable conditions within the industry.

Hubbell's performance on margins remains strong, and the concerns regarding a potential margin contraction seem to be unsubstantiated.

The company's Q3 organic results were seen in a fairly positive light amidst a backdrop that has been unforgiving towards revenue shortfalls. This perception is partly due to the company's thematic exposure, which is expected to experience accelerated growth once the current headwinds in telecom and inventory destocking subside.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

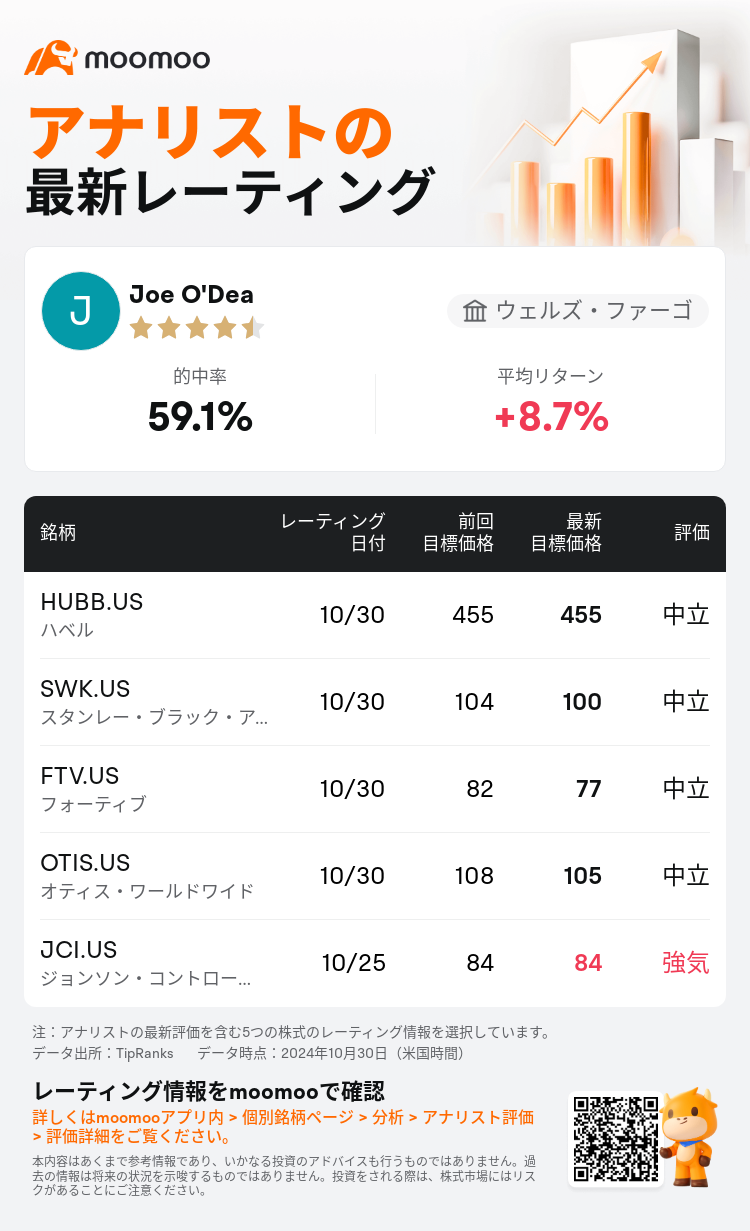

ウェルズ・ファーゴのアナリストJoe O'Deaは$ハベル (HUBB.US)$のレーティングを中立に据え置き、目標株価を455ドルに据え置いた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は59.1%、平均リターンは8.7%である。

また、$ハベル (HUBB.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ハベル (HUBB.US)$の最近の主なアナリストの観点は以下の通りである:

ハベルは第3四半期の有機的成長予測を下回り、暴風雨関連の需要の影響を除けば第4四半期は約350ベーシスポイントというコンセンサスに基づくと予測していますが、来年の公益事業セグメントの見通しに対する市場の強い信頼により、これらの有機的成長不足と長期にわたる在庫削減を見逃すことができました。今後12か月間の公益事業セグメントの改善については楽観的な見方が共有されていますが、特にHubbell Utilityの販売量は、業界内の多くの好条件にもかかわらず、2020年以降、複合年間成長率わずか2%で増加しているため、25年度に設定された野心的な期待には懸念があります。

Hubbellのマージンに関するパフォーマンスは引き続き堅調で、マージンが縮小する可能性に関する懸念は根拠がないようです。

収益不足が容認できない状況の中で、同社の第3四半期の業績はかなり好調でした。この認識は、テレコムと在庫削減の現在の逆風が収まると、成長が加速すると予想される、同社のテーマ別の露出に一部起因しています。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$ハベル (HUBB.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ハベル (HUBB.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of