October 30, 2024 - $Eli Lilly and Co (LLY.US)$ shares slumped 10.69% to $806.99 in pre-market trading on Wednesday. The company announced its financial results for the third quarter of 2024, reporting that both its profits and revenues fell short of expectations, and it significantly lowered its adjusted profit forecast for the entire year.

Q3 Highlights

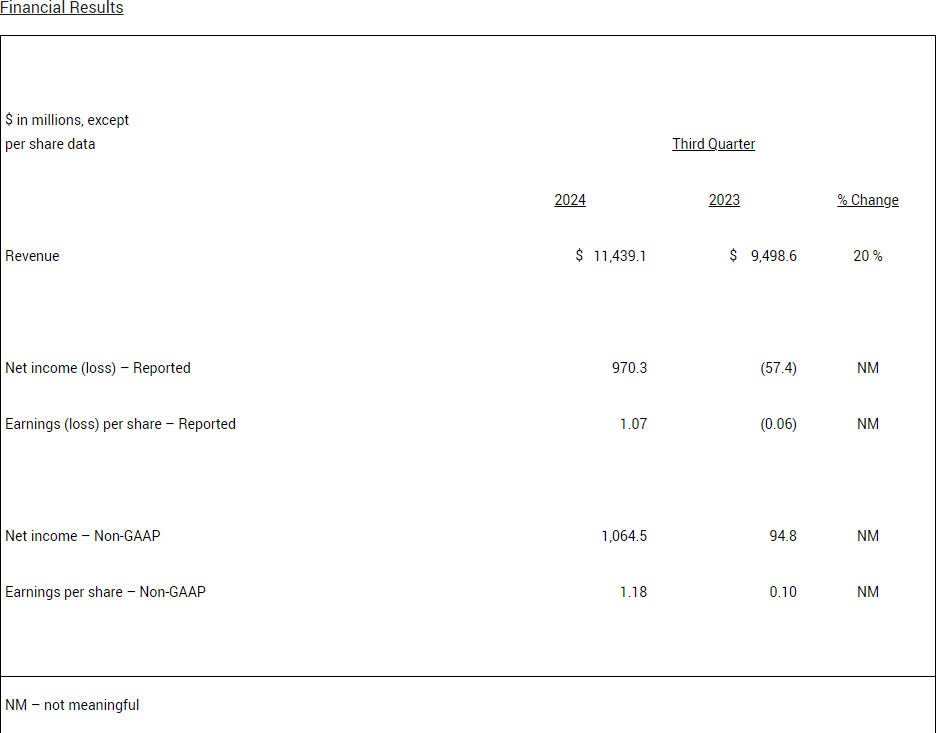

Revenue in Q3 2024 increased 20% to $11.44 billion, driven by volume growth from Mounjaro and Zepbound, falling short of market expectations of $12.18 billion. Excluding revenue from the olanzapine portfolio, total revenue increased 42%, and non-incretin revenue increased 17%.

Net income was $970 million, with an adjusted earnings per share of $1.18 (Non-GAAP), which was below analysts' expectations of $1.51, compared to $0.10 in the same period last year.

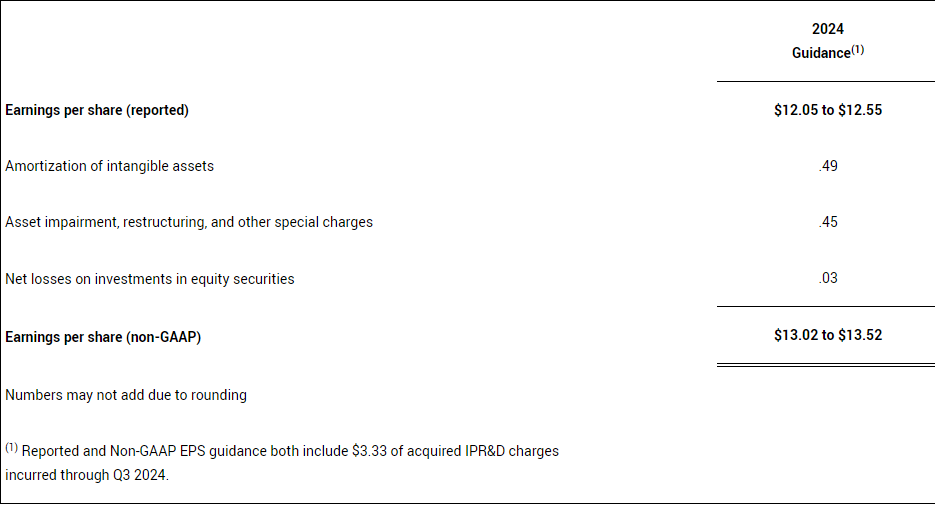

2024 revenue guidance range updated to $45.4 to $46.0 billion. 2024 reported EPS guidance updated to the range of $12.05 to $12.55, and non-GAAP EPS guidance updated to the range of $13.02 to $13.52, both driven by the acquired IPR&D charges incurred in Q3.

2024 revenue guidance range updated to $45.4 to $46.0 billion. 2024 reported EPS guidance updated to the range of $12.05 to $12.55, and non-GAAP EPS guidance updated to the range of $13.02 to $13.52, both driven by the acquired IPR&D charges incurred in Q3.

2024 Financial Guidance

The company updated 2024 full-year revenue guidance to between $45.4 billion and $46.0 billion. The company is investing heavily in increasing the supply of tirzepatide and has been balancing demand creation activities and launches into new markets with its production to support the continuity of care for patients. In Q3, the company continued to be prudent in scaling up demand generation activities.

Related Reading: Press Release