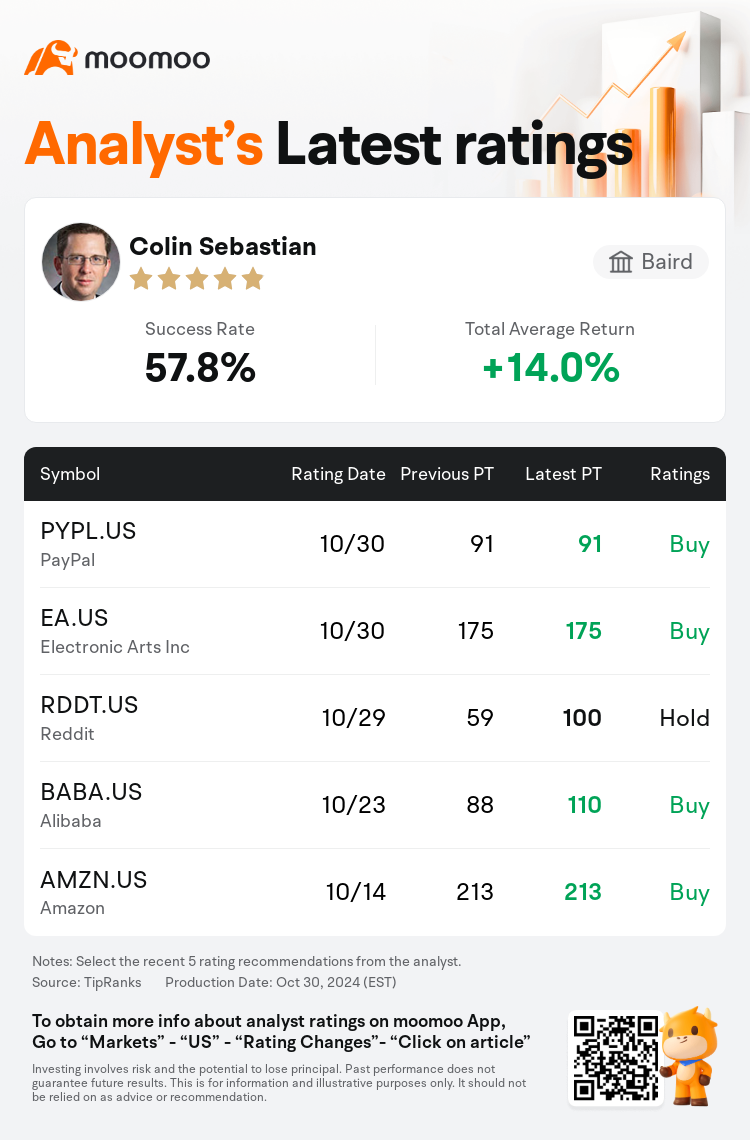

Baird analyst Colin Sebastian maintains $Electronic Arts Inc (EA.US)$ with a buy rating, and adjusts the target price from $170 to $175.

According to TipRanks data, the analyst has a success rate of 57.8% and a total average return of 14.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Electronic Arts Inc (EA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Electronic Arts Inc (EA.US)$'s main analysts recently are as follows:

Electronic Arts delivered fiscal Q2 bookings and adjusted earnings that surpassed the high end of their guidance and increased their fiscal 2025 projections. Nevertheless, the call for more consistent performance in non-sports titles is evident, with an inclination towards Take-Two shares as the Grand Theft Auto VI release approaches in Fall 2025.

Electronic Arts reported a robust earnings surpass in the second quarter, even with high expectations, due to the strong performance of their sports games, which made up for the less than expected results from Apex Legends. Additionally, the company pointed out a 140% increase in hours played across its American Football games, indicating that the introduction of College Football is likely to enhance rather than detract from its broad game portfolio.

The firm indicated that second quarter outcomes surpassed expectations, aligning with the robust initial engagement and monetization of College Football. The effective merging of Madden and CFB is cultivating a broader community of American football gamers. Combined with the company's dominant position in global football (soccer), this is believed to lay the groundwork for increased recurring revenues.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

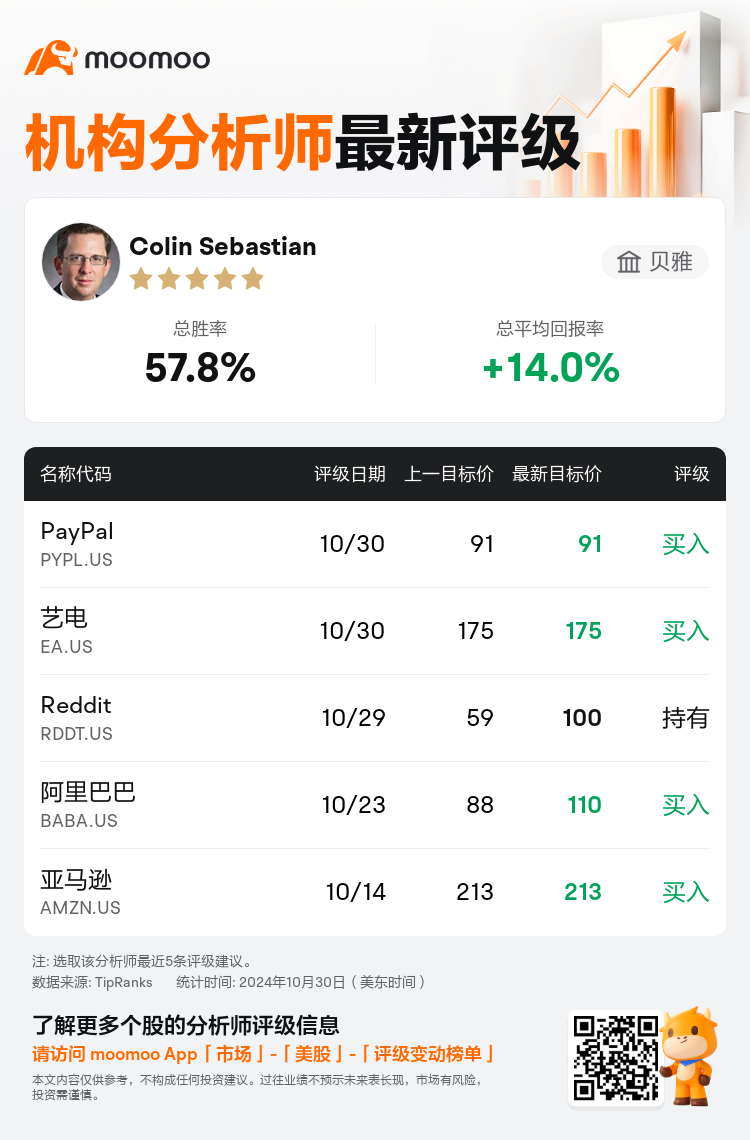

贝雅分析师Colin Sebastian维持$艺电 (EA.US)$买入评级,并将目标价从170美元上调至175美元。

根据TipRanks数据显示,该分析师近一年总胜率为57.8%,总平均回报率为14.0%。

此外,综合报道,$艺电 (EA.US)$近期主要分析师观点如下:

此外,综合报道,$艺电 (EA.US)$近期主要分析师观点如下:

艺电公布了财政第二季度的预订额和调整后的收益超过了他们指导的最高水平,并提高了他们2025财年的预测。然而,对于非体育游戏需要更加一致表现的呼声显而易见,在《侠盗猎车手VI》于2025年秋季推出之际,对Take-Two股票的偏好也越发明显。

艺电报告显示在第二季度实现了强劲的盈利超额,即使在高预期下也如此,这要归功于他们体育游戏的出色表现,弥补了《Apex Legends》成绩低于预期的情况。此外,该公司指出其美式橄榄球游戏的游戏时间增长了140%,表明《大学橄榄球》的推出很可能会提升而非削弱其广泛的游戏组合。

该公司表示第二季度的业绩超出预期,与《大学橄榄球》的强劲初期参与度和货币化相一致。《麦登》和《大学橄榄球》的有效融合正在培育更广泛的美式橄榄球玩家社区。再加上该公司在全球足球领域的主导地位,据信这将奠定增加循环收入的基础。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$艺电 (EA.US)$近期主要分析师观点如下:

此外,综合报道,$艺电 (EA.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of