"Almost optimistic sentiment" is driving the continuous rise of the S&P 500 index, while the timing of a pullback is becoming mature; the divided U.S. Congress and Harris's victory may bring opportunities.

According to the information from the Wise Finance APP, based on the betting situation in the gambling market, in the upcoming U.S. election next week, former President Donald Trump, who is known as the 'King of Understanding', is very likely to win, which could lead to a rise in the U.S. stock market. However, for the strategy team at Citigroup, a sweep by the Republicans will be a major sell signal for U.S. stocks in the short term.

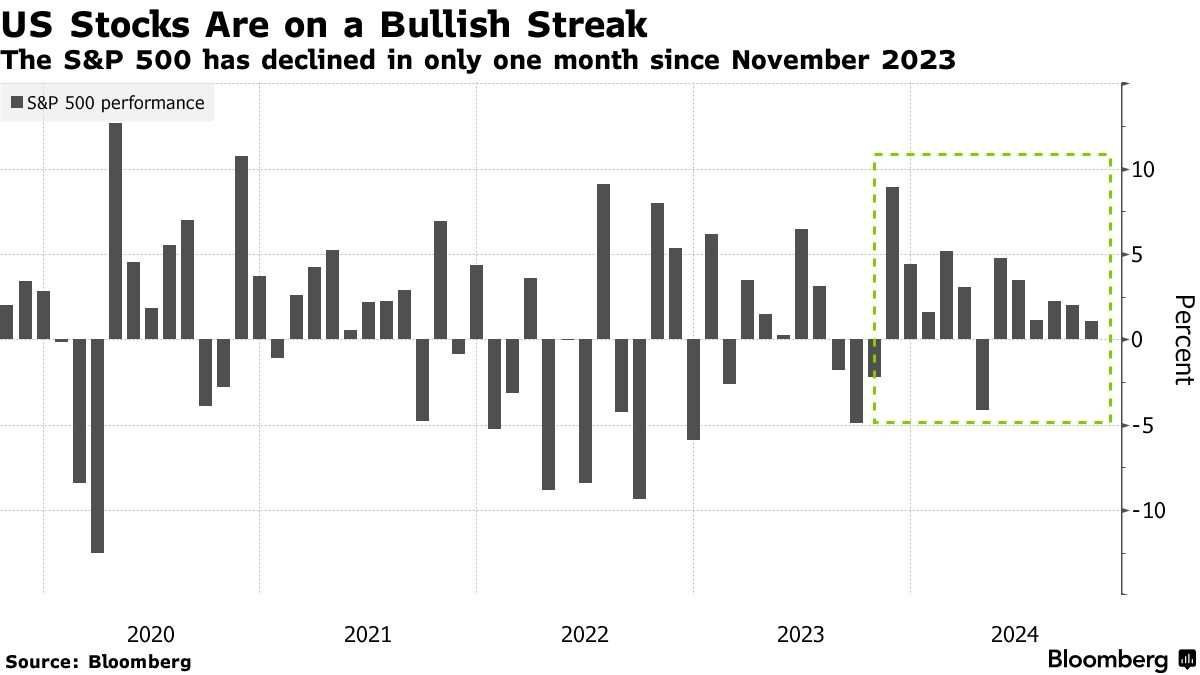

Most analysts view Trump's victory as good news for the U.S. stock market because his proposal to lower corporate taxes could lead to sustained profit growth for companies. However, Citigroup's strategy team believes that the 'almost extremely optimistic sentiment' that has driven the continuous rise of the S&P 500 index for six consecutive months has made the timing for a pullback of U.S. stocks increasingly mature.

However, the Citigroup team is not pessimistic about the future of U.S. stocks and emphasizes a bullish outlook on the rebound pace of U.S. stocks after a pullback period. The team led by Citigroup strategist Scott Kronet wrote in a report on October 29: "Given the inherent uncertainties expected in the scenario of Trump's + Republican Congress sweep, we tend to be optimistic about any post-election rebound in the U.S."

However, the Citigroup team is not pessimistic about the future of U.S. stocks and emphasizes a bullish outlook on the rebound pace of U.S. stocks after a pullback period. The team led by Citigroup strategist Scott Kronet wrote in a report on October 29: "Given the inherent uncertainties expected in the scenario of Trump's + Republican Congress sweep, we tend to be optimistic about any post-election rebound in the U.S."

The main drivers behind the record high of the S&P 500 index are primarily economic growth and corporate profit expectations. Recently, the gambling market has shifted to fully support a Trump win, which undoubtedly provides significant support for economic growth and corporate earnings. Vice President Kamala Harris's policy to raise taxes is considered relatively pessimistic for the stock market. Most major opinion polls show that the support for the two candidates is neck and neck, but the betting market's bet on a Trump victory has reached extreme levels.

The most optimistic prediction for the U.S. stock market is a big win for the Republicans – that is, a victory for President Trump in the election, while his Republican Party secures majority seats in the Senate and House. Analysts from the Royal Bank of Canada have stated that a big win for the Republicans will greatly benefit the U.S. stock market, with the energy and financial sectors benefiting the most, while a big win for the Democrats may lead to short-term bearishness in the U.S. stock market. Wall Street strategists generally believe that a Trump victory could lead to tariff increases and tax cuts, which would significantly outperform European stock markets.

However, the analysis team led by Citigroup strategist Kroenert believes that the policy tendencies of the two candidates towards fairness are gradually becoming negative. The Citigroup strategy team believes that the S&P 500 index seems to be 'fully valued' at its current level. However, compared to the pessimistic outlook on the US stock market after Harris' victory by most Wall Street peers, Citigroup strategists are not pessimistic about the US stock market after Harris' victory. They emphasize that any selling due to Harris' victory and the divided state of the US Congress will create buying opportunities at low points.

但是花旗团队对于美股后市并不悲观,并强调看好美股经历回调时期后的反弹步伐。花旗策略师斯科特·克罗内特领衔的团队在10月29日的一份报告中写道:“鉴于特朗普+红色席卷国会情景中所预期的根本不确定性,我们倾向于对美国总统选举后的任何反弹持乐观态度。”

但是花旗团队对于美股后市并不悲观,并强调看好美股经历回调时期后的反弹步伐。花旗策略师斯科特·克罗内特领衔的团队在10月29日的一份报告中写道:“鉴于特朗普+红色席卷国会情景中所预期的根本不确定性,我们倾向于对美国总统选举后的任何反弹持乐观态度。”