Earnings Miss: Sanquan Food Co., Ltd. Missed EPS By 37% And Analysts Are Revising Their Forecasts

Earnings Miss: Sanquan Food Co., Ltd. Missed EPS By 37% And Analysts Are Revising Their Forecasts

The analysts might have been a bit too bullish on Sanquan Food Co., Ltd. (SZSE:002216), given that the company fell short of expectations when it released its quarterly results last week. It wasn't a great result overall - while revenue fell marginally short of analyst estimates at CN¥1.5b, statutory earnings missed forecasts by an incredible 37%, coming in at just CN¥0.07 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

分析师对三全食品股份有限公司(SZSE:002216)可能有点过于看好了,因为上周发布季度业绩时,公司未达到预期。整体来看,这并不是一个很好的结果 - 虽然营业收入略低于分析师预估的人民币15亿元,但法定收益却出乎意料地缺乏37%,仅为每股人民币0.07。收益对投资者来说是一个重要的时间点,他们可以追踪公司的业绩,查看分析师对明年的预测,并了解市场对公司的情绪是否发生了变化。我们已收集了最新的法定预测,以查看分析师是否在公布这些结果后调整了他们的盈利模型。

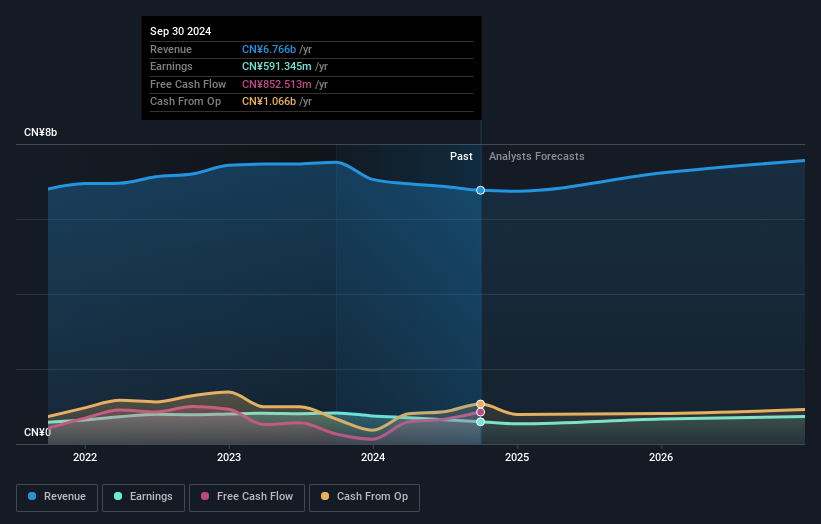

After the latest results, the eight analysts covering Sanquan Food are now predicting revenues of CN¥7.23b in 2025. If met, this would reflect an okay 6.8% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to climb 13% to CN¥0.76. In the lead-up to this report, the analysts had been modelling revenues of CN¥7.26b and earnings per share (EPS) of CN¥0.77 in 2025. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

根据最新的结果,覆盖三全食品的八位分析师预测,2025年营业额为72.3亿元。如果实现,这将反映出与过去12个月相比约6.8%的收入改善。预计法定每股盈利将增长13%至每股人民币0.76。在此报告发布之前,分析师一直在模拟2025年的营业额为72.6亿元,每股盈利(EPS)为每股1人民币0.77。所以很明显,尽管分析师已经更新了他们的估值,但在最新的结果后,对公司的预期并没有发生重大变化。

The analysts reconfirmed their price target of CN¥12.96, showing that the business is executing well and in line with expectations. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Sanquan Food, with the most bullish analyst valuing it at CN¥17.00 and the most bearish at CN¥10.00 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Sanquan Food shareholders.

分析师重申了他们对人民币12.96的目标价,表明公司的执行情况良好,并符合预期。共识目标价只是各个分析师目标价的平均值,因此-查看潜在估值范围的广度可能很有用。对于三全食品存在一些不同的看法,最看好的分析师将其价值定为每股17.00元,而最看淡的为每股10.00元。分析师对该公司的看法确实存在差异,但在我们看来,各种预测值的差距还不够大,以表明三全食品的股东可能会遭遇极端结果。

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that Sanquan Food's rate of growth is expected to accelerate meaningfully, with the forecast 5.4% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 2.9% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to see revenue growth of 11% annually. It seems obvious that, while the future growth outlook is brighter than the recent past, Sanquan Food is expected to grow slower than the wider industry.

从更大的图景来看,我们理解这些预测的一种方式是将其与过去的业绩和行业增长预期进行比较。从最新的预测来看,三全食品的增长速度预计将显著加快,到2025年底,预计年化营业收入增长率为5.4%,明显快于其过去五年的历史增长2.9%。将此与同行业其他公司的预测相比较,他们预计每年营收增长11%。显然,虽然未来增长前景比最近的过去更为明亮,但三全食品预计增长速度将慢于整个行业。

The Bottom Line

最重要的事情是分析师增加了它对下一年每股亏损的估计。令人欣慰的是,营收预测未发生重大变化,业务仍有望比整个行业增长更快。共识价格目标稳定在28.50美元,最新估计不足以对价格目标产生影响。

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

最明显的结论是,最近该企业的前景没有发生重大变化,分析师们保持着他们的盈利预测,与之前的估计持平。好消息是,对营收预测没有发生重大变化。尽管预测表明它们的表现将劣于更广泛的行业,但预测的价格没有发生实质性的变化,这表明公司的内在价值没有在最新的估计中发生重大变化。

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Sanquan Food going out to 2026, and you can see them free on our platform here.

谨记这一点,我们仍然认为业务的长期轨迹对投资者来说更加重要。我们对三全食品的预测延伸至2026年,您可以在我们的平台上免费查看。

However, before you get too enthused, we've discovered 1 warning sign for Sanquan Food that you should be aware of.

然而,在你过于兴奋之前,我们发现了三全食品的1个警示信号,您应该注意。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that Sanquan Food's rate of growth is expected to accelerate meaningfully, with the forecast 5.4% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 2.9% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to see revenue growth of 11% annually. It seems obvious that, while the future growth outlook is brighter than the recent past, Sanquan Food is expected to grow slower than the wider industry.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that Sanquan Food's rate of growth is expected to accelerate meaningfully, with the forecast 5.4% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 2.9% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to see revenue growth of 11% annually. It seems obvious that, while the future growth outlook is brighter than the recent past, Sanquan Food is expected to grow slower than the wider industry.

评论(0)

请选择举报原因