Qingdao Zhongzi Zhongcheng Group Co.,Ltd. (SZSE:300208) shareholders will doubtless be very grateful to see the share price up 71% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. The share price has sunk like a leaky ship, down 72% in that time. So it sure is nice to see a bit of an improvement. Of course the real question is whether the business can sustain a turnaround.

The recent uptick of 40% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Because Qingdao Zhongzi Zhongcheng GroupLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Qingdao Zhongzi Zhongcheng GroupLtd's revenue dropped 49% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 20%, reflects this weak fundamental performance. We prefer leave it to clowns to try to catch falling knives, like this stock. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

Over the last three years, Qingdao Zhongzi Zhongcheng GroupLtd's revenue dropped 49% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 20%, reflects this weak fundamental performance. We prefer leave it to clowns to try to catch falling knives, like this stock. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

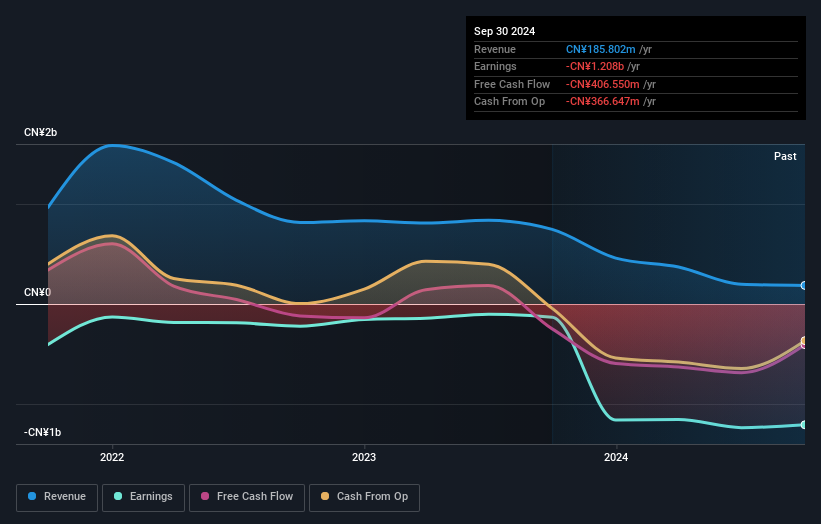

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Qingdao Zhongzi Zhongcheng GroupLtd shareholders are down 57% for the year, but the market itself is up 6.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Qingdao Zhongzi Zhongcheng GroupLtd you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.