Market Mover | Roku's Shares Slump 14% After Q3 Earnings Release, the Company Will Stop Reporting Quarterly Data on Streaming User Numbers

Market Mover | Roku's Shares Slump 14% After Q3 Earnings Release, the Company Will Stop Reporting Quarterly Data on Streaming User Numbers

October 31, 2024 - $Roku Inc (ROKU.US)$ shares slumped 14.20% to $66.50 in pre-market trading on Thursday. The company announced its third quarter 2024 financial results.

2024年10月31日 - $Roku Inc (ROKU.US)$ 周四美股盘前交易中,股价下跌14.20%,至66.50美元。该公司宣布了其2024年第三季度财务结果。

Q3 Highlights

Q3亮点

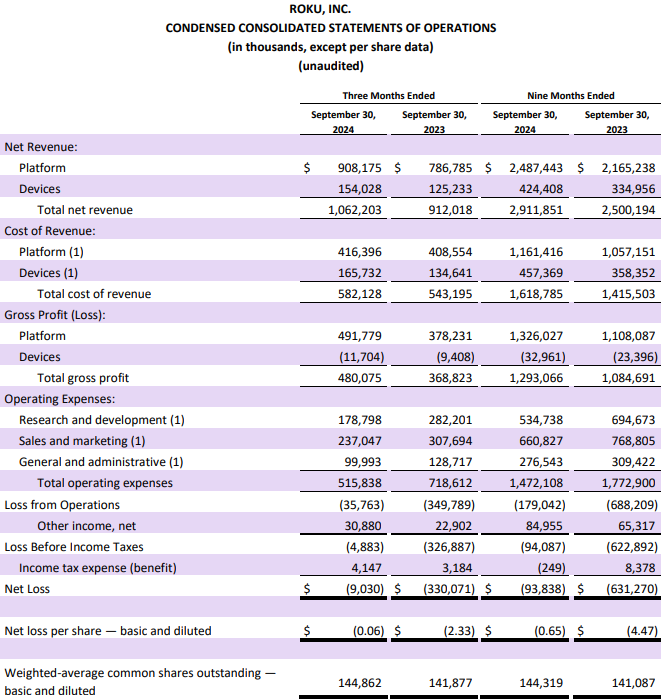

Revenue for the third quarter was $1.062 billion, a year-over-year increase of 16%, exceeding market expectations of $1.016 billion.

Net loss was $9.03 million, resulting in a loss of $0.06 per share, compared to a loss of $2.33 per share in the same period last year; the market had expected a loss of $0.32.

The number of streaming users grew by 13% to 85.5 million, while average revenue per user remained flat at $41.10 year-over-year.

Roku will stop reporting quarterly data on streaming user numbers and average revenue per user starting from the first quarter of 2025.

第三季度营业收入为10.62亿美元,同比增长16%,超过市场预期的10.16亿美元。

净亏损为903万美元,导致每股亏损0.06美元,而去年同期每股亏损为2.33美元;市场预期亏损0.32美元。

流媒体用户数量增长13%,达到8550万,而每位用户的平均收入同比保持在41.10美元。

Roku将从2025年第一季度开始停止报告关于流媒体用户数量和平均每用户收入的季度数据。

Outlook

展望

Q4 Total Net Revenue: $1.140 billion (up 16% year-over-year).

Platform Revenue Growth: 14% year-over-year.

Devices Revenue Growth: 25% year-over-year.

Q4 Total Gross Profit: $465 million.

Adjusted EBITDA for Q4: $30 million.

Expected Q4 Operating Expenses (OpEx) Growth: Up 9% year-over-year.

Sales and Marketing Expenses: Expected to be more seasonal than the prior year.

Overall Sales and Marketing Expenses and Total OpEx for Full Year 2024: Expected to be slightly down, reflecting ongoing operational discipline.

Exclusions: Expectations for Q4 and 2024 OpEx year-over-year growth rates exclude one-time restructuring charges from 2023.

第四季度总净营业收入:11.4亿美元(同比增长16%)。

平台营收增长:同比增长14%。

设备营收增长:同比增长25%。

第四季度总毛利润:46500万美元。

第四季度调整后的EBITDA:3千万美元。

预计第四季度营业费用(OpEx)增长:同比增长9%。

销售和营销费用:预计比上一年更具季节性。

2024年全年销售和营销费用总额及总营业费用:预计略有下降,反映持续的运营纪律。

排除因素:2024年第四季度和全年营业费用增长率的预期不包括2023年的一次性重组费用。

Related Reading: Press Release

相关阅读:新闻发布

The number of streaming users grew by 13% to 85.5 million, while average revenue per user remained flat at $41.10 year-over-year.

The number of streaming users grew by 13% to 85.5 million, while average revenue per user remained flat at $41.10 year-over-year.