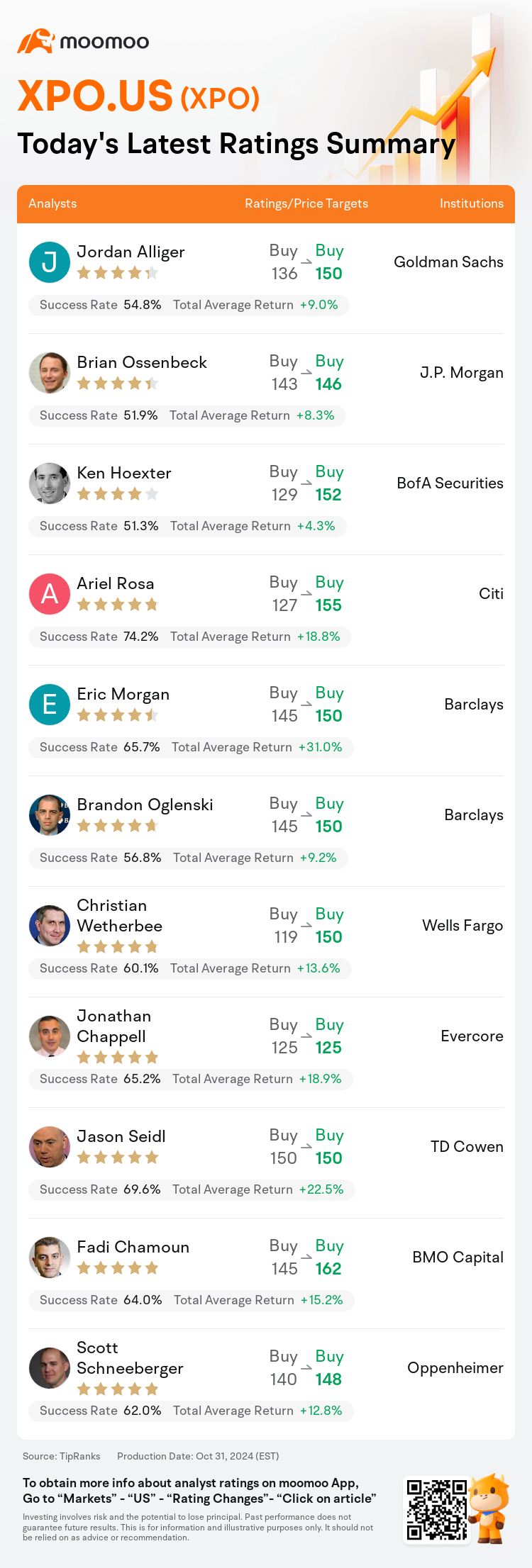

On Oct 31, major Wall Street analysts update their ratings for $XPO (XPO.US)$, with price targets ranging from $125 to $162.

Goldman Sachs analyst Jordan Alliger maintains with a buy rating, and adjusts the target price from $136 to $150.

J.P. Morgan analyst Brian Ossenbeck maintains with a buy rating, and adjusts the target price from $143 to $146.

BofA Securities analyst Ken Hoexter maintains with a buy rating, and adjusts the target price from $129 to $152.

BofA Securities analyst Ken Hoexter maintains with a buy rating, and adjusts the target price from $129 to $152.

Citi analyst Ariel Rosa maintains with a buy rating, and adjusts the target price from $127 to $155.

Barclays analyst Eric Morgan maintains with a buy rating, and adjusts the target price from $145 to $150.

Furthermore, according to the comprehensive report, the opinions of $XPO (XPO.US)$'s main analysts recently are as follows:

XPO, Inc's third-quarter results, along with a positive management discussion, have evidenced the company's effective execution of strategic goals. This underlines the view that XPO merits recognition as a leading national less-than-truckload carrier.

Amidst a challenging freight environment, XPO, Inc. has reported another robust quarter. Analyst predictions indicate that the ongoing pricing trends are likely to contribute to sustained margin and earnings growth into 2025, as the company consistently performs despite a subdued freight context.

XPO, Inc's third-quarter adjusted EBITDA figure significantly surpassed expectations, reflecting the company's consistent ability to deliver strong financial performance.

XPO, Inc's performance exceeded forecasts and consensus expectations in the third quarter. The company's full-year less-than-truckload (LTL) margin targets are anticipated to surpass initial guidance, a feat not common among most transportation peers, even with the expansion that included the opening of 21 service centers this year.

Following a period of reassessment, it is believed that XPO, Inc's prospects for 2025 and beyond are becoming increasingly stable, with significant leverage anticipated in line with the forthcoming industrial freight cycle. While volume remains subdued, favorable pricing dynamics and XPO's effective cost management strategies are expected to yield superior operating ratio results compared to industry counterparts. There is a perception of enduring value in the company's shares.

Here are the latest investment ratings and price targets for $XPO (XPO.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月31日,多家华尔街大行更新了$XPO (XPO.US)$的评级,目标价介于125美元至162美元。

高盛集团分析师Jordan Alliger维持买入评级,并将目标价从136美元上调至150美元。

摩根大通分析师Brian Ossenbeck维持买入评级,并将目标价从143美元上调至146美元。

美银证券分析师Ken Hoexter维持买入评级,并将目标价从129美元上调至152美元。

美银证券分析师Ken Hoexter维持买入评级,并将目标价从129美元上调至152美元。

花旗分析师Ariel Rosa维持买入评级,并将目标价从127美元上调至155美元。

巴克莱银行分析师Eric Morgan维持买入评级,并将目标价从145美元上调至150美元。

此外,综合报道,$XPO (XPO.US)$近期主要分析师观点如下:

xpo公司的第三季度业绩结果,加上积极的管理讨论,证明了公司有效执行战略目标。这强调了xpo有资格被认定为领先的全国零担运输承运商。

在充满挑战的货运环境中,xpo公司再次报告了一个强劲的季度。分析师预测表明,当前的价格趋势可能有助于2025年持续增长的利润和收入,因为该公司始终保持着出色表现,尽管货运环境疲软。

xpo公司第三季度调整后的EBITDA数字显著超出预期,反映了该公司持续提供强劲财务表现的能力。

xpo公司的表现超出了第三季度的预测和共识预期。该公司全年零担(LTL)运输利润率目标有望超过最初的指导,这在大多数运输同行中并不常见,即使包括今年开设的21个服务中心。

经过重新评估期,人们认为xpo公司在2025年及以后的前景变得越来越稳定,预计将出现重大的杠杆比例,符合即将到来的工业货运周期。尽管成交量仍然疲软,但看好的价格动态和xpo有效的成本管理策略预计将带来与行业同行相比更出色的营运比率结果。人们认为该公司股票具有持久价值。

以下为今日11位分析师对$XPO (XPO.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Ken Hoexter维持买入评级,并将目标价从129美元上调至152美元。

美银证券分析师Ken Hoexter维持买入评级,并将目标价从129美元上调至152美元。

BofA Securities analyst Ken Hoexter maintains with a buy rating, and adjusts the target price from $129 to $152.

BofA Securities analyst Ken Hoexter maintains with a buy rating, and adjusts the target price from $129 to $152.