On Oct 31, major Wall Street analysts update their ratings for $Confluent (CFLT.US)$, with price targets ranging from $25 to $40.

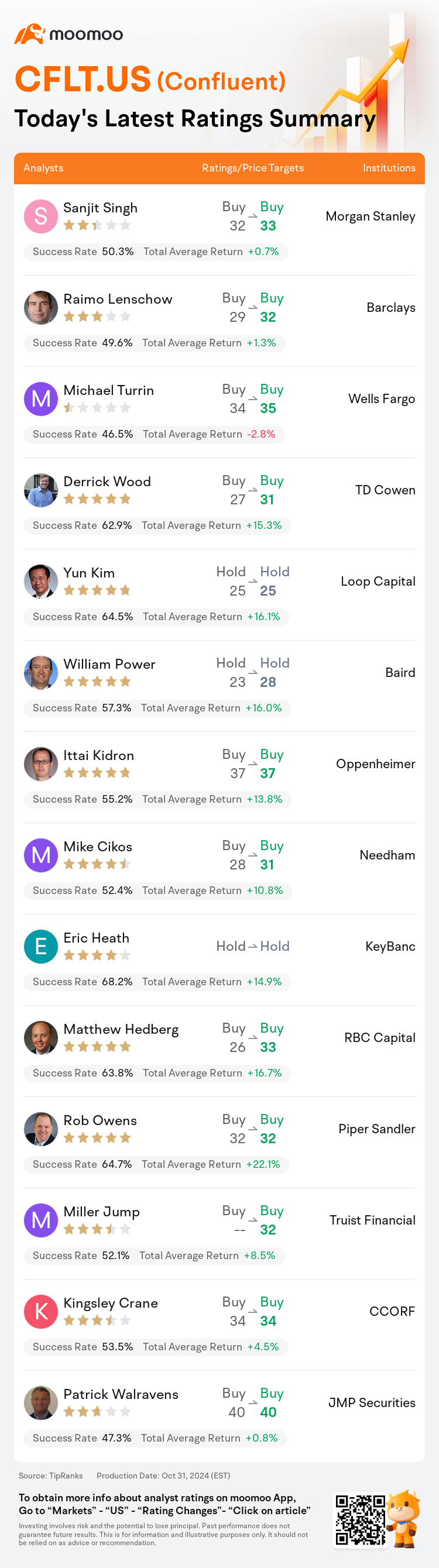

Morgan Stanley analyst Sanjit Singh maintains with a buy rating, and adjusts the target price from $32 to $33.

Barclays analyst Raimo Lenschow maintains with a buy rating, and adjusts the target price from $29 to $32.

Wells Fargo analyst Michael Turrin maintains with a buy rating, and adjusts the target price from $34 to $35.

Wells Fargo analyst Michael Turrin maintains with a buy rating, and adjusts the target price from $34 to $35.

TD Cowen analyst Derrick Wood maintains with a buy rating, and adjusts the target price from $27 to $31.

Loop Capital analyst Yun Kim maintains with a hold rating, and maintains the target price at $25.

Furthermore, according to the comprehensive report, the opinions of $Confluent (CFLT.US)$'s main analysts recently are as follows:

The firm remains 'comfortable' on the sidelines despite the company's sequential revenue outperformance in the Cloud segment and confirmation of the anticipated subscription revenue for Q4. Confluent's emphasis on substantial digital native customers was reiterated, and there is a belief that the significant reliance on this customer subset enhances the risk profile.

The company's Cloud results exceeded expectations and saw acceleration, a factor deemed crucial for investors. With the Flink contribution poised to become significant in upcoming quarters, it is suggested that the company's growth narrative has further potential to unfold.

The firm perceives a 'relatively positive set-up' leading into the Q3 results, with potential for exceeding estimates, particularly due to significant platform renewals and robust government sector performance. Concurrently, the firm noted varied feedback regarding cloud commitment utilization.

Confluent's third quarter performance outpaced expectations, with a 25% year-over-year rise in Subscription revenue surpassing the anticipated 23.5%. Additionally, a significant uptick in Cloud revenue marked a 42% year-over-year increase, outperforming the forecasted 37%. The ongoing shift towards managed data stream processing solutions is expected to continue, positioning Confluent to benefit from the rising adoption of data streaming over the medium to long term.

The company exhibited a robust quarter, marked by a 27% expansion in subscriptions and a 42% surge in cloud growth, outperforming both consensus estimates and the upper spectrum of guidance. Despite a one-time cloud deal in Q3 contributing to the figures, the underlying momentum remained solid with a stabilization in consumption among digitally-native customers and an increase in new use cases by large cloud customers.

Here are the latest investment ratings and price targets for $Confluent (CFLT.US)$ from 14 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月31日,多家华尔街大行更新了$Confluent (CFLT.US)$的评级,目标价介于25美元至40美元。

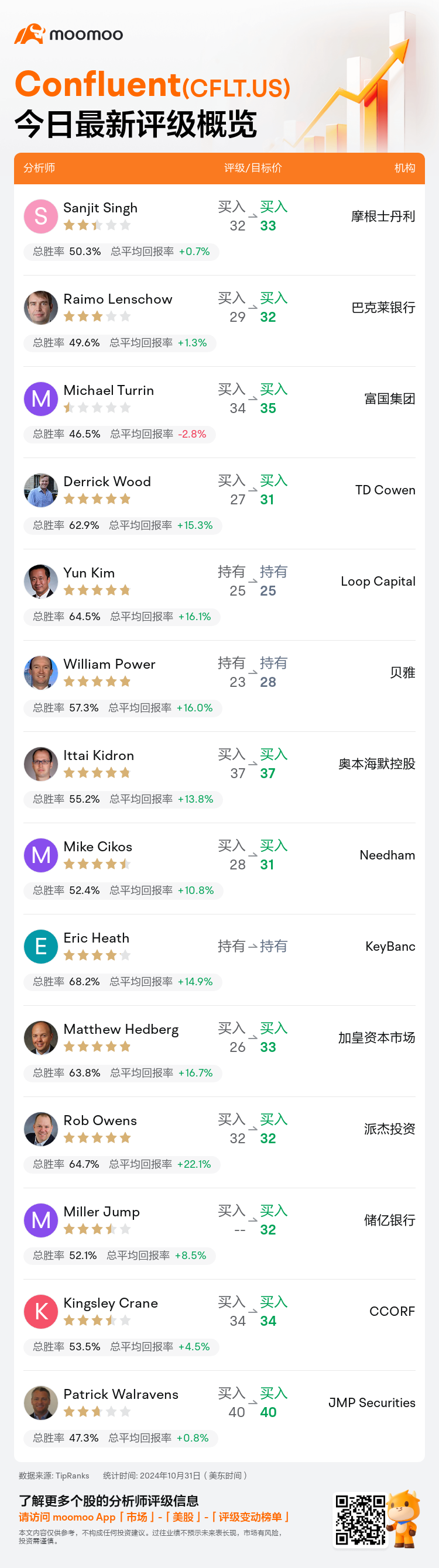

摩根士丹利分析师Sanjit Singh维持买入评级,并将目标价从32美元上调至33美元。

巴克莱银行分析师Raimo Lenschow维持买入评级,并将目标价从29美元上调至32美元。

富国集团分析师Michael Turrin维持买入评级,并将目标价从34美元上调至35美元。

富国集团分析师Michael Turrin维持买入评级,并将目标价从34美元上调至35美元。

TD Cowen分析师Derrick Wood维持买入评级,并将目标价从27美元上调至31美元。

Loop Capital分析师Yun Kim维持持有评级,维持目标价25美元。

此外,综合报道,$Confluent (CFLT.US)$近期主要分析师观点如下:

尽管该公司在云业务板块表现卓越且确认了Q4预期的订阅营业收入,但该公司仍然对局外人保持"舒适"态度。Confluent再次强调对重要数字原生客户的侧重,并相信对这类客户子群体的重大依赖提高了风险概况。

公司的云业务结果超出预期并呈现加速增长,这被投资者认为是至关重要的因素。随着Flink的贡献在未来几个季度变得重要,有人认为公司的增长叙事有进一步潜力展开。

公司认为进入Q3业绩的"相对积极"状态,有可能超出预期,尤其是由于重要平台续约和政府板块表现强劲。与此同时,公司注意到云服务承诺利用率方面的不同反馈。

Confluent第三季度业绩超越预期,订阅营业收入同比增长25%,超过了预期的23.5%。此外,云营业收入显著增长42%,同比增长超过预期的37%。持续向托管数据流处理解决方案转变的趋势预计将继续,这将使Confluent受益于数据流媒体的长期普及。

公司展现出强劲季度业绩,订阅业务增长27%,云业务增长激增42%,超出共识预期和指导的最高水平。尽管Q3的一次性云交易有助于这一数据,但消费趋势保持稳健,数字原生客户消费稳定,并有大型云客户使用案例增加。

以下为今日14位分析师对$Confluent (CFLT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Michael Turrin维持买入评级,并将目标价从34美元上调至35美元。

富国集团分析师Michael Turrin维持买入评级,并将目标价从34美元上调至35美元。

Wells Fargo analyst Michael Turrin maintains with a buy rating, and adjusts the target price from $34 to $35.

Wells Fargo analyst Michael Turrin maintains with a buy rating, and adjusts the target price from $34 to $35.