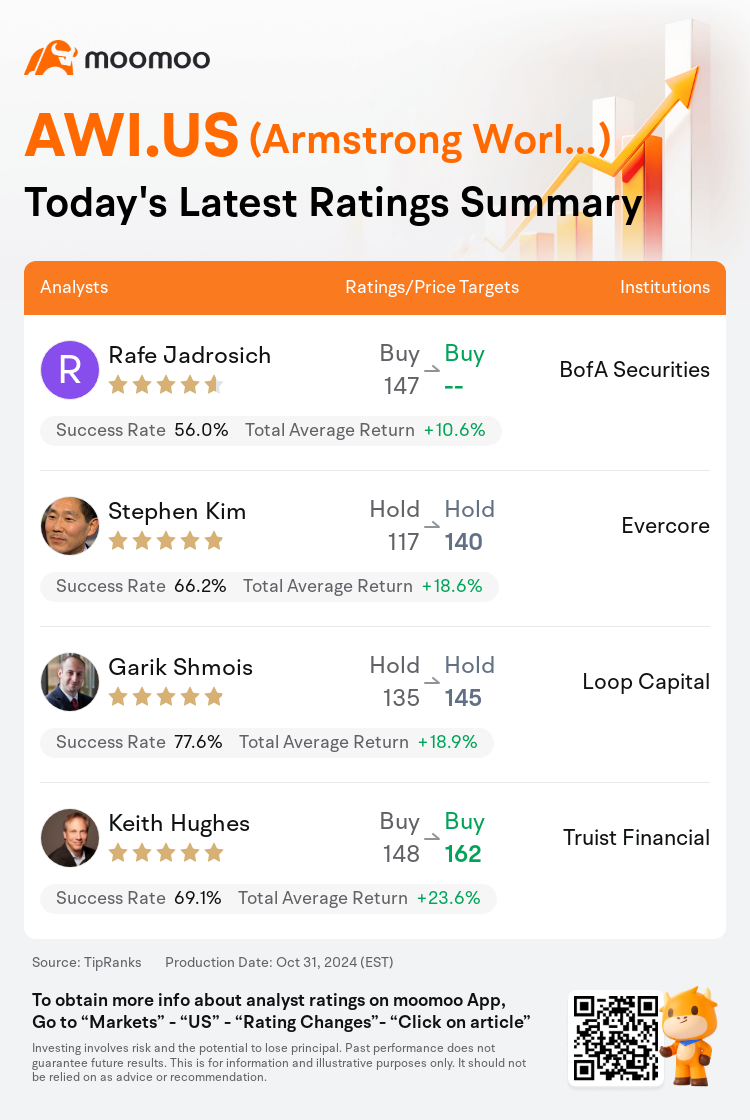

On Oct 31, major Wall Street analysts update their ratings for $Armstrong World Industries (AWI.US)$, with price targets ranging from $140 to $162.

BofA Securities analyst Rafe Jadrosich maintains with a buy rating.

Evercore analyst Stephen Kim maintains with a hold rating, and adjusts the target price from $117 to $140.

Loop Capital analyst Garik Shmois maintains with a hold rating, and adjusts the target price from $135 to $145.

Loop Capital analyst Garik Shmois maintains with a hold rating, and adjusts the target price from $135 to $145.

Truist Financial analyst Keith Hughes maintains with a buy rating, and adjusts the target price from $148 to $162.

Furthermore, according to the comprehensive report, the opinions of $Armstrong World Industries (AWI.US)$'s main analysts recently are as follows:

Following the company's quarterly results which surpassed both the firm's and consensus estimates, the forecast for the adjusted earnings per share in 2024 and 2025 has been revised upward by 2%.

The company has delivered another robust quarter, bolstered by growth in Architectural Specialties sales and an expansion in Mineral Fiber margins. This has reinforced the company's impressive performance trajectory, positioning it as one of the strongest within its sector for the current year. The outlook for sustained earnings growth is becoming clearer, and the margin enhancements achieved over the past two years appear to be maintainable.

Here are the latest investment ratings and price targets for $Armstrong World Industries (AWI.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

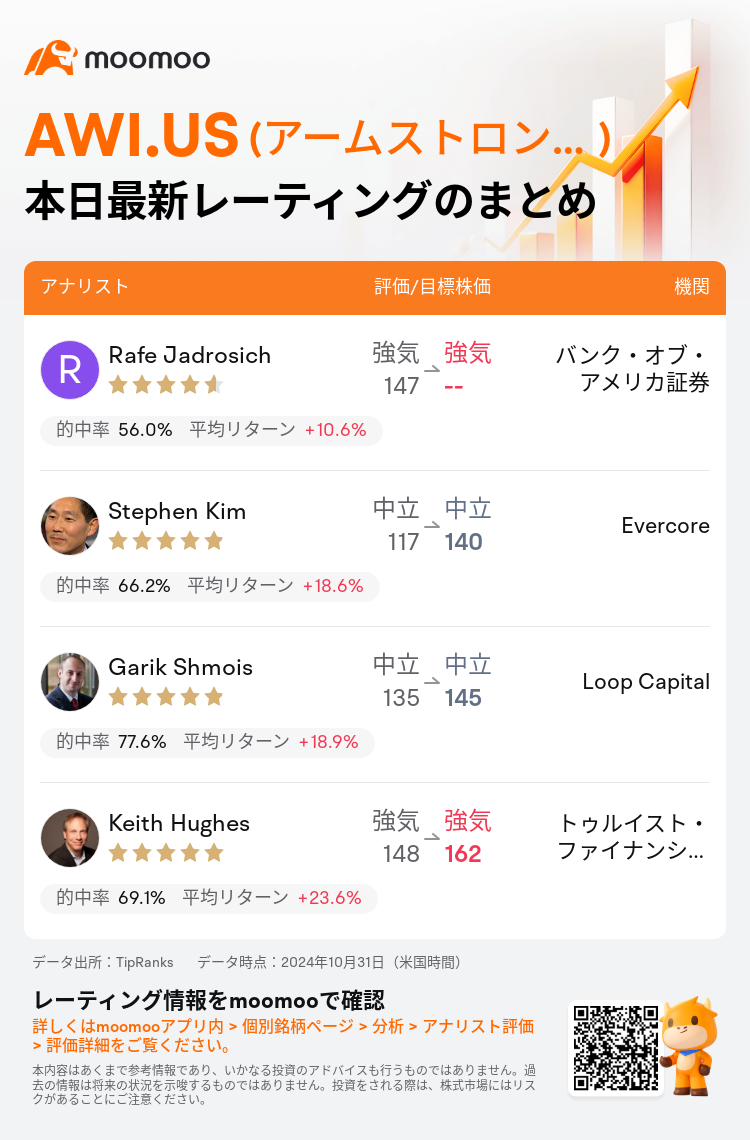

10月31日(米国時間)、ウォール街主要機関のアナリストが$アームストロング・ワールド・インダストリーズ (AWI.US)$のレーティングを更新し、目標株価は140ドルから162ドル。

バンク・オブ・アメリカ証券のアナリストRafe Jadrosichはレーティングを強気に据え置き。

EvercoreのアナリストStephen Kimはレーティングを中立に据え置き、目標株価を117ドルから140ドルに引き上げた。

Loop CapitalのアナリストGarik Shmoisはレーティングを中立に据え置き、目標株価を135ドルから145ドルに引き上げた。

Loop CapitalのアナリストGarik Shmoisはレーティングを中立に据え置き、目標株価を135ドルから145ドルに引き上げた。

トゥルイスト・ファイナンシャルのアナリストKeith Hughesはレーティングを強気に据え置き、目標株価を148ドルから162ドルに引き上げた。

また、$アームストロング・ワールド・インダストリーズ (AWI.US)$の最近の主なアナリストの観点は以下の通りである:

企業の四半期業績は、企業及びコンセンサスの予想を上回り、2024年および2025年の調整後一株当たり利益の予測が2%上方修正されました。

企業は売上高の成長とミネラルファイバーの利益率の拡大により強力な四半期を達成しました。これにより、会社の印象的な業績軌道が強化され、現在の年度においてセクター内で最も強力な1つとしての地位が確立されました。持続的な利益成長の見通しが明確になり、過去2年で達成されたマージンの向上は維持可能なものと見られています。

以下の表は今日4名アナリストの$アームストロング・ワールド・インダストリーズ (AWI.US)$に対する最新レーティングと目標価格である。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

Loop CapitalのアナリストGarik Shmoisはレーティングを中立に据え置き、目標株価を135ドルから145ドルに引き上げた。

Loop CapitalのアナリストGarik Shmoisはレーティングを中立に据え置き、目標株価を135ドルから145ドルに引き上げた。

Loop Capital analyst Garik Shmois maintains with a hold rating, and adjusts the target price from $135 to $145.

Loop Capital analyst Garik Shmois maintains with a hold rating, and adjusts the target price from $135 to $145.