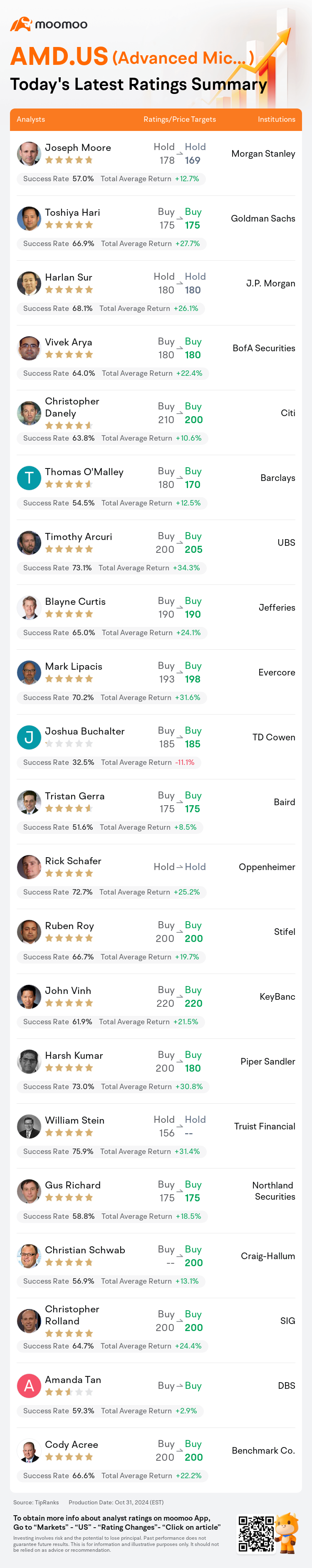

On Oct 31, major Wall Street analysts update their ratings for $Advanced Micro Devices (AMD.US)$, with price targets ranging from $169 to $220.

Morgan Stanley analyst Joseph Moore maintains with a hold rating, and adjusts the target price from $178 to $169.

Goldman Sachs analyst Toshiya Hari maintains with a buy rating, and maintains the target price at $175.

J.P. Morgan analyst Harlan Sur maintains with a hold rating, and maintains the target price at $180.

J.P. Morgan analyst Harlan Sur maintains with a hold rating, and maintains the target price at $180.

BofA Securities analyst Vivek Arya maintains with a buy rating, and maintains the target price at $180.

Citi analyst Christopher Danely maintains with a buy rating, and adjusts the target price from $210 to $200.

Furthermore, according to the comprehensive report, the opinions of $Advanced Micro Devices (AMD.US)$'s main analysts recently are as follows:

AMD's revenue guidance aligned with expectations, and while areas beyond Data Center are no longer seen as headwinds, this may lead to a mild sense of disappointment among investors. Nevertheless, the overarching narrative appears to remain intact. In the short term, the stock might experience limited price movement, and there is a concern that the year 2025 could represent a transitional phase for the company's AI narrative.

AMD reported satisfactory results, although guidance fell short of the consensus, influenced by reduced gaming margins. It's expected that the MI300 will have a dilutive effect on margins for a period, potentially impacting the stock's valuation multiple.

While the recent financial results were largely aligned with consensus and expectations, the post-earnings sell-off was somewhat unexpected. Looking ahead, the upcoming years are viewed as a period of investment, particularly in the AI sector. There is an opinion that some of the revenue and earnings forecasts may still be overly optimistic.

Near-term robustness in Client juxtaposes with a forecast for a more than seasonal first quarter, resulting in a slight moderation of the sales outlook for 2025. The MI300 consistently meets all expectations, but in the absence of specific guidance for the long term and with figures adjusting, the stock currently appears somewhat static.

AMD experienced a decrease of 8% in aftermarket trading subsequent to the announcement of its September quarter results, which met expectations, and a forecast for the December quarter that fell short by 10% regarding EPS. However, the perspective remains positive, with the belief that the company is steadily increasing its presence as a prominent supplier of merchant accelerator solutions.

Here are the latest investment ratings and price targets for $Advanced Micro Devices (AMD.US)$ from 21 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

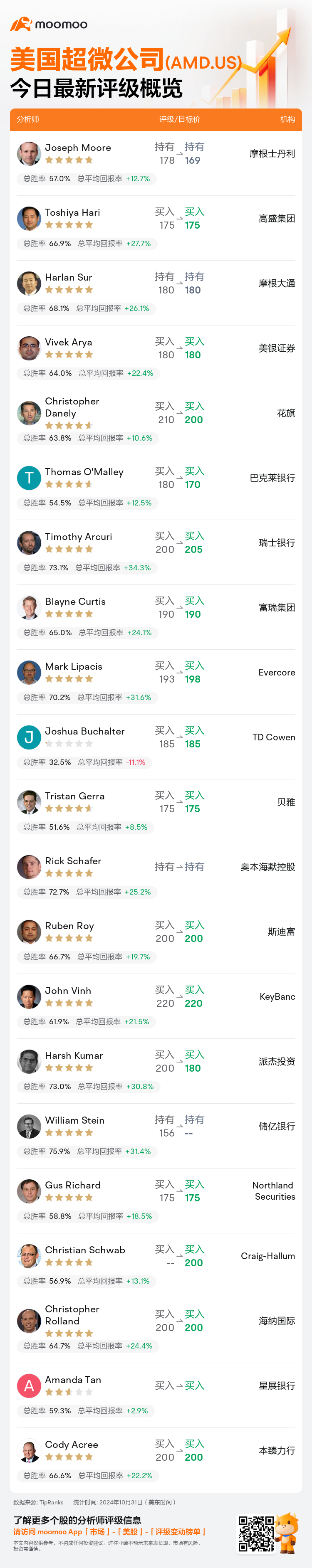

美东时间10月31日,多家华尔街大行更新了$美国超微公司 (AMD.US)$的评级,目标价介于169美元至220美元。

摩根士丹利分析师Joseph Moore维持持有评级,并将目标价从178美元下调至169美元。

高盛集团分析师Toshiya Hari维持买入评级,维持目标价175美元。

摩根大通分析师Harlan Sur维持持有评级,维持目标价180美元。

摩根大通分析师Harlan Sur维持持有评级,维持目标价180美元。

美银证券分析师Vivek Arya维持买入评级,维持目标价180美元。

花旗分析师Christopher Danely维持买入评级,并将目标价从210美元下调至200美元。

此外,综合报道,$美国超微公司 (AMD.US)$近期主要分析师观点如下:

AMD的营业收入指导符合预期,尽管数据中心以外的领域不再被视为阻碍,这可能会在投资者中引发轻微失望情绪。然而,在整体叙事中似乎仍然完整。短期内,股价可能会出现有限的价格波动,人们担心2025年可能代表该公司人工智能叙事的过渡阶段。

AMD报告了令人满意的结果,尽管指引未达共识,受到游戏利润率下降的影响。预计MI300将在一段时间内对利润率产生摊薄效应,可能影响股票的估值倍数。

尽管最近的财务结果基本符合共识和预期,但盈利发布后出现的大幅抛售有些出人意料。展望未来,未来几年被视为一个投资时期,特别是在人工智能板块。有人认为一些收入和盈利预测仍然可能过于乐观。

客户端的短期稳健与对更多季度的预测形成鲜明对比,导致2025年销售前景略微降温。MI300始终达到所有预期,但缺乏长期的具体指导和数据调整,使得股价目前显得有些静态。

AMD在9月季度业绩公布后的盘后交易中经历了8%的下跌,符合预期,并且关于EPS的12月季度预测低于10%。然而,展望仍然积极,认为该公司正在稳步增强其作为一家显赫的商用加速器解决方案供应商的地位。

以下为今日21位分析师对$美国超微公司 (AMD.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

摩根大通分析师Harlan Sur维持持有评级,维持目标价180美元。

摩根大通分析师Harlan Sur维持持有评级,维持目标价180美元。

J.P. Morgan analyst Harlan Sur maintains with a hold rating, and maintains the target price at $180.

J.P. Morgan analyst Harlan Sur maintains with a hold rating, and maintains the target price at $180.