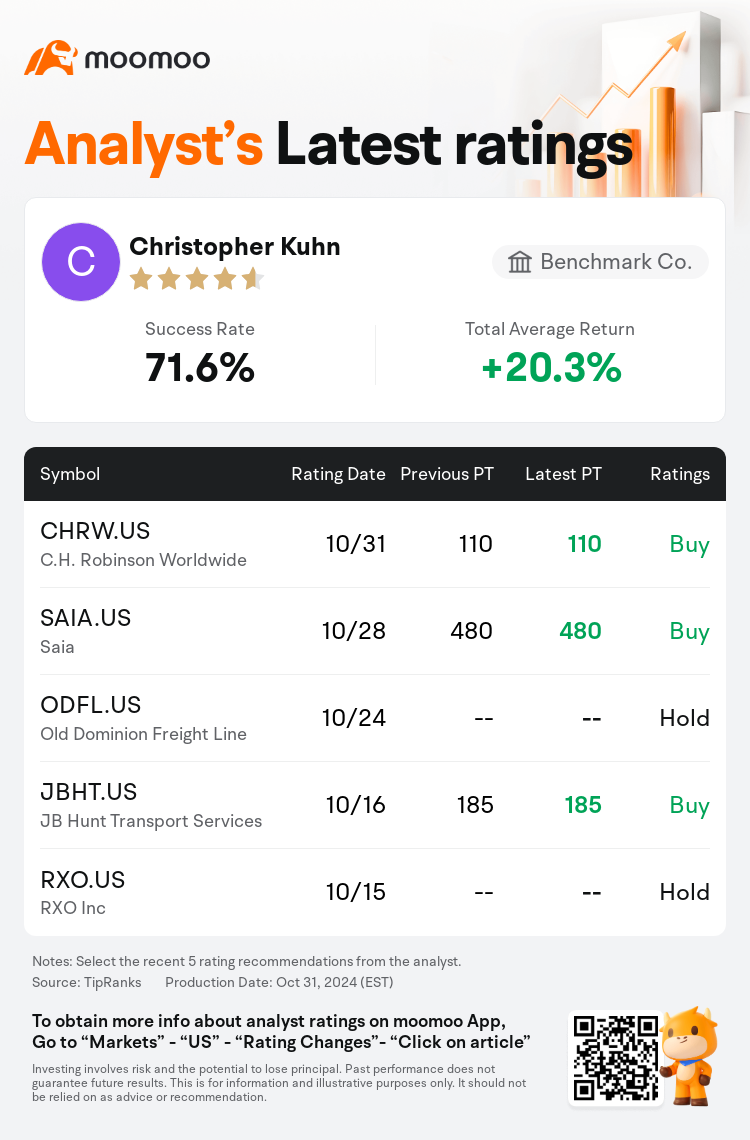

Benchmark Co. analyst Christopher Kuhn maintains $C.H. Robinson Worldwide (CHRW.US)$ with a buy rating, and maintains the target price at $110.

According to TipRanks data, the analyst has a success rate of 71.6% and a total average return of 20.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $C.H. Robinson Worldwide (CHRW.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $C.H. Robinson Worldwide (CHRW.US)$'s main analysts recently are as follows:

The company has reported another strong quarter with notable cost control measures and significant growth in ocean freight forwarding, leading to substantial third-quarter results. It is anticipated that management will disclose more ambitious long-term productivity goals at the forthcoming analyst gathering.

The company's third-quarter results surpassed expectations, primarily due to a temporary increase in Forwarding. The company is also showing significant advancement in its new operating model, particularly in the core NAST business, which performed slightly better than anticipated in the face of challenging macroeconomic conditions.

The firm noted that C.H. Robinson's revenue aligned with projections, albeit with a lighter organic component, and margins fell short of expectations for both the quarter and the outlook. Logistics are improving as anticipated; however, persistent weakness in other areas is dampening overall growth.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

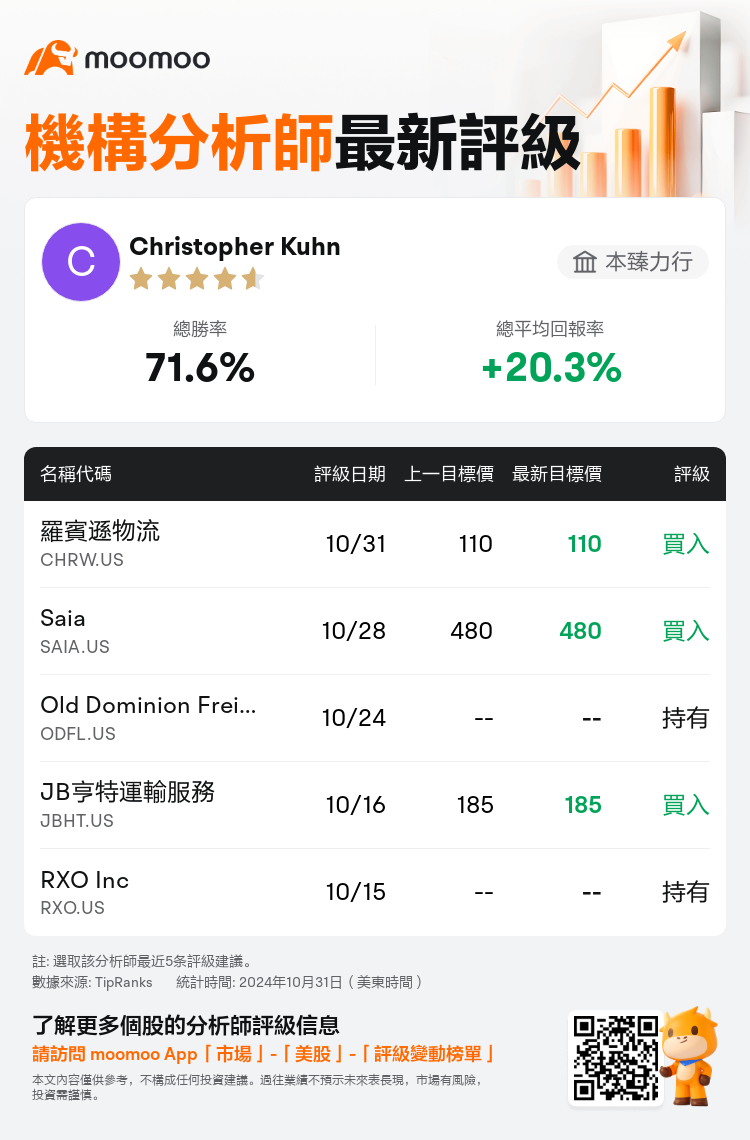

本臻力行分析師Christopher Kuhn維持$羅賓遜物流 (CHRW.US)$買入評級,維持目標價110美元。

根據TipRanks數據顯示,該分析師近一年總勝率為71.6%,總平均回報率為20.3%。

此外,綜合報道,$羅賓遜物流 (CHRW.US)$近期主要分析師觀點如下:

此外,綜合報道,$羅賓遜物流 (CHRW.US)$近期主要分析師觀點如下:

公司報告稱,本季度採取了顯著的成本控制措施,海運貨物運輸業務增長顯著,導致第三季度業績大幅增長。預計管理層將在即將到來的分析師聚會上披露更加雄心勃勃的長期生產力目標。

公司的第三季度業績超出預期,主要是由於貨運量暫時增加。公司新的運營模式也取得了顯著進展,特別是在覈心NASt業務方面,其業績略好於預期,儘管面臨複雜的宏觀經濟形勢。

公司指出,C.H. Robinson的營業收入與預期一致,儘管有一定輕量級的有機組成部分,但利潤率在本季度和未來預期方面均低於預期。預期物流業務將會改善;然而,其他方面的持續疲弱正在抑制整體增長。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$羅賓遜物流 (CHRW.US)$近期主要分析師觀點如下:

此外,綜合報道,$羅賓遜物流 (CHRW.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of