Carvana Co. (NYSE:CVNA) reported better-than-expected third-quarter financial results on Wednesday.

Carvana reported third-quarter revenue of $3.66 billion, beating the consensus estimate of $3.45 billion, according to Benzinga Pro. The used car retailer reported third-quarter earnings of 64 cents per share, beating analyst estimates of 17 cents per share.

"Carvana's exceptional results underscore our position as the fastest-growing and most profitable automotive retailer. Our progress in Q3 further highlights the strength of our vertically integrated business model and also begins to demonstrate the power of our unique infrastructure, including the ADESA network," said Ernie Garcia, co-founder and CEO of Carvana.

Carvana said it anticipates a sequential increase in year-over-year growth for retail units sold in the fourth quarter. The company also expects full-year adjusted EBITDA to be above the high end of its previous guidance range of $1 billion to $1.2 billion.

Carvana said it anticipates a sequential increase in year-over-year growth for retail units sold in the fourth quarter. The company also expects full-year adjusted EBITDA to be above the high end of its previous guidance range of $1 billion to $1.2 billion.

Carvana shares jumped 23.5% to trade at $256.00 on Thursday.

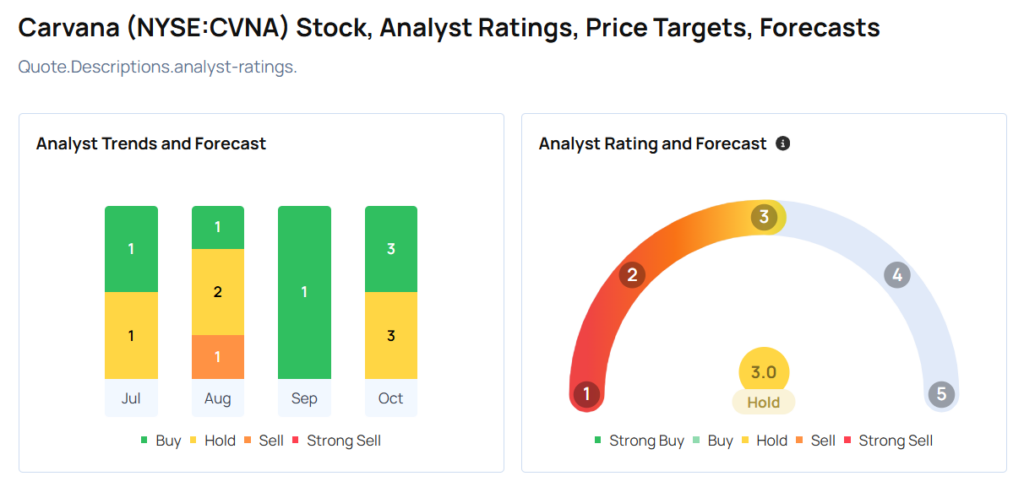

These analysts made changes to their price targets on Carvana following earnings announcement.

- Baird analyst Colin Sebastian maintained Carvana with a Neutral and raised the price target from $160 to $240.

- Needham analyst Chris Pierce maintained Carvana with a Buy and raised the price target from $200 to $300.

- JP Morgan analyst Rajat Gupta maintained the stock with an Overweight and raised the price target from $230 to $300.

Considering buying CVNA stock? Here's what analysts think:

Read More:

- Jim Cramer: This Financial Stock Is 'One Of The Most Consistent, Great Companies'