Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Sichuan Yahua Industrial Group Co., Ltd. (SZSE:002497) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Sichuan Yahua Industrial Group's Debt?

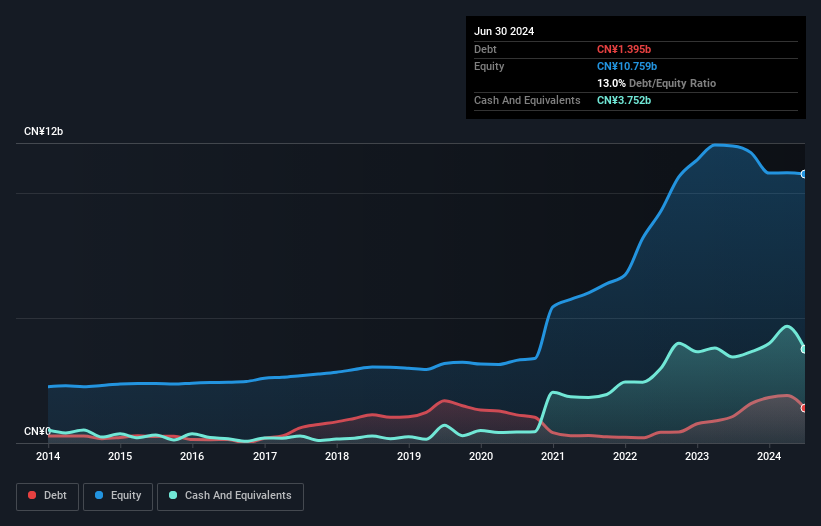

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Sichuan Yahua Industrial Group had CN¥1.40b of debt, an increase on CN¥1.06b, over one year. However, it does have CN¥3.75b in cash offsetting this, leading to net cash of CN¥2.36b.

A Look At Sichuan Yahua Industrial Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Sichuan Yahua Industrial Group had liabilities of CN¥2.69b due within 12 months and liabilities of CN¥574.7m due beyond that. On the other hand, it had cash of CN¥3.75b and CN¥2.16b worth of receivables due within a year. So it actually has CN¥2.64b more liquid assets than total liabilities.

Zooming in on the latest balance sheet data, we can see that Sichuan Yahua Industrial Group had liabilities of CN¥2.69b due within 12 months and liabilities of CN¥574.7m due beyond that. On the other hand, it had cash of CN¥3.75b and CN¥2.16b worth of receivables due within a year. So it actually has CN¥2.64b more liquid assets than total liabilities.

This surplus suggests that Sichuan Yahua Industrial Group is using debt in a way that is appears to be both safe and conservative. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Succinctly put, Sichuan Yahua Industrial Group boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Sichuan Yahua Industrial Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Sichuan Yahua Industrial Group had a loss before interest and tax, and actually shrunk its revenue by 34%, to CN¥9.6b. To be frank that doesn't bode well.

So How Risky Is Sichuan Yahua Industrial Group?

Although Sichuan Yahua Industrial Group had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of CN¥552m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. For riskier companies like Sichuan Yahua Industrial Group I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.