その独自のTrimer-Tag技術プラットフォームにより、トレーフ生物のRSV候補ワクチンSCB-1019は、将来的に同類で最高の可能性を秘め、RSVワクチンの市場構造を再構築することが期待されています。

現在は第三四半期の決算報告シーズンであり、中国のワクチン産業は経済サイクルの波によって業績が圧迫され、これまで人気のあったワクチンの大量品種も国内市場での価格競争のさらなる挑戦に直面しています。バイオ医薬品のサブセクターである国内の革新的ワクチン産業が、いかにブレークスルーして安定し、雲を切り開き明るい未来を見出す道を見つけるかは、各国のワクチンメーカーの将来のビジネスの存亡を決定する中核的な戦略的検討になります。

同時に、近年、双抗、革新的小分子薬、核薬など、革新的な生物医薬の他のサブセクターでは、国内企業が自主開発した潜在的なベストインクラスのバイオ資産がいくつか出ており、それらは数千万ドルまたは数億ドルで多国籍薬企によって海外権益を購入されています。これは、2018年から2021年までの資本ブームによって孵化された中国のバイオ革新薬の分野において、本当に自主開発された革新的能力を持つ国内のバイオ革新薬メーカーが、中国の革新的なバイオ資産を「海外に打って出る」展開していることを示しています。このような業界全体の動向の中で、ノウハウを持ち、革新的独自ワクチンを開発し海外展開が可能な国内革新ワクチン企業が早急にチャンスを活かしていることを期待しています。自主研究された革新的ワクチン製品が優れた力を持って国際市場に参入することは、国内ワクチン産業が現在の国内運営課題に打ち勝つ唯一の実現可能な道かもしれません。この戦略に基づいて、2021年末に香港株に上場したトレーフ生物(02197)が私たちの視野に入りました。

トレーフ生物は、自主開発したTrimer-Tag(蛋白三量体化)ワクチン開発技術プラットフォームを所有しており、この技術プラットフォームはすでに完全に検証されています。この技術プラットフォームに基づいて自主開発された新型コロナワクチン(SCB-2019)は、世界8カ国、5大陸で約4万人が参加したIII期臨床試験を行い、その後中国で緊急使用認可(EUA)を取得しました。2023年半ば以降、トレーフ生物は、自主開発した新型コロナワクチンで蓄積した豊富な経験とリソースを活かし、自社の技術プラットフォームの特性を活かして、SCB-1019という呼吸器合胞病ウイルス(RSV)の候補ワクチンのパイプライン研究開発を積極的に進めています。2023年12月初旬、トレーフ生物はRSV候補ワクチンI期臨床試験を開始し、中国初のRSV PreF(融合前構造のFタンパク質に基づく)ワクチンを開発し、人体臨床試験段階に進入したワクチン企業となり、トレーフ生物の中国RSV領域でのリーダーシップを確固たるものにしました。

トレーフ生物は、自主開発したTrimer-Tag(蛋白三量体化)ワクチン開発技術プラットフォームを所有しており、この技術プラットフォームはすでに完全に検証されています。この技術プラットフォームに基づいて自主開発された新型コロナワクチン(SCB-2019)は、世界8カ国、5大陸で約4万人が参加したIII期臨床試験を行い、その後中国で緊急使用認可(EUA)を取得しました。2023年半ば以降、トレーフ生物は、自主開発した新型コロナワクチンで蓄積した豊富な経験とリソースを活かし、自社の技術プラットフォームの特性を活かして、SCB-1019という呼吸器合胞病ウイルス(RSV)の候補ワクチンのパイプライン研究開発を積極的に進めています。2023年12月初旬、トレーフ生物はRSV候補ワクチンI期臨床試験を開始し、中国初のRSV PreF(融合前構造のFタンパク質に基づく)ワクチンを開発し、人体臨床試験段階に進入したワクチン企業となり、トレーフ生物の中国RSV領域でのリーダーシップを確固たるものにしました。

間もなく、トレーフ生物は2024年4月と6月にそれぞれ、二価RSV候補ワクチンSCB-1019のI期臨床試験が若年成人および高齢者の群で積極的な初期データを獲得しました。四か月後、トレーフ生物は、RSV候補ワクチンを既承認の国際的なRSVワクチン製品と対面させた臨床試験結果を世界で初めて公開したメーカーとなり、世界中の同業者や資本市場の高い注目を集めました。現在、世界中で3社の主要大手製薬会社が高齢者向けに承認されたRSVワクチン製品を保有していますが、トレーフ生物の自主開発RSV候補ワクチンはどのような差別化された優位性を持ち、最終的に海外進出の戦略目的を達成できるのか、重要な点です。

Best-in-Classの可能性を秘めたSCB-1019が注目を集めています

10月29日、トレーフ生物は発表しました。同社のI期臨床試験で、非佐剤使用の二価RSV PreF-トリマー亜単位候補ワクチンSCB-1019とGSKのAS01E佐剤を使用したRSVワクチンAREXVYを老人被験者で比較した結果、より多くの積極的な免疫原性と安全性データを収集しました。

免疫原性の観点では、28日目に、アジュバントが使用されていないSCB-1019によって誘導されたRSV-AおよびRSV-Bの中和抗体の幾何平均滴度(GMTs)はそれぞれ約30500IU/mLおよび32000IU/mLであり、AREXVYによって誘導されたRSV-AおよびRSV-Bの中和抗体の幾何平均滴度(GMTs)はそれぞれ約26700IU/mLおよび37700IU/mLで、プラセボ群はそれぞれ約3300IU/mLおよび2900IU/mLです。

安全性の面では、GSKがAS01Eアジュバントを使用したRSVワクチンAREXVY(76.7%)と比較して、アジュバントを使用していないSCB-1019(16.7%)の局所有害事象(AEs)の発生率が著しく低いことが示されています。

SCB-1019は全体的に良好な耐容性を示し、SCB-1019による局所および全身有害事象(AEs)は全体的に軽く、生理食塩水プラセボ群と同等です。

全球で市販されているRSVワクチンの販売データによると、GSKのAREXVYはRSVワクチン市場での主力製品であり、そのため三叉草生物はアジュバントを使用していないRSV候補ワクチンSCB-1019とGSKのAS01Eアジュバントを使用したAREXVYの臨床試験結果を直接比較しました。結果は非常に積極的で、効力は同等でありながら安全性がより優れているため、三叉草生物のSCB-1019が同様の分野で最も有望な製品となる可能性があることが示されています。

智通財経アプリによると、RSVは一般的な呼吸器ウイルスであり、現在特効薬は市場に出回っておらず、RSV感染による合併症に対して対症療法が唯一の治療法となります。そのため、ワクチン接種による積極的な予防がRSV重症感染を避け、死亡率を低下させるための重要な手段となっています。

実際、1960年代以降、RSVワクチンの開発はWHOの優先課題の一つでした。RSV病原体の病態生理は複雑であるため、多くの年月を費やして多くの大手製薬企業がRSVワクチンの開発で挫折してきました。

昨年、つまり2023年にGSKは、RSVワクチンArexvyが米国食品医薬品局(FDA)の承認を受けて市場に投入され、高齢者を対象としてRSV感染による下部呼吸器疾患を予防するためのRSV感染のゼロ予防を実現しました。

現在、世界中でRSVワクチン4種類の製品が承認されて市場に投入されており、それぞれ葛兰素史克(GSK)製のArexvy、辉瑞(Pfizer)製のABRYSVO、サノフィとアストラゼネカ製のNirsevimab(尼塞韦モノクローナル抗体)、Moderna製のmRNA-1345が含まれています。

技術経路と保護力の観点から見ると、gskとファイザーのRSVワクチンは両方とも再構成タンパク質経路に属しています。gskのAREXVYは単価のRSVワクチンで、アジュバンツを使用し、保護力は他のRSVワクチンよりも高く、82.6%に達し、重症のRSV関連下気道疾患を予防する保護力は94.1%に達します。一方、ファイザーの二価RSVワクチンの保護力は60%前後です。モデルナの単価RSVワクチンは今年5月に市場投入されましたが、技術経路はmRNAであり、保護力も80%以上ですが、今年の中頃、CDCはこの単価RSVワクチンが1シーズンを完全にカバーするのに十分な保護力を持っていないことを公表し、接種から8か月後には保護力が50%未満に低下すると報告しました。mRNA技術経路のRSVワクチンの商業化展望は不安定であり、モデルナの株価も6月末から50%近く下落しています。一方、同時期に発表された再構成タンパク質経路を中心とするgskとファイザーのRSVワクチンは、保護力の持続性が約2年となっています。したがって、現時点では保護力と持続性の観点から見て、再構成タンパク質経路のRSVワクチンがmRNA経路のRSVワクチンよりも優れています。

現在の商業販売結果から見ると、GSKのRSVワクチンが優位に立っています。2023年、GSKのRSVワクチンの売り上げは156.4億米ドルであり、ファイザーは89億米ドルの売り上げを達成し、GSKの半分にとどまりました。GSKのCEOであるEmma Walmsleyは、同社のRSVワクチンが米国市場の3分の2を占めていると述べています。

RSVワクチンの営業初期売上は1四半期で13億ドル近くという業界記録を樹立しましたが、世界的なRSVワクチンが100億ドルの大口になるかどうかは、将来の繰り返し接種の市場機会次第です。また、商業化された再構成タンパク質経路RSVワクチンは、以前と最新の臨床データによると、有効な繰り返し接種の問題に直面しています。というのも、GSKもファイザーも、それぞれの第III相臨床データは接種後12か月または24か月後に、ワクチンを再接種した場合の中和抗体の滴定量が最初のピークレベルの約45-60%にしかならないことを示しています。GSKは第III相臨床で保護力データを公表しており、接種後12か月の繰り返し接種を示し、最初の中和抗体のピーク値55%に相当する保護力に到達しないことを示しており、安慰剤と同等の効力しかないと報告されました。科学的観点から推測すると、これら2社のRSVワクチンの抗原は異なりますが、3量体のタグにはT4-Foldon技術が使用されています。この技術自体が抗原であるため、人体に入って免疫干渉を引き起こす可能性があり、したがって繰り返し接種の効果が不十分である可能性があります。

現在、GSKとファイザーは3年および4年の間隔で再接種を行う第III相臨床試験を実施していますが、両社のRSVワクチンの保護力の持続性データによると、約2年ごとに再接種が必要です。では、誰が不足を補うことができるのでしょうか?

国際的な大手製薬企業の3種類の高齢者向け商業化済みRSVワクチン製品のうち2種は有効な繰り返し接種の課題に直面しており、もう1種は保護力が完全な流行季範囲をカバーできない状況です。現在の国際的巨人の製品の欠陥は、3リーフ生物および世界中の他の生物医学革新ワクチン企業にとって、潜在的なスーパーパスの機会を意味しています。

三葉生物については、アジュバントを使用していない二価の再構成タンパク質RSV候補ワクチンSCB-1019は、同社が開発したTrimer-Tag技術プラットフォームに基づいています。Trimer-Tagは、人間由来の共有結合三量体タグを利用した唯一のグローバルな再構成タンパク質ワクチン技術であり、共有結合による結合は天然三量体抗原の構造を安定させることができるため、強力で正確な中和性免疫応答を誘導し、これまでの臨床試験経験により、免疫干渉や既存の免疫が観察されていないことが確認されています。現在実施中のオーストラリア第I相臨床では、SCB-1019はGSKのAREXVYとの比較で積極的なデータを示し、RSVワクチンでSCB-1019が同類の中で最も優れた保護力を提供することが確実となっています。三葉生物によると、SCB-1019のRSVワクチンの再接種適用を評価する第III相臨床試験を2025年に開始する予定であり、期待されています。

Trimer-Tagプラットフォームに基づくRSVワクチンやその他の呼吸器連動ワクチンが迅速に開発される見込みです

呼吸器ワクチン分野では、効果的な組合せワクチンの開発が全体の成長傾向です。同様に、RSVワクチン市場においても、各社の長期的なパイプライン計画には関連する呼吸連動ワクチンの開発が含まれており、より大きな商業化市場機会に参入しています。注目すべきは、インフルエンザウイルス、呼吸器合胞ウイルス(RSV)、およびSARS-CoV-2ウイルスが重要な世界的公衆衛生課題となっている点です。季節性インフルエンザは毎年、世界の成人の5%から10%および子供の20%から30%に影響し、300万から500万の重症例を引き起こし、約29万から65万人の死亡をもたらしています。

2019年、SARS-CoV-2によって引き起こされた新型コロナウイルス感染症(COVID-19)の大流行は、ますます深刻化し、世界では少なくとも7.75億件の症例が報告され、約700万人がそのために亡くなりました。

COVID-19の後、インフルエンザやSARS-CoV-2などのウイルスの共同感染現象は、0.2%から48%までの罹患率を示し、その範囲は様々です。このような合併感染は通常、病状を悪化させ、病程を延長させます。

したがって、合同呼吸器ワクチンの開発が徐々に注目を集めるようになりました。この傾向の中心は、単一のワクチンを通じて複数の呼吸器ウイルスに対する保護を提供し、接種回数を減らし、接種率を高め、免疫カバー範囲を拡大することにあります。

Trimer-Tag(タンパク質トリマータグ)ワクシン開発技術プラットフォームは、Clover Biopharmaceuticals社が開発したもので、類似構造を持つ複数の呼吸器ウイルス抗原を結合させるのに特に適しています。このプラットフォームはワクシン抗原の安定性と免疫原性を促進し、複数価または合同ワクチンの開発に堅固な基盤を提供します。特に、Clover Biopharmaceuticals社がこのプラットフォームを用いて開発したRSVワクシンに関する貴重な経験は、呼吸器合同ワクチンの開発に道を開いています。

現在、Clover Biopharmaceuticals社のRSV候補ワクチンSCB-1019は、単一のRSウイルス感染および他の呼吸器合同ワクチン(RSV+hMPV±PIV3)の開発に使用されており、2025年にRSV合同ワクチンの応用を評価する臨床試験が開始される予定です。その呼吸器合同ワクチンの有効性が臨床で検証されれば、同社の候補ワクチン製品の海外展開能力はさらに向上するでしょう。

グローバルRSVワクシンのビジネス展望と市場競争

2023年下半期にRSVワクシンの販売が始まって以来、約25億ドルの売り上げを記録してきました。GSKやファイザーの成功はRSV市場の巨大な需要をさらに裏付け、後続の研究企業に安心感を与えました。Insight Researchの調査データによると、RSV治療薬と予防薬を含む世界のRSV薬市場規模は、2020年の18億ドルから2030年の128億ドルに増加し、年平均成長率は21.4%に達すると予想されています。

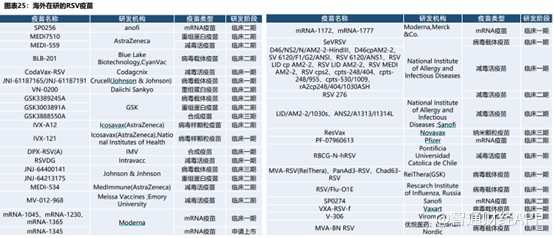

ClinicalTrialsデータベースによると、2023年9月時点で、世界各地で20種類以上の異なる技術経路を持つRSVワクシンや抗体医薬品の研究パイプラインが次々に臨床研究段階に進んでいます。

RSVワクチン開発に参加している企業は多数いますが、RSVワクチンの開発障壁は非常に高く、安全かつ効果的なRSVワクチンの開発は困難です。しかし、三叶草生物は独自かつ成熟したTrimer-Tag技術プラットフォームを活用し、RSV候補ワクチンSCB-1019は業界で最も有望な存在となる可能性があり、国産RSVワクチンの開発ではリーダーグループに位置しており、国内のバイオ医薬品イノベーションの成功を海外へと導く可能性が高いです。

結論

RSVワクチン市場の急速な成長に伴い、三叶草生物は独自のTrimer-Tag技術プラットフォームとRSV候補ワクチンSCB-1019によって、この分野で巨大な潜在能力を示しています。臨床試験データによると、三叶草生物の二価RSV PreF-トリマー亜単位候補ワクチンは、免疫原性と安全性の面で優れた性能を示しており、現行の商業RSVワクチンの繰り返し接種の効果不足の問題を解決し、呼吸器合併症ワクチンへの臨床応用の評価も期待されています。

RSVワクチン市場は現在、GSKなどの国際製薬大手によって支配されていますが、三叶草生物は独自の優位性を活かし、国内およびグローバルなRSVワクチン開発におけるリーダーシップを確立しています。将来、さらなる臨床試験の推進や呼吸器合併症ワクチンの開発により、三叶草生物はRSV感染への効果的かつ持続的な解決策を提供し、グローバルなバイオヘルス領域での影響力をさらに拡大する見通しです。

三叶草生物拥有自研的Trimer-Tag (蛋白质三聚体化)疫苗开发技术平台,且该技术平台已得到全面验证: 基于该技术平台自研的新冠疫苗 (SCB-2019) 在全球八个国家、五大洲有近4万人入组多项III期临床试验,后在中国获得紧急使用授权(EUA)。从2023年中开始,三叶草生物以其自研新冠疫苗所累积的丰富经验和资源,结合自身技术平台特点,以潜在商业价值最大化为导向布局管线研发,开始集中快速推进自研的呼吸道合胞病毒(RSV)候选疫苗SCB-1019。2023年12月初,三叶草生物宣布启动RSV候选疫苗I期临床试验,成为中国首家开发 RSV PreF (基于融合前构象的F蛋白) 疫苗并进入人体临床试验阶段的疫苗公司,这坚定了三叶草生物在中国RSV领域的领跑地位。

三叶草生物拥有自研的Trimer-Tag (蛋白质三聚体化)疫苗开发技术平台,且该技术平台已得到全面验证: 基于该技术平台自研的新冠疫苗 (SCB-2019) 在全球八个国家、五大洲有近4万人入组多项III期临床试验,后在中国获得紧急使用授权(EUA)。从2023年中开始,三叶草生物以其自研新冠疫苗所累积的丰富经验和资源,结合自身技术平台特点,以潜在商业价值最大化为导向布局管线研发,开始集中快速推进自研的呼吸道合胞病毒(RSV)候选疫苗SCB-1019。2023年12月初,三叶草生物宣布启动RSV候选疫苗I期临床试验,成为中国首家开发 RSV PreF (基于融合前构象的F蛋白) 疫苗并进入人体临床试验阶段的疫苗公司,这坚定了三叶草生物在中国RSV领域的领跑地位。