It is a pleasure to report that the China Fortune Land Development Co., Ltd. (SHSE:600340) is up 113% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. In fact, the share price has tumbled down a mountain to land 90% lower after that period. The recent bounce might mean the long decline is over, but we are not confident. The real question is whether the business can leave its past behind and improve itself over the years ahead. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

On a more encouraging note the company has added CN¥2.9b to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

China Fortune Land Development isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade China Fortune Land Development reduced its trailing twelve month revenue by 32% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 14% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

Over half a decade China Fortune Land Development reduced its trailing twelve month revenue by 32% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 14% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

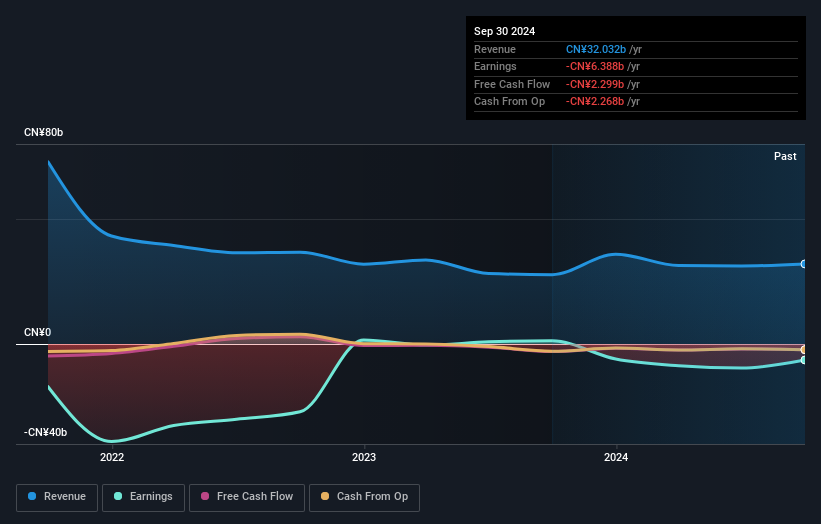

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on China Fortune Land Development's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that China Fortune Land Development shareholders have received a total shareholder return of 23% over the last year. Notably the five-year annualised TSR loss of 14% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with China Fortune Land Development (including 2 which are concerning) .

Of course China Fortune Land Development may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.