In September, the company was included in the Hong Kong Stock Connect, and the improvement in liquidity may have also helped the company's stock price rise.

Since October, the unusual volatility of Yisou Technology (02550) stock price has attracted investors' attention. On October 29, the company reached a high of 67.25 Hong Kong dollars, but rapidly fell just 2 trading days later, closing at 44.4 Hong Kong dollars on the 31st, a decrease of about 23.45%. At the same time, the company's trading volume did not significantly increase, with the highest volume around 1 million.

Public information shows that Yisou Technology is a digital reading company, with Yi Sou Xiao Shuo as its main IP. In terms of business model, Yisou Technology pushes digital content to end users through apps and H5 pages, generating revenue through paid content, as well as free content with advertisements. According to the prospectus, in 2021, Yisou Xiao Shuo app has a monthly active user base of 18 million people, making it the fifth largest domestic online literary reading platform after China Literature, iReader Technology, Migu Culture Media, and Alibaba Literature.

Previously in September, the company was included in the Hong Kong Stock Connect, and the improvement in liquidity may have also helped the company's stock price rise. In terms of funding, the largest net buyers today are through the Shanghai-Hong Kong Stock Connect, buying 0.083 million shares, followed by Yuexiu Group and the Shenzhen-Hong Kong Stock Connect buying 0.0285 million shares and 17,500 shares respectively; the largest sellers are JP Morgan selling 0.0375 million shares, Citigroup Global and Zhejiang International selling 0.0165 million shares and 16,000 shares respectively.

Previously in September, the company was included in the Hong Kong Stock Connect, and the improvement in liquidity may have also helped the company's stock price rise. In terms of funding, the largest net buyers today are through the Shanghai-Hong Kong Stock Connect, buying 0.083 million shares, followed by Yuexiu Group and the Shenzhen-Hong Kong Stock Connect buying 0.0285 million shares and 17,500 shares respectively; the largest sellers are JP Morgan selling 0.0375 million shares, Citigroup Global and Zhejiang International selling 0.0165 million shares and 16,000 shares respectively.

Facing a large-scale concentrated lifting of restrictions

Public information shows that the controlling shareholder Growth Value LTD. will face lifting of restrictions on December 7, 2024, and June 7, 2025 respectively, with a lock-up ratio of 32.49%.

Growth Value is owned 99% by Gather Forever Investments Limited and 1% by FASE LTD. Fase Ltd is wholly owned by Wang Xi, the founder and CEO of Yisou Technology. Therefore, after the global offering is completed, Wang Xi, Growth Value, Fase Ltd, and Gather Forever will be the controlling shareholders.

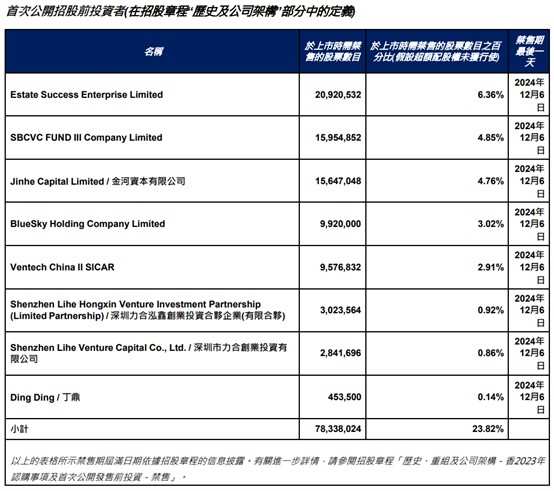

Investors before the initial public offering will also face lock-up expiration on December 7th. Estate Success Enterprise Limited and SBCVC FUND III Company Limited will have 6.36% and 4.85% unlocked respectively, while Jinhe Capital Limited will have 4.76% unlocked. A total of 8 investors will unlock 23.82% of shares.

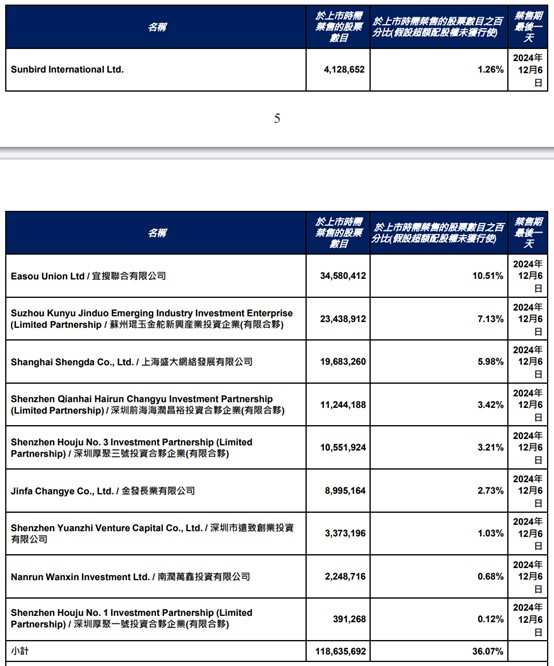

On December 7th, existing shareholders including Yisou Joint Venture Co., Ltd., Shanghai Shengda, Suzhou Kunpeng Jinduo Emerging Industries Investment Enterprise, and others will face unlock, totaling 36.07% of shares. Excluding the controlling shareholder, investors before the IPO and other existing shareholders will collectively unlock 59.89% of shares on December 7th.

Zhixun Finance APP learned that Yisou Technology had initiated listing plans multiple times. As early as 2013, it established an offshore company with plans to list on the NYSE, but eventually shelved the plan. In 2017, Yisou Technology's domestic operating entity Yisou Shenzhen listed its shares on the National Equities Exchange and Quotations (NEEQ) with the code 870926. In June 2019, Yisou Shenzhen was delisted from the NEEQ and submitted an application for the STAR Market in September 2019, which was withdrawn in 2020 after two rounds of inquiries. In May 2022, Yisou Technology completed restructuring, with founder Wang Xi and 3 other shareholders holding 88.10%, 6.80%, 3.40%, and 1.70% respectively. Yisou Shenzhen's shares held by other shareholders were repurchased by a company fully owned by Wang Xi.

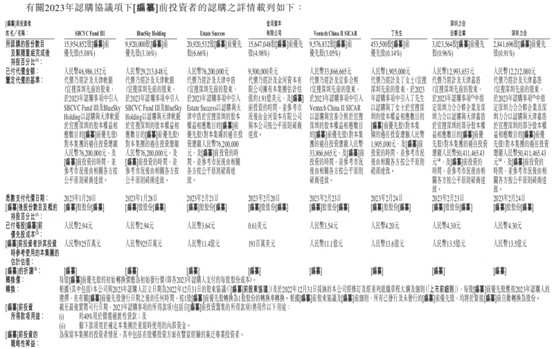

By the end of 2022, the original institutional shareholders of Yisou Shenzhen signed a subscription agreement with Yisou Technology (referred to as the '2023 Subscription Agreement'). SBCVC Fund III corresponding price is 2.94 yuan, Estate Success corresponding price is 3.64 yuan, Jinhe Capital corresponding price is 0.61 USD, and other investors' corresponding prices range from 0.32 to 4.45 yuan.

Based on the company's closing price of 44.4 Hong Kong dollars on October 31st, even buying at the higher price of 4.45 yuan would yield a profit of around ten times.

The announcement shows that in the previous IPO issuance, the public offering ratio was adjusted to 13.17%, with international placements accounting for 86.83%. The final offering was priced at the lower limit of 5.8 Hong Kong dollars, raising a total of 85.85 million Hong Kong dollars. Based on the latest stock price of 44.4 Hong Kong dollars, disregarding the controlling shareholder, the shares unlocked this time amount to 0.197 billion shares, with a total unlocked value reaching 8.746 billion Hong Kong dollars.

In terms of performance, Yisou Technology previously released its interim results for the six months ending on June 30, 2024. The group achieved revenue of 0.278 billion yuan (RMB) during the period, a 13.37% year-on-year increase. Shareholders' attributable profit was 3.385 million yuan, compared to a loss of 12.856 million yuan in the same period last year, turning the loss into a profit; basic earnings per share were 1.07 points.

Yisou Technology (02550) announced the interim performance for the six months ended June 30, 2024. During this period, the group achieved a profit of 0.278 billion yuan (RMB) with a year-on-year increase of 13.37%. The net profit attributable to shareholders was 3.385 million yuan, compared to a loss of 12.856 million yuan in the same period last year, turning losses into profits. The basic earnings per share were 1.07 cents.

此前9月公司获纳入港股通,流通性的提升或在一定程度上也助力了公司股价上涨。资金面上,今日净买入最多的为沪港通,买入8.3万股,其次是元库和深港通分别买入2.85万股和1.75万股;最大的卖出方是JP 摩根卖出3.75万股,花旗环球和浙商国际分别卖出1.65万股和1.6万股。

此前9月公司获纳入港股通,流通性的提升或在一定程度上也助力了公司股价上涨。资金面上,今日净买入最多的为沪港通,买入8.3万股,其次是元库和深港通分别买入2.85万股和1.75万股;最大的卖出方是JP 摩根卖出3.75万股,花旗环球和浙商国际分别卖出1.65万股和1.6万股。