Golden Finance | Retail investors often invest without looking at the fundamentals of the business, this ignorant investment approach will eventually teach retail investors a lesson, remember, prices will eventually return to value. Here is an example that happened many years ago.

--Stock Price Severely Deviates from Value--

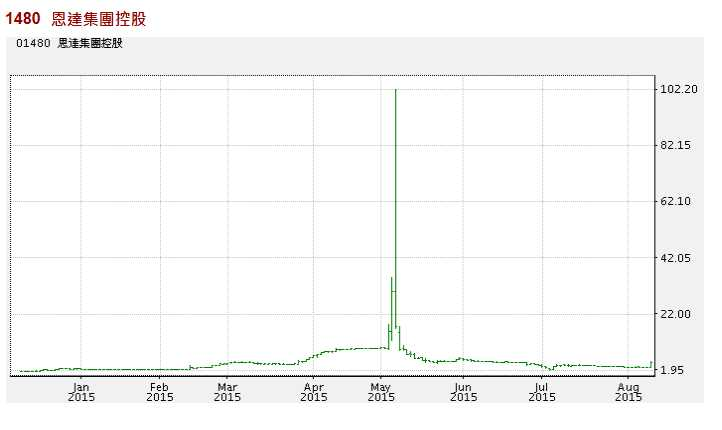

Printed circuit board manufacturer Enda Group (01480), listed at $1.23 at the end of 2014. Calculated based on the price-to-earnings ratio at that time, this price is considered reasonable, close to its value.

A few months later, due to some favorable factors, the stock price quickly doubled to $2, then $3. From the perspective of its core business of printed circuit boards, even with positive factors, the value of this company would not increase so rapidly. Therefore, the significant increase in the stock price is a manifestation of the price exceeding its value, clearly driven purely by emotional factors without substantial support.

A few months later, due to some favorable factors, the stock price quickly doubled to $2, then $3. From the perspective of its core business of printed circuit boards, even with positive factors, the value of this company would not increase so rapidly. Therefore, the significant increase in the stock price is a manifestation of the price exceeding its value, clearly driven purely by emotional factors without substantial support.

Subsequently, speculation on this stock intensified. Without substantial support, the stock price continued to rise, reaching over $10 within a month, becoming a hotly speculated stock with rapid growth. This clearly entered a frenzy stage, where buyers completely ignored its fundamental factors, purely thinking of it as a rapidly growing stock and continued to buy in.

--The Myth of Going from $1 to $100--

In the midst of frenzy and the possibility of the stock price being manipulated by certain forces, this stock skyrocketed to $100 in just a few days, breaking the Hong Kong stock record of going from $1 to $100. On the day it surpassed $100, the stock plummeted to $30 in the afternoon. According to the trading records of that day, there were dozens of people buying at $100, calculated at 2000 shares per lot, the entry fee at that time was $0.2 million per lot!

More sadly, a month later the stock price dropped to below $3. If one unfortunately bought in at $100, the unrealized loss per lot would be $194,000! Many investors suffered heavy losses as the stock had no value and would not return to its previous high, leaving investors with no hope of recovery. Additionally, it's worth mentioning that this stock is not only not a high-quality stock, but its price is highly artificial, so it is best to stay away at all times.

In this example, everyone can see that when prices rise, it is driven by some non-substantial factors, and a sharp decline is only a matter of time. Why do some people still chase after at high levels? Because they believe that this stock still has room to rise, they believe that since this stock has doubled in the past, it will double in the future, they believe that if they don’t make a profit at this moment, they won’t have the opportunity to make a profit, so they rush in with an impatient and irrational attitude, causing huge losses as a result.

【Author Introduction】Gong Cheng

- Bestselling author of "Stock Victory", "Stock Selection Victory", "Annual Report Victory", "38 Global Multiplier Stocks", "50 High-quality Potential Stocks", "50 Steady Income Stocks", "50 Value Multiplier Stocks", "Wealthy Blueprint", "Millionaires born in the 80s", "2 Millionaires born in the 80s", "3 Millionaires born in the 80s", "Millionaires of the 80s", "The Knowledge of Getting Rich", "Buying a House in 5 years, 4 part series", "Financial Freedom Travel", "Illustrated Stock Encyclopedia"

- Host of the 'Economic Week' show, serving as a wealth coach

• Has been interviewed by multiple media outlets

• Previously engaged in investment-related work in banks for many years

• Once accumulated millions in wealth through stocks while earning a monthly salary of tens of thousands of yuan

• Shared investment insights online, with over a million views, a popular blog, and answered over 20,000 financial questions from netizens

• Licensed individual in the securities industry

• Stocks course instructor, with over 5,000 students

Facebook page 'Gong Cheng' has over 200,000 fans

在数个月后,由于有一些利好的因素,股价很快倍升至$2、然后是$3。以其印刷电路板的本业来看,就算有利好的因素,这企业的价值都不会有如此急速的增长。因此,股价如此的升幅,已是价格高于价值的表现,明显地此股已纯粹由情绪因素而推动,并没有实质因素的支持。

在数个月后,由于有一些利好的因素,股价很快倍升至$2、然后是$3。以其印刷电路板的本业来看,就算有利好的因素,这企业的价值都不会有如此急速的增长。因此,股价如此的升幅,已是价格高于价值的表现,明显地此股已纯粹由情绪因素而推动,并没有实质因素的支持。