To the annoyance of some shareholders, Expro Group Holdings N.V. (NYSE:XPRO) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

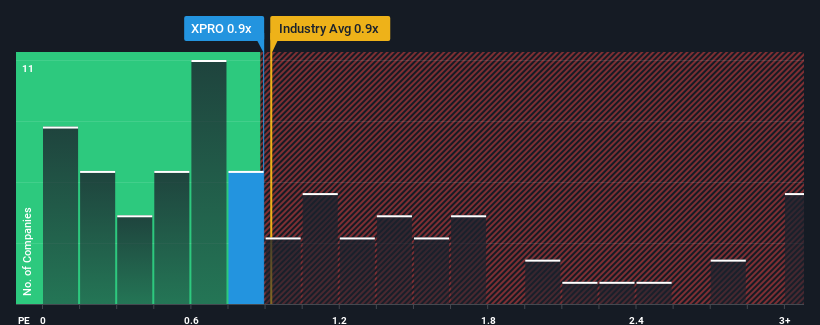

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Expro Group Holdings' P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Energy Services industry in the United States is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Expro Group Holdings Has Been Performing

With revenue growth that's superior to most other companies of late, Expro Group Holdings has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Expro Group Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Expro Group Holdings would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, Expro Group Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. Pleasingly, revenue has also lifted 146% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 7.8% per annum over the next three years. That's shaping up to be materially higher than the 4.3% per year growth forecast for the broader industry.

In light of this, it's curious that Expro Group Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Expro Group Holdings' P/S Mean For Investors?

Following Expro Group Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Expro Group Holdings' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware Expro Group Holdings is showing 2 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.