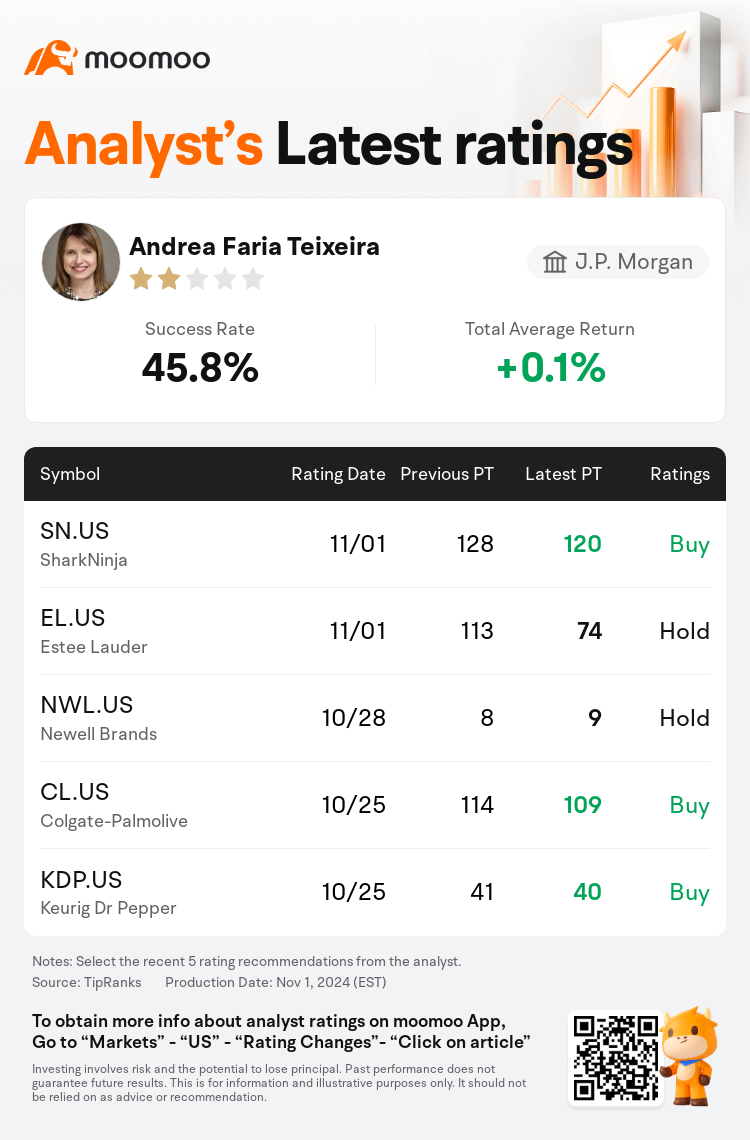

J.P. Morgan analyst Andrea Faria Teixeira maintains $SharkNinja (SN.US)$ with a buy rating, and adjusts the target price from $128 to $120.

According to TipRanks data, the analyst has a success rate of 45.8% and a total average return of 0.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $SharkNinja (SN.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $SharkNinja (SN.US)$'s main analysts recently are as follows:

The quarter for SharkNinja was exceptionally strong, with sales surging by 35%, a figure that likely surpassed even the most optimistic forecasts. Although the significant revenue increase did not fully translate to the bottom line, which may have left some investors wanting more, there is a general willingness to overlook this as long as the company's additional investments are yielding visible returns. While there is an inclination to view the stock more favorably, the absence of a price pullback has resulted in a continued neutral stance, with an eye out for a potential catalyst to prompt a reassessment.

Following the significant drop in SharkNinja's share price after earnings, analysts recommend buying the stock. The company maintains robust sales growth, and its fourth-quarter forecasts appear to be rather understated. Additionally, SharkNinja is anticipated to be in a stronger position by 2025 compared to previous projections. Analysts suggest that investors should not overly fixate on the company's short-term profit maximization if it comes at the cost of compromising its core strength of developing innovative solutions for consumers and achieving quicker market penetration than its rivals.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

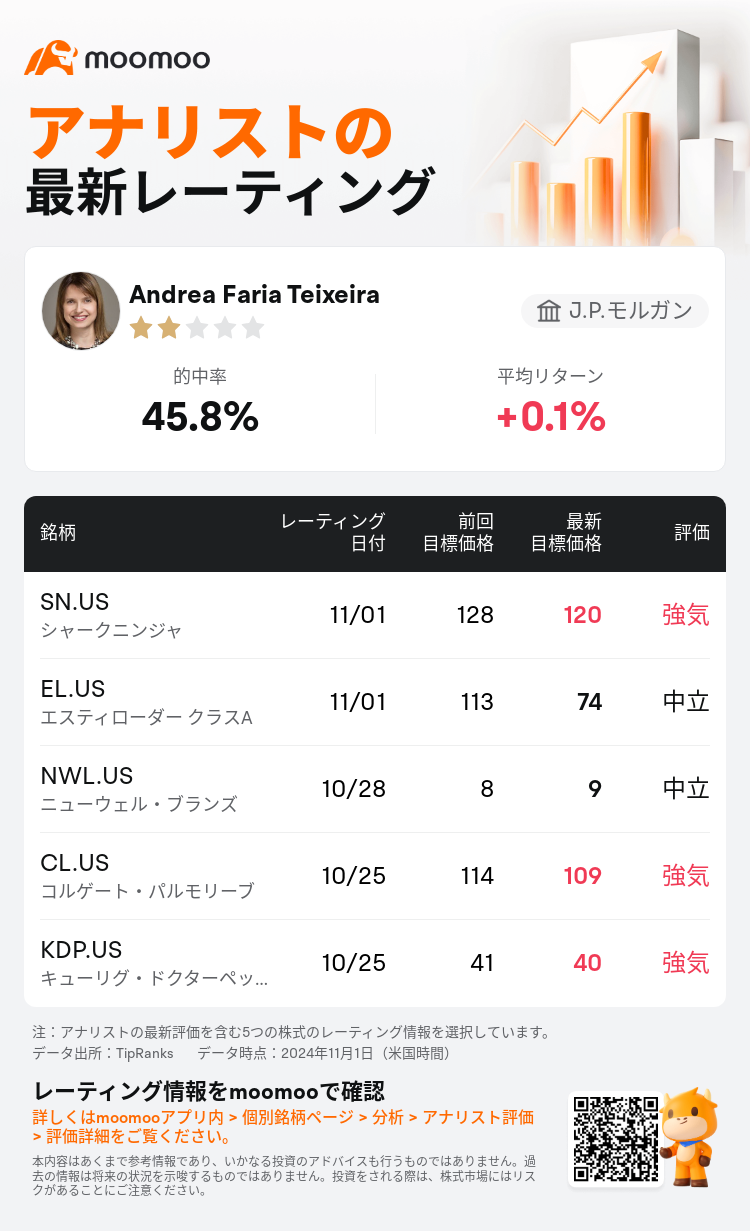

J.P.モルガンのアナリストAndrea Faria Teixeiraは$シャークニンジャ (SN.US)$のレーティングを強気に据え置き、目標株価を128ドルから120ドルに引き下げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は45.8%、平均リターンは0.1%である。

また、$シャークニンジャ (SN.US)$の最近の主なアナリストの観点は以下の通りである:

また、$シャークニンジャ (SN.US)$の最近の主なアナリストの観点は以下の通りである:

SharkNinjaの四半期は非常に好調で、売上高は35%急増しました。この数字は、最も楽観的な予測をも上回る可能性があります。大幅な収益増加は収益に完全には反映されず、一部の投資家はもっと収益を上げたいと考えているかもしれませんが、会社の追加投資が目に見える利益をもたらしている限り、一般的にこれを見落としがちです。株式をより好意的に見る傾向がありますが、価格の引き戻しがなかったため、再評価を促す潜在的な触媒に注目して、ニュートラル姿勢が続いています。

SharkNinjaの株価が決算後に大幅に下落したため、アナリストは株式の購入を推奨しています。同社は堅調な売上成長を維持しており、第4四半期の予測はかなり控えめなようです。さらに、SharkNinjaは、以前の予測と比較して、2025年までに強い立場に立つと予想されています。アナリストは、消費者向けの革新的なソリューションを開発し、競合他社よりも迅速な市場浸透を実現するという同社の強みを犠牲にして、投資家は会社の短期的な利益最大化に過度に固執すべきではないと示唆しています。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$シャークニンジャ (SN.US)$の最近の主なアナリストの観点は以下の通りである:

また、$シャークニンジャ (SN.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of