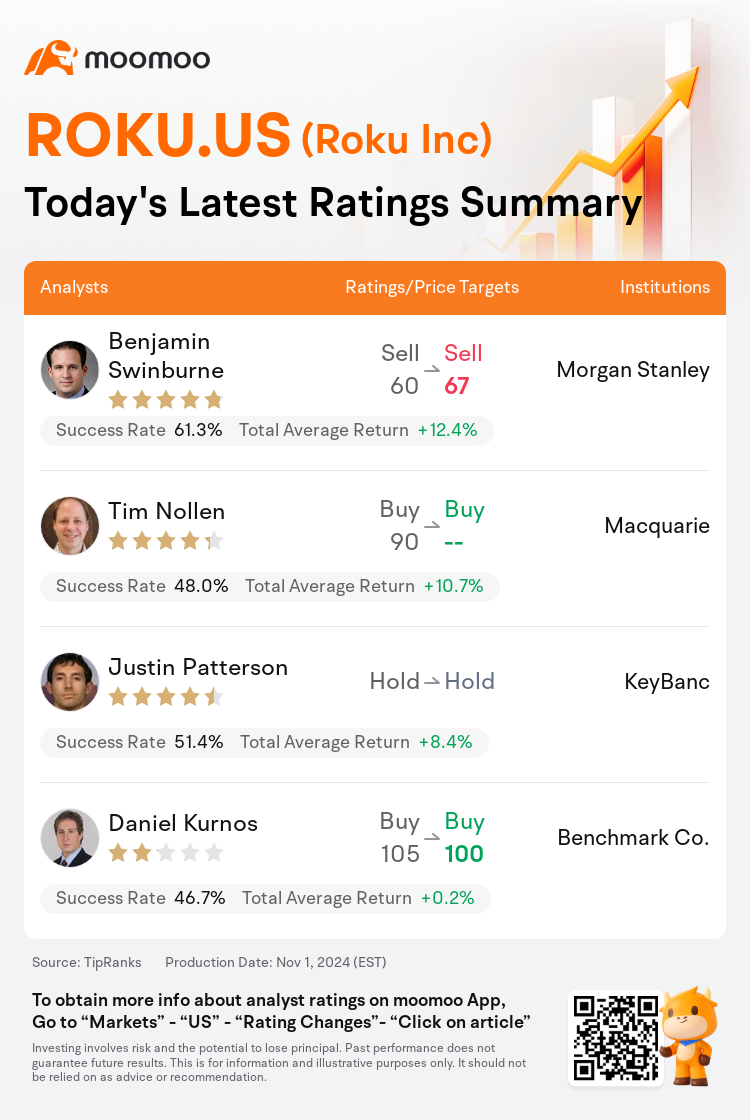

On Nov 01, major Wall Street analysts update their ratings for $Roku Inc (ROKU.US)$, with price targets ranging from $67 to $100.

Morgan Stanley analyst Benjamin Swinburne maintains with a sell rating, and adjusts the target price from $60 to $67.

Macquarie analyst Tim Nollen maintains with a buy rating.

KeyBanc analyst Justin Patterson maintains with a hold rating.

KeyBanc analyst Justin Patterson maintains with a hold rating.

Benchmark Co. analyst Daniel Kurnos maintains with a buy rating, and adjusts the target price from $105 to $100.

Furthermore, according to the comprehensive report, the opinions of $Roku Inc (ROKU.US)$'s main analysts recently are as follows:

Q3 results and Q4 forecasts surpassed expectations, fueled by political advertising, subscription video on demand (SVOD) platforms' price hikes, and initial gains from partnerships with third-party Demand-Side Platforms (DSP). Yet, challenging comparisons due to political factors and a deceleration in third-party DSP contributions may pose risks to the platform's revenue growth acceleration in the upcoming year amidst a more competitive Connected TV (CTV) industry.

Roku's Q3 platform revenue growth and the projected approximately 14% platform revenue growth for Q4 were deemed 'solid'. However, the concern arises from the omission of any reference to accelerating growth in 2025, which may lead to near-term pressure on the stock due to high investor expectations.

Roku's third-quarter results surpassed expectations across all metrics, and forecasts for fourth-quarter revenue are also exceeding consensus. However, the projection for fourth-quarter profits was marginally below expectations. Engagement remains robust with a 20% rise in viewing hours, increases in streaming per viewer and an 80% year-over-year growth for The Roku Channel. It's also observed that costs are likely to rise only slightly in the following year, potentially contributing to further margin expansion.

The firm observes that Roku's substantial outperformance in Q3 is tempered by a growth trajectory into Q4 of 2024 and the first half of 2025 that appears less predictable. The firm suggests that a clearer outlook is necessary to support a more optimistic scenario given Roku's valuation, which stands high at 27 times the firm's projected 2025 EV/EBITDA.

Here are the latest investment ratings and price targets for $Roku Inc (ROKU.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月1日,多家华尔街大行更新了$Roku Inc (ROKU.US)$的评级,目标价介于67美元至100美元。

摩根士丹利分析师Benjamin Swinburne维持卖出评级,并将目标价从60美元上调至67美元。

麦格理集团分析师Tim Nollen维持买入评级。

KeyBanc分析师Justin Patterson维持持有评级。

KeyBanc分析师Justin Patterson维持持有评级。

本臻力行分析师Daniel Kurnos维持买入评级,并将目标价从105美元下调至100美元。

此外,综合报道,$Roku Inc (ROKU.US)$近期主要分析师观点如下:

第三季度的业绩和第四季度的预测超过了预期,受政治广告、订阅视频点播(SVOD)平台价格上涨以及与第三方需求侧平台(DSP)合作的初步收益推动。然而,由于政治因素造成的挑战性比较以及第三方DSP贡献的减速可能对平台在即将到来的一年内的营业收入增长加速构成风险,面对更具竞争力的联接电视(CTV)行业。

Roku第三季度平台营收增长和预计第四季度约14%的平台营收增长被认为“稳健”。然而,人们担心的是在2025年加速增长没有任何提及,这可能会导致股价受到近期压力,因为投资者对公司的期望较高。

Roku第三季度的各项指标均超出预期,第四季度营收预测也超过共识。然而,第四季度利润的预期略低于预期。用户参与度仍然强劲,观看时长增长20%,单个用户的观看量增加,The Roku Channel的同比增长80%。还观察到成本可能在接下来的一年中略微上升,有可能进一步扩大利润率。

该公司指出,Roku在第三季度的显著表现受到2024年第四季度和2025年上半年增长轨迹似乎不太可预测的影响。该公司建议,鉴于Roku的估值高达公司预计2025年EV/EBITDA的27倍,支持更乐观情景需要一个更为明确的展望。

以下为今日4位分析师对$Roku Inc (ROKU.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

KeyBanc分析师Justin Patterson维持持有评级。

KeyBanc分析师Justin Patterson维持持有评级。

KeyBanc analyst Justin Patterson maintains with a hold rating.

KeyBanc analyst Justin Patterson maintains with a hold rating.