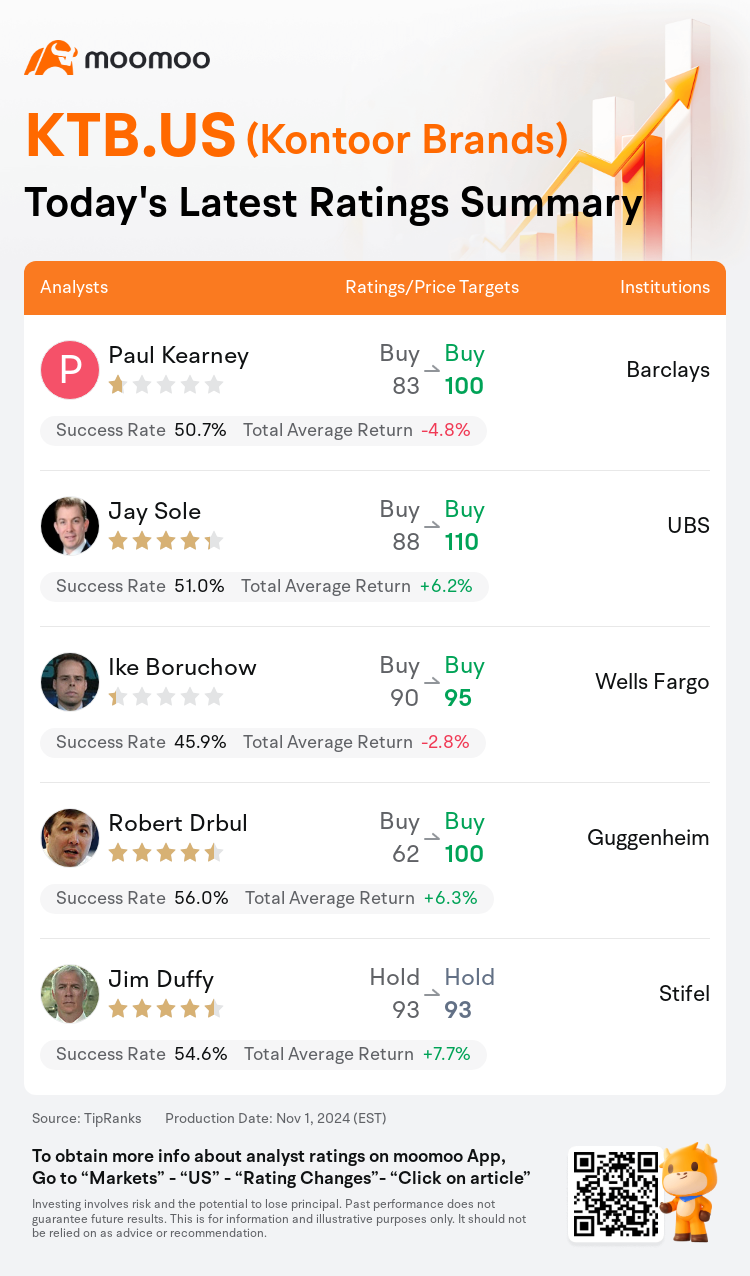

On Nov 01, major Wall Street analysts update their ratings for $Kontoor Brands (KTB.US)$, with price targets ranging from $93 to $110.

Barclays analyst Paul Kearney maintains with a buy rating, and adjusts the target price from $83 to $100.

UBS analyst Jay Sole maintains with a buy rating, and adjusts the target price from $88 to $110.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and adjusts the target price from $90 to $95.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and adjusts the target price from $90 to $95.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $62 to $100.

Stifel analyst Jim Duffy maintains with a hold rating, and maintains the target price at $93.

Furthermore, according to the comprehensive report, the opinions of $Kontoor Brands (KTB.US)$'s main analysts recently are as follows:

Kontoor Brands' third-quarter report highlighted the brands' escalating momentum, showcasing the company's enhancement as a prominent denim entity, marked by continuous gains in point of sale share. The anticipated 11% compound annual growth rate over five years and the expectation of earnings per share outperformance in the near future are seen as potential catalysts for the company's stock movement.

Kontoor Brands is advancing on various fronts, achieving organic market share gains, extending its categories, and widening distribution channels. Additionally, the company is enhancing its leading operating margin, with prospects for further improvement over the forthcoming two years.

The firm's optimism towards Kontoor Brands is supported by enhanced profitability, ongoing market share gains, and visibility into the Spring/Summer '25 orderbook. This positive outlook is reflected in the increased EPS estimates for FY24 and FY25 following the Q3 report.

The company has demonstrated commendable execution amidst a fluctuating environment, and while its stock has experienced a significant 84% increase on a year-over-year basis, it is suggested that the current valuation fully reflects the expectations for a business with low-single digit revenue growth. The Project Jeanius is anticipated to contribute to margin improvement in the fiscal years of 2025 and 2026. However, considering the potential for valuation contraction, the reliance on Walmart accounting for 36% of business, and the unpredictability of commodity prices, it is challenging to argue for a persuasive growth narrative for the stock.

Here are the latest investment ratings and price targets for $Kontoor Brands (KTB.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

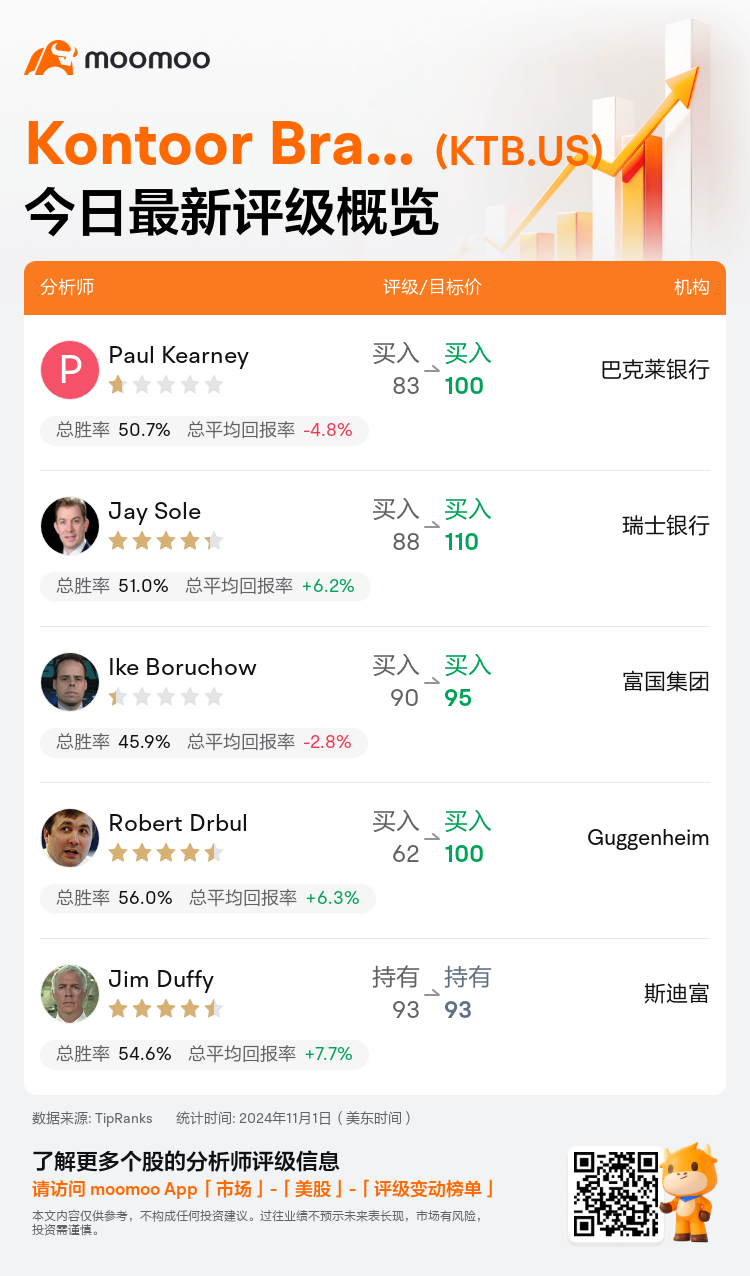

美东时间11月1日,多家华尔街大行更新了$Kontoor Brands (KTB.US)$的评级,目标价介于93美元至110美元。

巴克莱银行分析师Paul Kearney维持买入评级,并将目标价从83美元上调至100美元。

瑞士银行分析师Jay Sole维持买入评级,并将目标价从88美元上调至110美元。

富国集团分析师Ike Boruchow维持买入评级,并将目标价从90美元上调至95美元。

富国集团分析师Ike Boruchow维持买入评级,并将目标价从90美元上调至95美元。

Guggenheim分析师Robert Drbul维持买入评级,并将目标价从62美元上调至100美元。

斯迪富分析师Jim Duffy维持持有评级,维持目标价93美元。

此外,综合报道,$Kontoor Brands (KTB.US)$近期主要分析师观点如下:

Kontoor Brands的第三季度报告突显了品牌逐渐增长的势头,展示了公司作为一家著名牛仔布实体的提升,不断提高销售点份额。预期的五年11%复合年增长率以及近期每股收益超额表现的预期被视为公司股票走势的潜在催化剂。

Kontoor Brands在各个方面都在取得进展,实现有机市场份额增长,拓展其产品类别,并扩大分销渠道。此外,公司正在提高其领先的营业利润率,并有望未来两年进一步改善。

公司对Kontoor Brands的乐观态度得到了增强的盈利能力、持续的市场份额增长和对2025年春夏订单簿的前景的支持。这种积极的前景反映在Q3报告后对FY24和FY25的EPS估计增加。

在不断变化的环境中,公司展示了值得称赞的执行力,尽管其股票在年度基础上经历了显着的84%增长,但目前的估值完全反映了对低个位数营业收入增长的期望。Jeanius项目预计将有助于在2025和2026财年改善利润率。然而,考虑到估值可能收缩的潜力,对沃尔玛的依赖占业务的36%,以及商品价格的不可预测性,很难为该股票提出有说服力的增长叙事。

以下为今日5位分析师对$Kontoor Brands (KTB.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Ike Boruchow维持买入评级,并将目标价从90美元上调至95美元。

富国集团分析师Ike Boruchow维持买入评级,并将目标价从90美元上调至95美元。

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and adjusts the target price from $90 to $95.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and adjusts the target price from $90 to $95.