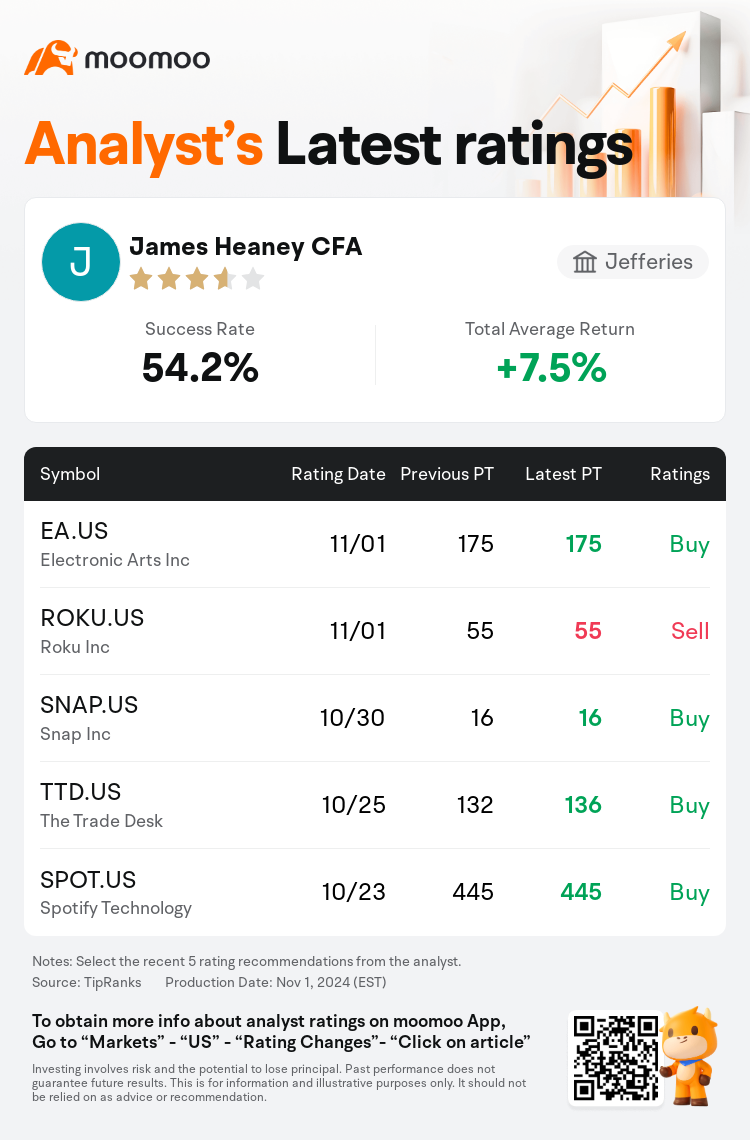

Jefferies analyst James Heaney CFA maintains $Electronic Arts Inc (EA.US)$ with a buy rating, and maintains the target price at $175.

According to TipRanks data, the analyst has a success rate of 54.2% and a total average return of 7.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Electronic Arts Inc (EA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Electronic Arts Inc (EA.US)$'s main analysts recently are as follows:

Electronic Arts reported fiscal Q2 bookings and adjusted earnings that surpassed the high-end of guidance, and the company has increased its fiscal 2025 outlook. Nevertheless, there is a focus on the need for more consistent execution on non-sports titles, and a comparative preference is noted for Take-Two's shares leading up to the GTA VI launch slated for Fall 2025.

Electronic Arts achieved a robust earnings outperformance and raised its projections for Q2, even as expectations were already high. This was propelled by the robust performance of its sports titles, which balanced out the less-than-anticipated results from Apex Legends. Additionally, an increase of 140% in time spent on American Football games indicates that the inclusion of College Football is likely serving to enhance rather than detract from the company's comprehensive suite of offerings.

The firm noted that 2Q results surpassed expectations, aligning with robust initial engagement and monetization of College Football. Further observations indicated that the fusion of Madden and College Football is cultivating a broader American football gaming community. This expansion, coupled with the company's dominant position in global football (soccer), is believed to pave the way for increased recurring revenues.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

富瑞集團分析師James Heaney CFA維持$藝電 (EA.US)$買入評級,維持目標價175美元。

根據TipRanks數據顯示,該分析師近一年總勝率為54.2%,總平均回報率為7.5%。

此外,綜合報道,$藝電 (EA.US)$近期主要分析師觀點如下:

此外,綜合報道,$藝電 (EA.US)$近期主要分析師觀點如下:

Electronic Arts公佈的第二財季預訂量和調整後的收益超過了預期的最高水平,該公司提高了2025財年的展望。儘管如此,人們仍然關注非體育類遊戲需要更穩定的執行,在定於2025年秋季發佈GTA VI之前,Take-Two的股票比較偏好。

儘管預期已經很高,但Electronic Arts仍實現了強勁的盈利跑贏大盤,並上調了對第二季度的預測。這是由其體育遊戲的強勁表現推動的,這平衡了Apex Legends意想不到的業績。此外,在美式橄欖球比賽上花費的時間增加了140%,這表明加入大學橄欖球可能會增強而不是減損該公司的全面產品組合。

該公司指出,第二季度的業績超出了預期,這與大學橄欖球的強勁初始參與度和盈利能力相吻合。進一步的觀察表明,Madden和College Football的融合正在培育更廣泛的美式足球遊戲社區。這種擴張,加上該公司在全球足球(足球)中的主導地位,被認爲爲經常性收入的增加鋪平了道路。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$藝電 (EA.US)$近期主要分析師觀點如下:

此外,綜合報道,$藝電 (EA.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of