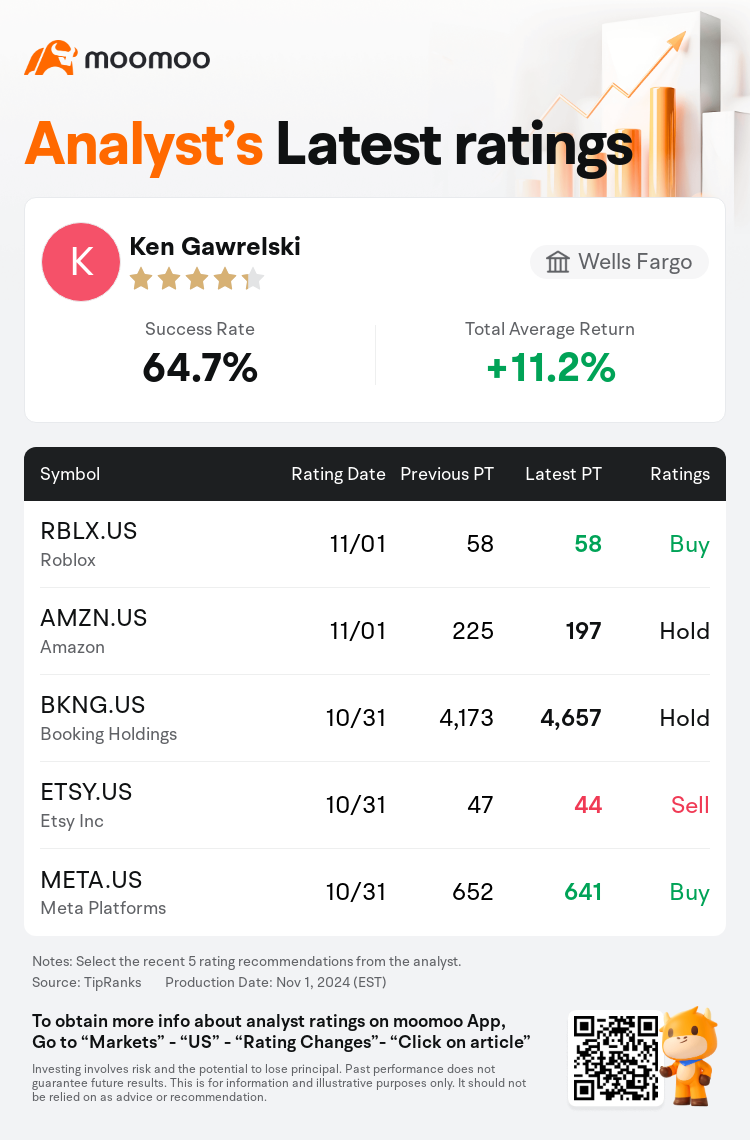

Wells Fargo analyst Ken Gawrelski maintains $Roblox (RBLX.US)$ with a buy rating, and maintains the target price at $58.

According to TipRanks data, the analyst has a success rate of 64.7% and a total average return of 11.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Roblox (RBLX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Roblox (RBLX.US)$'s main analysts recently are as follows:

Roblox reported a Q3 performance that surpassed expectations and has increased its 2024 forecasts for all metrics. The outlook provided may tend to be on the conservative side, with discussions indicating that the company's bookings trends continue to be robust.

Roblox's key performance indicators are demonstrating acceleration, marked by record-high bookings, an increase in daily active users, and engagement hours. While safety concerns, which are prevalent across numerous social platforms, persist, they are addressable issues that management is actively tackling.

Roblox achieved a new peak in performance metrics according to a recent analysis. The availability of PlayStation 5 was a significant factor, contributing to the platform's success, with the console now representing 8% of total bookings and enhancing monetization efforts. It is anticipated that console bookings will surpass mobile bookings by 2025, owing to the console's lower penetration among Roblox developers and its ability to generate more revenue because of an older and wealthier player demographic.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

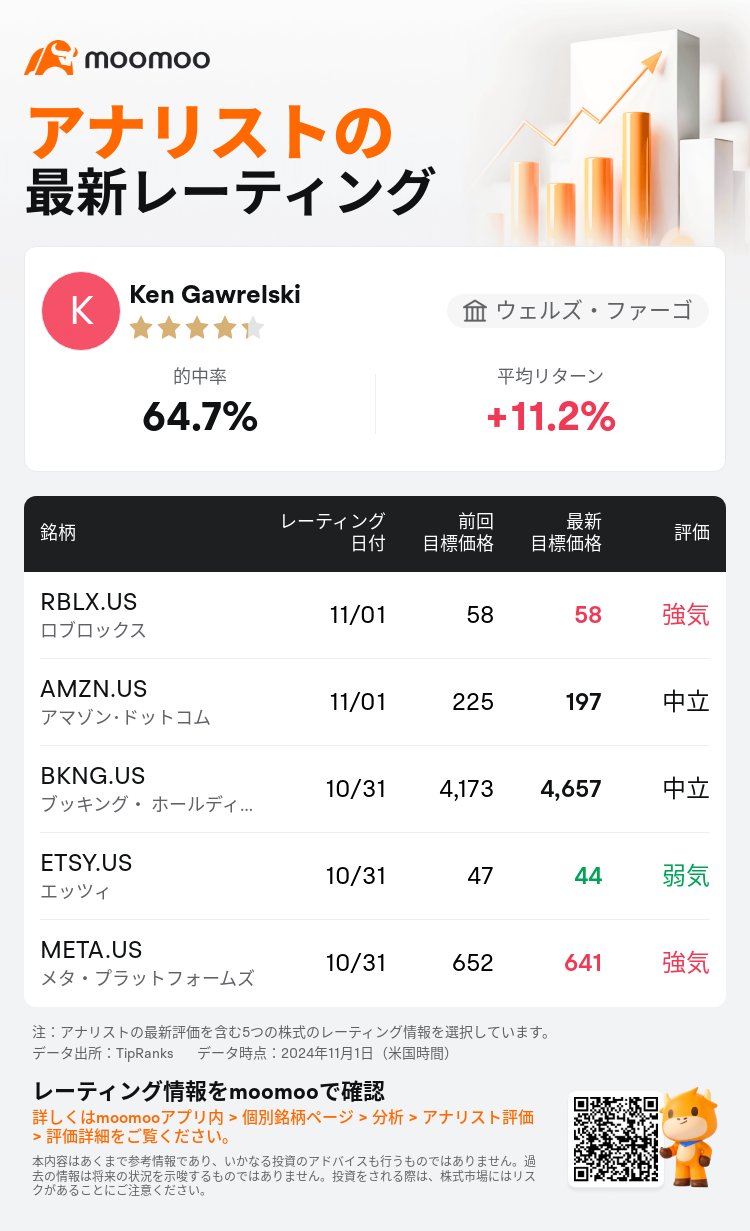

ウェルズ・ファーゴのアナリストKen Gawrelskiは$ロブロックス (RBLX.US)$のレーティングを強気に据え置き、目標株価を58ドルに据え置いた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は64.7%、平均リターンは11.2%である。

また、$ロブロックス (RBLX.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ロブロックス (RBLX.US)$の最近の主なアナリストの観点は以下の通りである:

ロブロックスは、全セクターに対する2024年の予測を引き上げ、期待を上回る第3四半期の業績を報告しました。提供された見通しは保守的な傾向であり、会社のブッキングトレンドは引き続き順調であるとの議論があります。

ロブロックスの主要な業績指標は加速を示しており、史上最高のブッキング、デイリーアクティブユーザーの増加、エンゲージメント時間の増加がみられます。多くのソーシャルプラットフォーム全体で広く見られる安全上の懸念は依然として残っていますが、それらは対処可能な問題であり、管理陣が積極的に取り組んでいます。

ロブロックスは最近の分析によると、パフォーマンス指標で新たなピークを達成しました。PlayStation 5の入手可能性は重要な要因であり、プラットフォームの成功に貢献し、コンソールが総ブッキングの8%を占め、収益化の取り組みを強化しています。2025年までに、コンソールのブッキングがモバイルのブッキングを上回ることが予想されており、その理由は、コンソールがロブロックスの開発者の間での普及率が低く、古い年齢層と豊かなプレーヤー層によりより多くの収益を生み出す能力があるからです。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$ロブロックス (RBLX.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ロブロックス (RBLX.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of