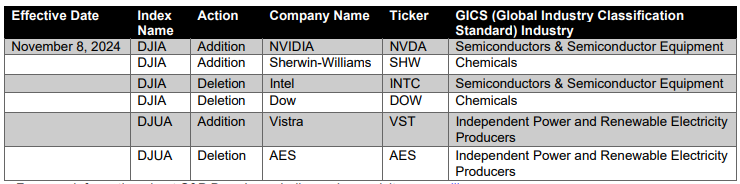

① Nvidia will replace Intel, and Sherwin-Williams will replace Dow Chemical into the Dow Jones Industrial Average, effective before the opening of the market on November 8. ② The purpose of this adjustment is to ensure that the semiconductor industry and materials industry are more representative. Nvidia's addition reflects the booming development of artificial intelligence and major changes in the semiconductor industry.

Financial Services, November 2 (Editor Zhao Hao) After US stocks closed on Friday (November 1), S&P Dow Jones Indices (S&P Dow Jones Indices) announced changes in the composition of the Dow Jones Industrial Average:

Nvidia will replace Intel, and Sherwin-Williams (Sherwin-Williams) will replace Dow Chemical (Dow) in the Dow Jones Industrial Average, the “Dow” of the three major US stock indices, which will take effect before the opening of the market next Friday (November 8).

After the announcement, Nvidia and Sherman's after-hours stock prices both rose more than 3%, Intel fell nearly 2%, and Dow Chemical fell more than 0.6%.

After the announcement, Nvidia and Sherman's after-hours stock prices both rose more than 3%, Intel fell nearly 2%, and Dow Chemical fell more than 0.6%.

The press release explained that the index adjustment is to ensure a higher representation of the semiconductor industry and the materials industry. According to media analysis, the inclusion of Nvidia is a “major restructuring” of this blue chip index, reflecting the booming development of artificial intelligence and a major shift in the semiconductor industry.

As a “seller” of AI computing power, Nvidia's value has developed by leaps and bounds in the past two years. Last year, the stock surged 239%. On this basis, it has climbed more than 173% this year. Currently, Nvidia's market capitalization has reached 3.3 trillion US dollars, second only to Apple among the world's listed companies.

With the addition of Nvidia, four of the six US stock “trillion market capitalization club” companies have already been included in the Dow. Google's parent company Alphabet and Meta Platforms are not among them, and Amazon only joined in February of this year.

In May of this year, Nvidia announced that it would split common shares according to the “1 split of 10” ratio. After the split, the price per share changed from around 1,000 US dollars to slightly above 100 US dollars. At the time, some analysts pointed out that the move was probably to prepare for inclusion in the Dow.

Unlike the S&P 500 index's “shareholding market value weighting,” the Dow uses “price weighting,” which means that price changes in high-priced stocks have a greater impact on the index level than changes in the price of low-priced stocks. This mechanism makes it difficult for extremely expensive stocks to be included in the Dow.

Benefiting from purchases of graphics processors (GPUs) such as the H100 by other technology companies, Nvidia's August results showed that the company's quarterly revenue exceeded 30 billion US dollars, an increase of 122% over the previous year; net profit was 16.599 billion US dollars, an increase of 168%.

Last month, Nvidia CEO Hwang In-hoon said that demand for the company's next generation AI chip, Blackwell, was “crazy” and that “everyone wants to have the most products, and everyone wants to be the first to receive them.”

At the same time, Intel's stock price “dropped by a thousand miles”, falling more than 53% during the year. Once the world's largest chipmaker, Intel has been in a state of decline in recent years, and the decline accelerated in 2024.

Earlier this week, Intel CEO Pat Gelsinger said during an earnings call that the company is undergoing one of the most pioneering restructuring processes since it was founded in 1968.

Last quarter, Intel announced layoffs, spending cuts, and suspension of dividends to investors. It is worth mentioning that Intel was included in the Dow index in 1999, along with Microsoft.

声明公布后,英伟达和宣伟公司盘后股价双双涨超3%,英特尔跌近2%,陶氏化学跌逾0.6%。

声明公布后,英伟达和宣伟公司盘后股价双双涨超3%,英特尔跌近2%,陶氏化学跌逾0.6%。