The Kingwisoft Technology Group Company Limited (HKG:8295) share price has fared very poorly over the last month, falling by a substantial 36%. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 15%.

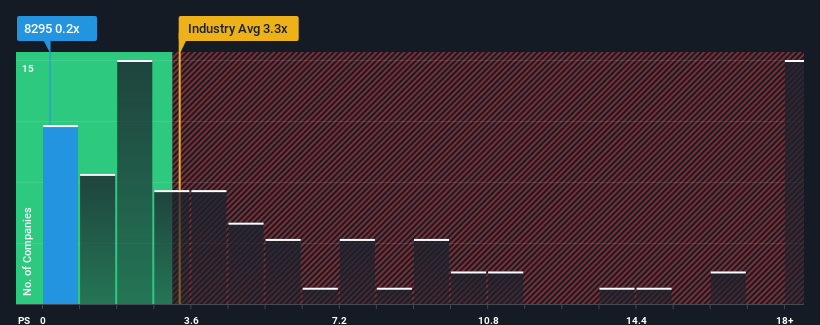

Since its price has dipped substantially, Kingwisoft Technology Group may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Capital Markets industry in Hong Kong have P/S ratios greater than 3.3x and even P/S higher than 11x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Kingwisoft Technology Group Has Been Performing

Recent times have been quite advantageous for Kingwisoft Technology Group as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on Kingwisoft Technology Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kingwisoft Technology Group's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Kingwisoft Technology Group?

Kingwisoft Technology Group's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Kingwisoft Technology Group's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 26% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Kingwisoft Technology Group is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Having almost fallen off a cliff, Kingwisoft Technology Group's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We're very surprised to see Kingwisoft Technology Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for Kingwisoft Technology Group (1 shouldn't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Kingwisoft Technology Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.