ExxonMobil and Chevron both announced results of a sharp increase in fossil fuel production, which ended the earnings season for major oil companies. Meanwhile, OPEC and its allies are about to increase the supply of crude oil to the global market.

The Zhitong Finance App learned that both ExxonMobil (XOM.US) and Chevron (CVX.US) announced results of a sharp increase in fossil fuel production, which put an end to the earnings season for major oil companies. Meanwhile, OPEC and its allies are about to increase the supply of crude oil to the global market.

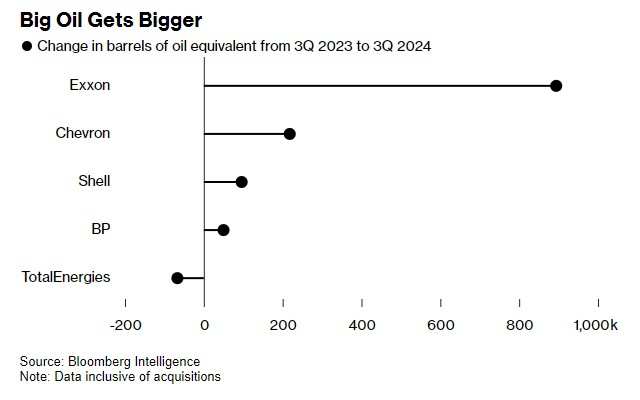

Production growth by US oil giants was driven by record crude oil production in the Permian Basin, where year-on-year growth and efficiency improvements continued to surprise analysts. Driven by the $60 billion acquisition of Pioneer Natural Resources, ExxonMobil's oil and gas production increased 24% year over year, while Chevron's production increased 7%.

American oil companies are not the only ones to increase production. Shell (SHEL.US) and British Petroleum (BP.US) also both increased production by 4% and 2%, respectively, although their net zero targets were more aggressive than their US rivals.

American oil companies are not the only ones to increase production. Shell (SHEL.US) and British Petroleum (BP.US) also both increased production by 4% and 2%, respectively, although their net zero targets were more aggressive than their US rivals.

All of this is taking place against the backdrop of weakening oil price prospects. Oil prices have fallen by about 12% in the past six months due to weak demand. Oil prices are likely to fall further if OPEC+ returns to previously cut production as planned.

This moment is also in stark contrast to a few years ago, when executives struggled to control capital spending during the pandemic and faced pressure from environmental, social, and governance movements to invest in low-carbon alternatives to fossil fuels. The success of the former and the failure of the latter led the oil and gas industry to agree on a common strategy: oil and gas are cheap enough to withstand any energy transition.

Nick Hummel, an analyst at Edward D. Jones & Co based in St. Louis, said, “ExxonMobil and Chevron are continuing to stick to their core oil and gas strategies while expanding some of the world's best assets. The short-term outlook for oil and gas feels weak, especially as OPEC prepares to launch more oil into the market.”

ExxonMobil is a prime example of a strategic shift. The company lost to ESG investment agency Engine No.1 in the 2021 rights protection war.

Chief Financial Officer Kathy Mikells said in an interview that since 2019, acquisitions, divestments, cost cuts, and efficiency improvements have “doubled” the oil giant's barrel oil profit margin even when oil prices have remained the same.

Meanwhile, although Chevron cut capital expenditure in half, its oil and gas production increased 27% from a decade ago. This is due in large part to the company's significant investment in the Australian gas project currently in operation, but it is also due to increased efficiency and a shift to the Permian basin. Chevron has doubled its production in the basin over the past five years and is now returning a record amount of cash to shareholders.

Chevron CEO Mike Wirth said in an interview: “We're making everything we do more efficient. We get more for every dollar we spend.”

Growth in US oil production — currently around 50% higher than Saudi Arabia — is helping OPEC block millions of barrels of crude oil from entering the market. Macquarie analysts said in a report that this oil, along with new supplies from Guyana, Brazil and elsewhere, could mean that 5 million barrels of production capacity per day “will be available in 2025, and there is currently no production.” They said this is still happening against the backdrop of “relatively weak” demand growth.

The bank expects that, unless a major geopolitical event occurs, the price of Brent crude oil will fall below $70 per barrel from the current level of around $73 per barrel.

The fall in oil prices has put pressure on the oil giants' ability to pay dividends and buy back shares. British Petroleum's stock price plummeted this week, after the company said it may reduce repurchases next year in the face of falling oil prices. But ExxonMobil, Chevron, and Shell are still confident to weather the storm.

ExxonMobil's projects in Guyana and the Permian currently account for about a quarter of total production, and their crude oil extraction price is less than $35 per barrel, which means they should remain profitable during a potentially sluggish period.

“The fundamental transformation of our business has given us a good foundation in any market environment, especially when the market environment is weak,” Mikells said.

并不只有美国石油公司实现产量增长。壳牌(SHEL.US)和英国石油(BP.US)的产量也都分别提高了4%和2%,尽管它们的净零目标比其美国竞争对手更为激进。

并不只有美国石油公司实现产量增长。壳牌(SHEL.US)和英国石油(BP.US)的产量也都分别提高了4%和2%,尽管它们的净零目标比其美国竞争对手更为激进。